East & Southern Africa Bitumen Market Report | Supply, Demand & Buyer Behavior

This report is based on direct customer feedback, live negotiations, and on-the-ground market observations gathered by the Infinity Galaxy sales team across East and Southern Africa. Rather than relying solely on price listings, this analysis reflects how buyers are behaving, how projects are evolving, and where real commercial opportunities are forming.

Kenya Bitumen Market

The Kenyan bitumen market is showing early signs of renewed activity after a relatively calm period. While large project demand has not yet fully materialized, buyer behavior indicates preparation rather than hesitation.

Inquiries are becoming more frequent, and discussions are gradually shifting from exploratory to more execution-oriented.

This phase suggests that the market is transitioning rather than stagnating.

Suppliers who engage early, establish visibility, and position themselves before project activity accelerates are likely to benefit once demand gains momentum.

Tanzania Bitumen Market

In Tanzania, the market is experiencing a mild price adjustment at the drum level, while freight costs remain largely unchanged.

This imbalance has increased buyer sensitivity to pricing and encouraged more active discussions around terms and conditions.

As a result, conversations have become more fluid and practical.

Buyers are more open to reviewing offers, creating a short-term environment where structured discussions and flexible positioning can lead to meaningful progress.

Uganda Bitumen Market

Uganda continues to move at a measured pace, typically reacting to regional shifts after Kenya. Current activity levels remain moderate, but this should not be mistaken for inactivity.

Market patterns suggest that demand can emerge quickly once projects are confirmed.

This interim period represents a valuable window for engagement.

Early dialogue, alignment on specifications, and supply readiness can place sellers in a strong position ahead of any sudden pickup in project execution.

Democratic Republic of the Congo Bitumen Market

In the DRC, market performance is shaped far more by logistics than by short-term price movement.

Buyers prioritize supply reliability, route efficiency, and delivery certainty over marginal price differences.

Success in this market depends heavily on having the right supply chain structure in place. Companies that can demonstrate control over logistics and execution tend to gain trust faster and secure repeat business.

Zimbabwe Bitumen Market

Zimbabwe remains a strictly project-driven market, where demand is closely tied to execution schedules rather than spot buying behavior.

Activity levels fluctuate based on how closely supply timelines align with project planning.

In this environment, delivery coordination and timing are decisive factors. Suppliers capable of matching project schedules accurately are better positioned to convert discussions into confirmed volumes.

Africa Bitumen Market

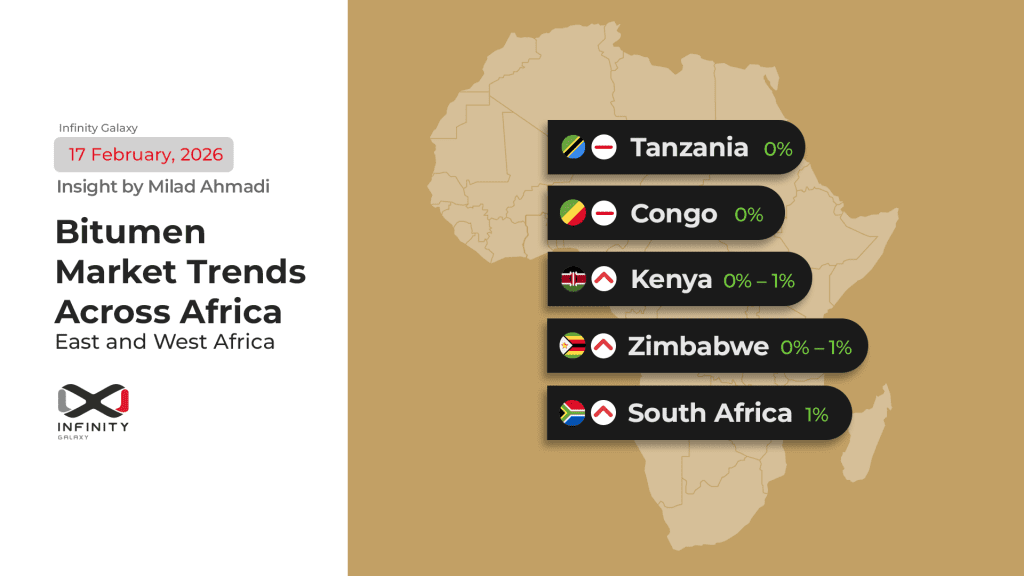

At a regional level, market behavior continues to diverge:

West Africa, including Nigeria, Ghana, and Côte d’Ivoire, is moving into a phase of gradual price strengthening.

East Africa is largely in a stabilization and adjustment mode, with buyers recalibrating expectations.

Southern Africa shows a mixed pattern, combining relatively high price levels with controlled consumption.

The broader signal across the continent points to measured upward movement in the west and structured, opportunity-driven negotiations in the east and south.

Insight by Milad Ahmadi from Infinity Galaxy

The African bitumen market is not experiencing a sudden surge, but it is clearly entering a decision-making phase.

In this environment, advantage lies with sellers who move early, secure logistics in advance, and focus on execution readiness rather than short-term price reactions.