Weekly Briefing: A Brighter Year For Oil

After the new year eve, markets pushed higher, and volatility seems to be lower. In lieu of the rising fear of new upcoming lockdowns and coronavirus strain, the market still expects brighter days. VIX dropped 25.40% in the first week of January, indicating more risk-tolerant traders. The stimulus package and released vaccines helped the sentiments. According to the Asia Pacific Petroleum Conference 2020 (APPEC), the only difficulty of the global gasoline and diesel demand recovery to the pre-pandemic levels is the new resurgence of coronavirus cases.

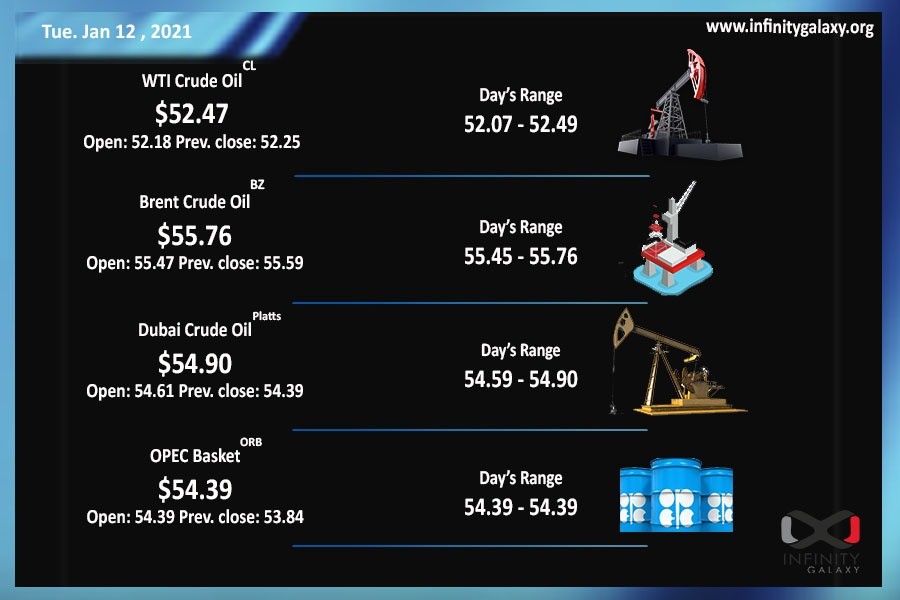

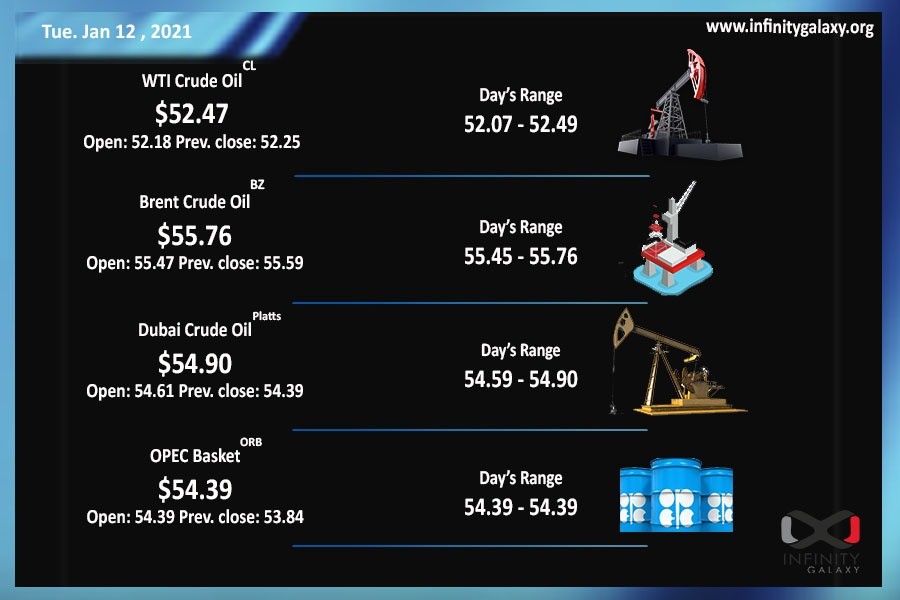

Oil and gas will have a better chance in 2021. After the plunge of Brent and WTI last year, the oil-oriented economies intend to keep the prices on an increasing trend. The Organization of the Petroleum Exporting Countries (OPEC) and the allies such as Russia had a consensus on cutting the supply in February. The US crude oil report shows a decline as well. The supply cut and the anticipated global demand will lead to higher oil prices. The taken actions have already boomed the oil about 11% in the week ending to 8th of January. Based on the Infinity Galaxy report, On the recent bullish trend, Brent and WTI may touch $60 soon in January.

Experts and financial institutes are likewise bullish on oil. “Growing economies will lead to global oil demand returning to the pre-coronavirus levels in late 2021,” said Ed Morse, Global Head of Commodities Research at Citigroup, in an interview with Bloomberg. Similarly, Goldman Sachs sees $60 and more for the oil. They believe the Brent gets to $65 in the third quarter of 2021. Though, they anticipate $58 for the end of 2021.