Weekly Oil Report: Demand Projections Boosted Price Growth

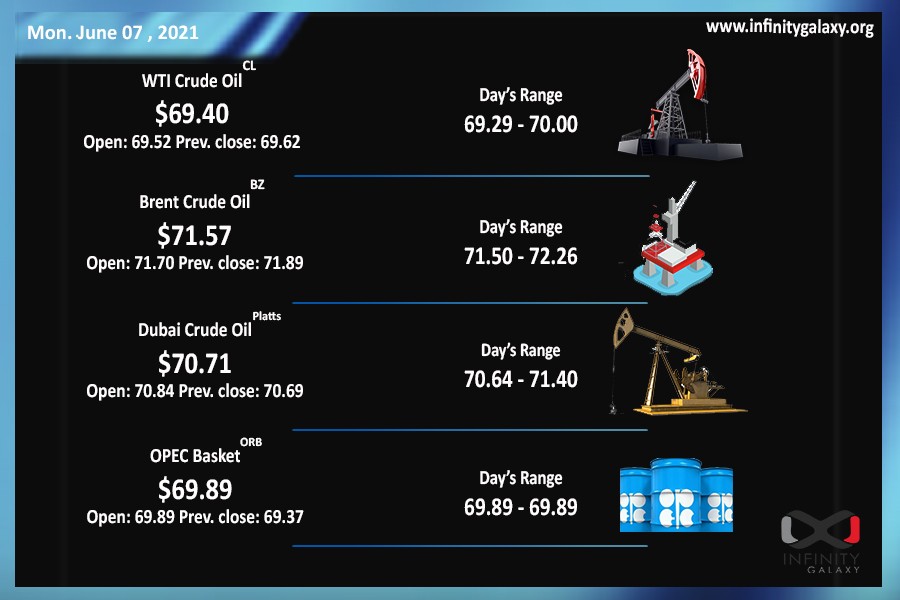

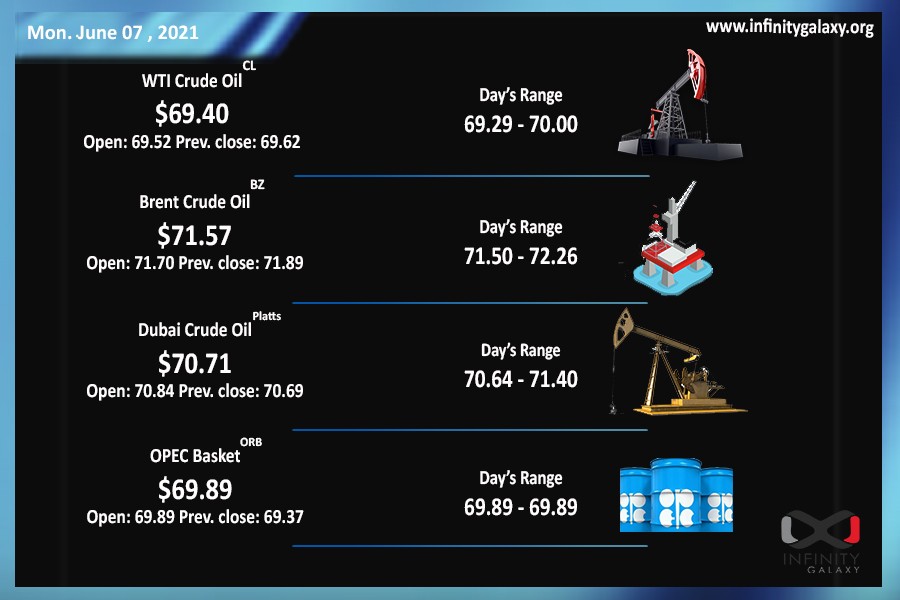

Crude finally succeeded to reach above 70 during the first week of June. On Friday, Brent closed at $71.27 and WTI closed at $69.38. Several stimulations helped the oil, including the OPEC meeting and dollar devaluation. Currently, Brent and WTI are at the strong statistic zone of $70 which they could not pass about 3 months ago. The chart is not also strong enough for hitting the top of the channel. However, OPEC and other major powers are trying to support crude and petrochemicals.

OPEC+ is apparently fully controlling the oil market at the moment. After the meeting on Tuesday, the market neglected all the oversupply possibilities and oil thrived for higher prices. OPEC declared that they still expect more demand until the end of the year and they are planning to gradually increase the production considering a better Covid situation.

Besides the OPEC+ decision, dollar devaluation helped the oil and commodities to rise. The dollar index experienced about 0.60% fall after the negative reports of nonfarm payrolls of the USA. The reports indicated that inflation has not improved the employment rate. Although it caused a negative sentiment for the dollar, the economy is not in danger as we can see improvement in the rates of wages and unemployment.

Along with oil, petrochemicals prices grew as well. Yet they can go for better prices if crude does not fall suddenly. Petrochemicals demand is also improving in big countries such as China and India.