Weekly Oil Report: Fluctuations Confused Commodity Traders

Volatile market of crude oil kept most of the commodity traders in limbo. While the trend of crude is hard to guess bitumen market is thriving.

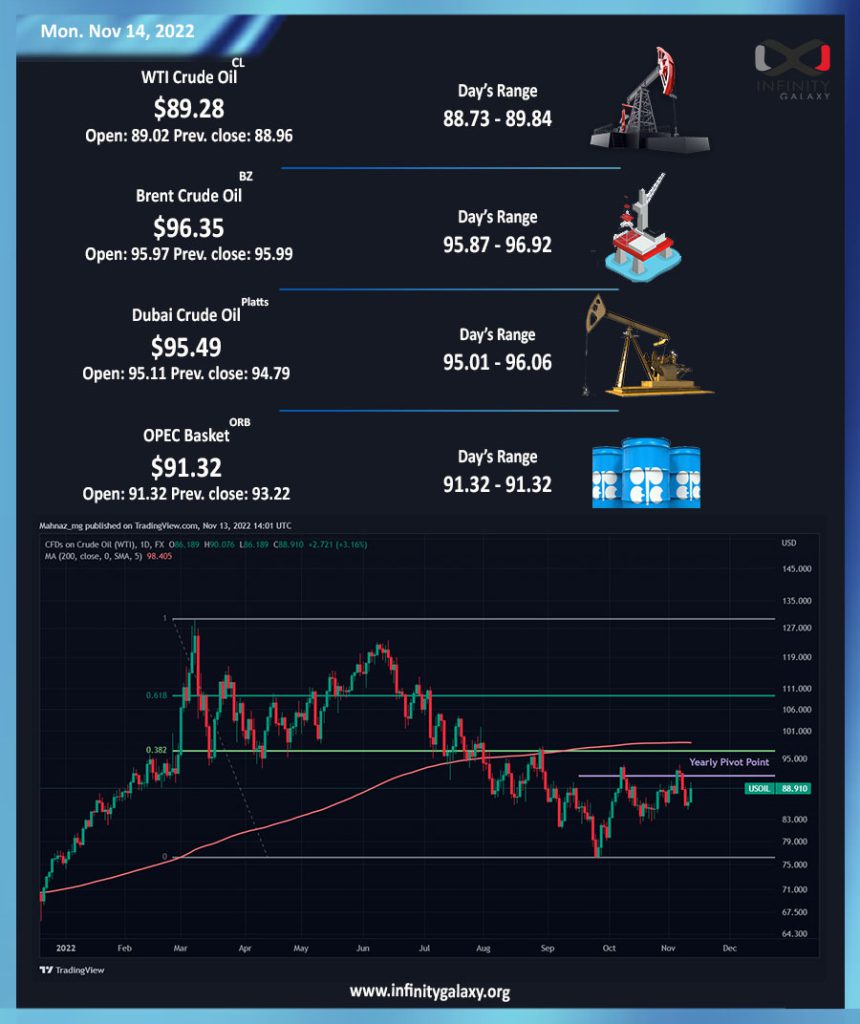

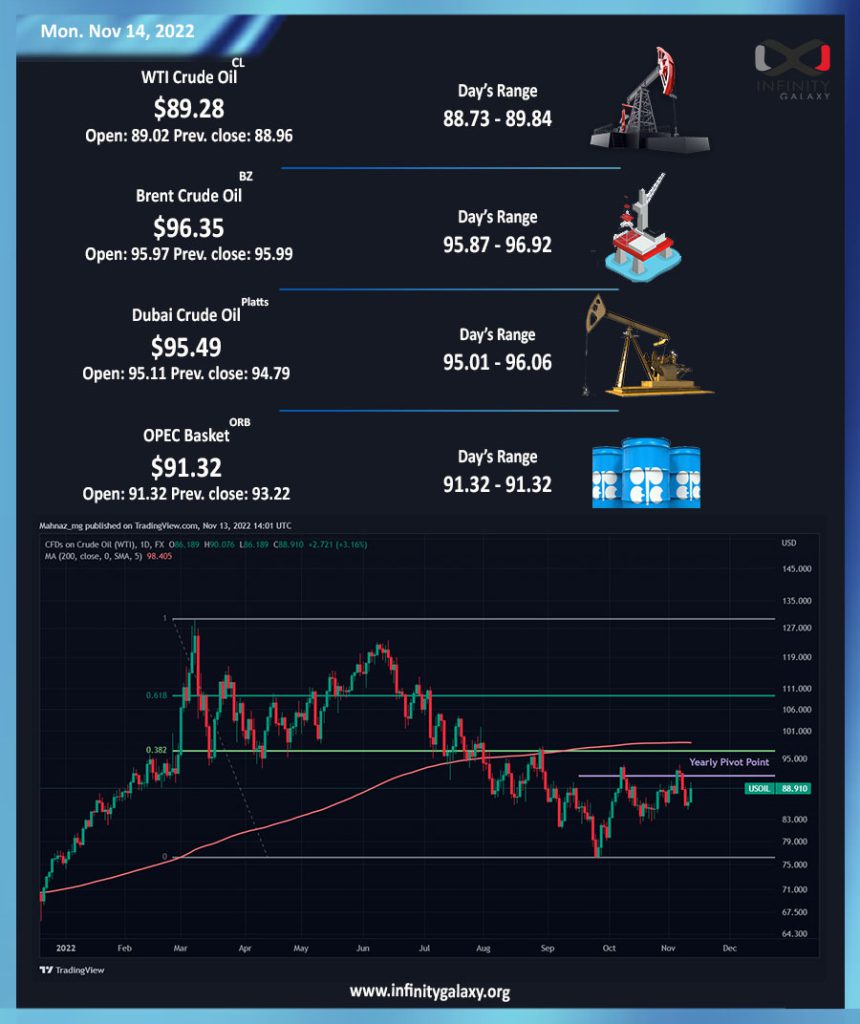

Brent closed at $95.82 and WTI settled at $88.91 on Friday, 11 Nov.

Oil headed down since the first day of the week. The recovery that happened in the last two days couldn’t take the price up to the opening price and caused more than a 3% loss.

What is visible in the daily chart, the price is probably making a double-top pattern. The price level as it is shown in the chart is very strong to pass. We have a yearly pivot point resistance and fib level of 38%. Considering the candles, the price is not probable to pass the resistance area for this week.

Surprisingly, oil did not comply to the regular reverse correlation with dollar, instead, it fell by its side. That might be a sign to be sure that the resistance is unlikely to break.

Aside from technical aspects, there were several fundamentals suppressing the price. The red wave didn’t take place as was expected in the US. Russia withdrew its forces from Kherson and made many suspicious of a new and probably dangerous decision by Russians. All the events set the background for better stocks in the US and Hong Kong but the outlook for China’s demand is still dim.

Bitumen market and fuel have been hot for another week.

Iran’s refineries competed for 75% over vacuum bottom last week, yet it was not the end of it. 63% competition took place on Saturday 12 Nov again.

India also looks determined to increase the price in mid-November.

Singapore fuel increased vigorously during the week but it had a decrease on Tuesday which did not last the growth on Friday.

Below, you can check several bitumen prices in different regions.

| Location | Price |

| Iran (drum) | $425 – $435 |

| Singapore | $560 – $570 |

| South Korea | $440 – $450 |

| Bahrain | $420 – $430 |

| Spain | $395 – $405 |