Weekly Bitumen Report: The Wave of Market is Opposite to the Buyer’s Expectations

One year after Russia’s war against Ukraine, the authorities of Ukraine state that Russia started a new chain of missile attacks throughout Ukraine and buildings and infrastructures of Kharkiv and Odessa. Hence, it seems that the world is getting ready for a longer war.

At the same time, China’s foreign minister declared that “US China policy has entirely deviated from the rational and sound track” and he warned about the probable consequences. He continued “Containment and suppression will not make America great, and it will not stop the rejuvenation of China”. These warnings and worries about the emergence of cold war will have effects on the world in long term.

Last week, Director General of the International Atomic Energy Agency (IAEA) visited Iran to change the mind of Board of Governors of IAEA and most probably, no resolution will be passed against Iran. This was enough to see a recovery of Iran Rial that was sharply devaluated during the last 2 weeks.

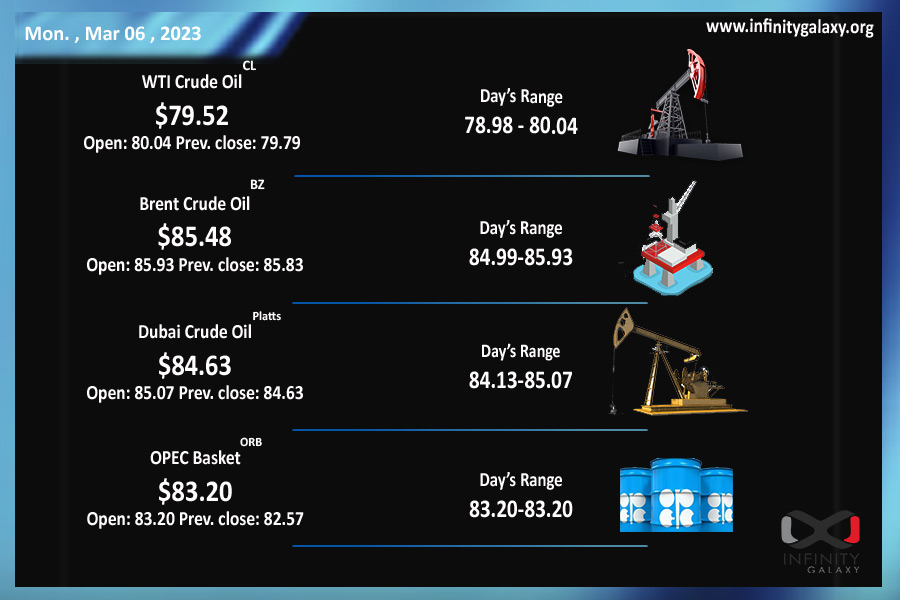

During the last week, crude price was in the range of 82 – 85 USD. Except Wednesday, 8 March, that a severe fall of Singapore’s fuel was observed, while an acceptable growth was recorded in the other days. On Wednesday, HSFO CST 180 was recorded at 446 USD, Singapore’s bulk bitumen was fluctuating in the range of 495 – 505 USD and South Korea’s bitumen fell up 5 USD and reached 440 USD.

Generally, the significant increase of South Korea’s bitumen price is attributed to the increase of demand from China and that’s the reason of observing a mild growth of South Korea’s bitumen prices since the beginning of February.

In the meantime, Bahrain’s bitumen price remained stable at 325 USD for almost 2 months and its surge is predicted considering the increase of fuel and crude oil prices.

While bitumen price in India increased in the second half of February, the stability of prices was observed on 1 March and now, the importers are mainly out of stock and the surge of prices in the second half of March is expected.

In Iran, the situation was somehow complicated. The unprecedented devaluation of Rial against US dollar led to the significant increase of production costs and on the other hand, the refineries competed over 120% for vacuum bottom. Approaching the end of year, the logistics and transportation issues raised and the exporters are under the pressure of their buyers to send the cargoes faster.

These issues and the ups and downs of Rial trend against US dollar led to the daily and serious changes of prices. Another side effect of currency fluctuation led to a new fact; and for the first time during the recent years, there was not any new announcement of vacuum bottom price in the second half of the Iranian month. Altogether, unlike the customers’ expectations and based on what Infinity Galaxy frequently mentioned in the last 3 weeks, Iran price trend is following an uptrend and the devaluation of Rial against US dollar did not lead to the fall of bitumen price.

It seems this challenging trend goes on till the end of current Iranian year and we should expect the increase of prices in some of the markets. However, Infinity Galaxy team strongly recommends the buyers to place their orders based on wise decision and careful investigations to avoid issues caused by sudden and unexpected changes of the market.

This article was prepared by Razieh Gilani, the export manager of Infinity Galaxy (www.infinitygalaxy.org).