Weekly Oil Report: Blessed with Crude’s Market Powers

Last week, OPEC and IEA (International Energy Agency) brought more optimism to the market. The boost was expected as we were getting more successful vaccination programs. As the vaccination is getting faster, mobility rises in countries. Therefore, the demand for crude oil will be expanding.

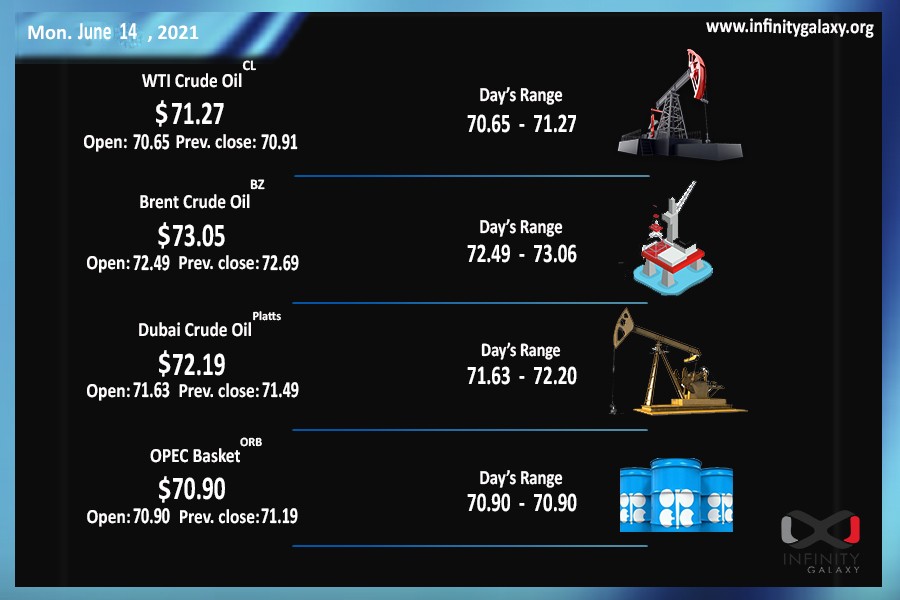

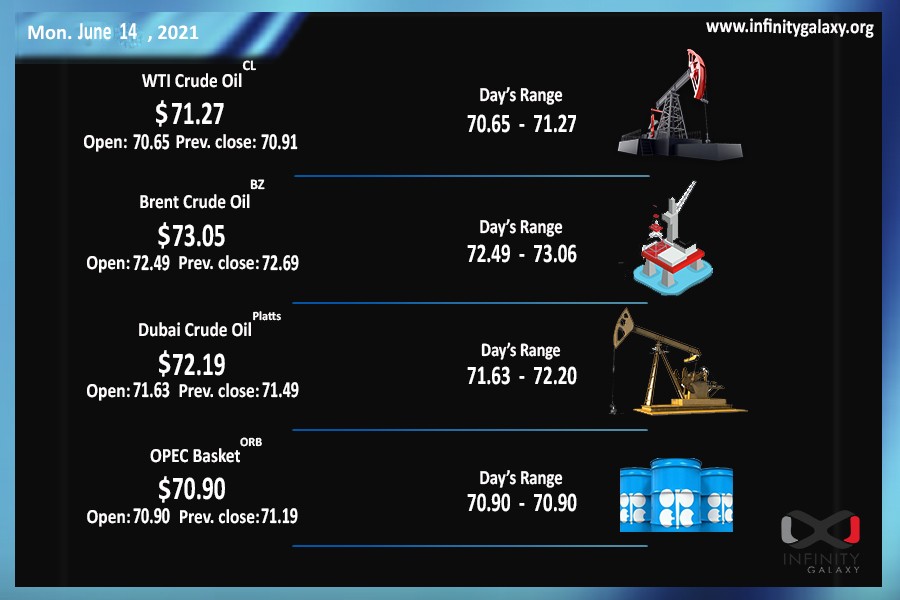

The chart of Brent oil and WTI is still not promising technically. Brent closed at $72.05 and WTI closed at $70.79 on Friday, June 11. As stated before, they are moving in a channel for about 7 months though could not rise above the midline yet. The price movement has not been strong enough. However, crude has been blessed with major powers’ support. It also experienced a short negative sentiment in the market after Iran’s several sanctions removed but it did not take long.

Goldman Sachs $80 crude outlook is still valid according to the reports by Reuters. However, they expect it to happen by the third quarter of the year instead of March. The anticipated vaccine-driven demand means a sudden extreme boost in the market. The change will have some consequences at the time, including refineries production plans and political confrontation.

US dollar was rallying last week and grew nearly up to 1%. We can expect more growth during the week because of the financial reports and market sentiments. On Monday, we may see a positive market for the dollar, however, we shall see new USD financial reports on Tuesday and Wednesday. If Dollar gets stronger during the week and stocks fall, oil can have some negative days.

Petrochemical demand was rising as well during the week. Strong LNG demand in China was only an example. India also seems to overcome the covid crisis gradually since the oil product demand is rising from the country’s traders.