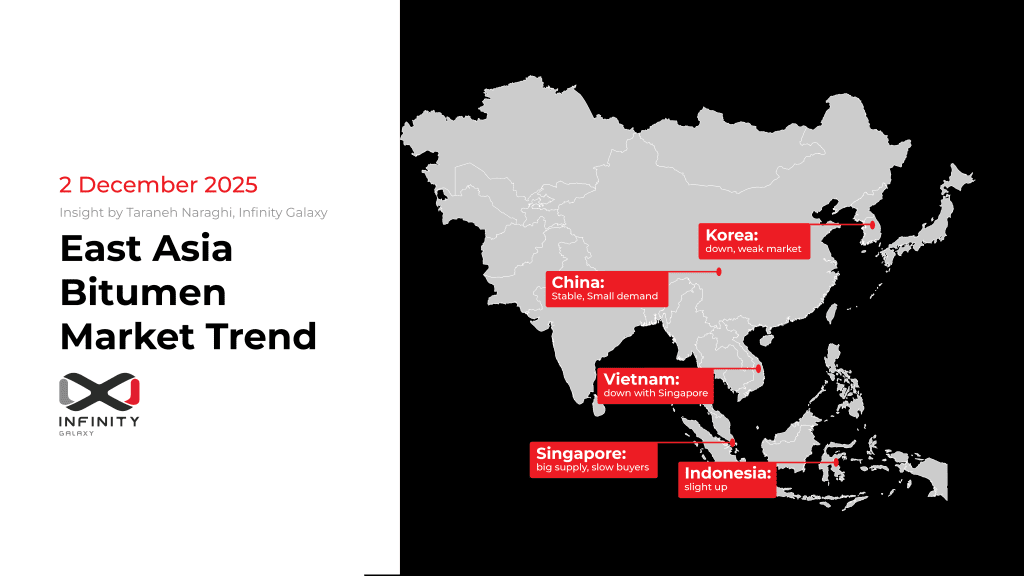

East Asia Bitumen Market Analysis: Supply Pressure Dominates Regional Trends

The bitumen market in East Asia experienced another week of pressure during 22–28 November 2025.

Weak demand, high supply, and end-of-year project delays shaped the general atmosphere in

the region.

In this analytical weekly review, Infinity Galaxy highlights key movements in China, South Korea, Singapore, Indonesia, and Vietnam, while explaining how regional connections influenced the overall trend.

China, Stable, Small demand

The Chinese bitumen market remained stable at 370–380 USD/MT (CFR East China) with no

week-over-week change. Although prices did not move, the market environment stayed quiet.

Most contractors preferred to complete ongoing projects instead of starting new ones.

This reduced spot demand and limited buying activity.

High supply from South Korea and Singapore continued to add pressure, even though Chinese

buyers avoided large orders. Negotiations were slow because buyers expected better prices.

For the next week, the trend is estimated to be stable to slightly down, as supply pressure is

stronger than demand signals.

South Korea, Down, Weak market

South Korea recorded a 1.4% decline from last week. Domestic demand stayed weak, and many buyers preferred to wait instead of placing new orders. Strong competition among regional producers pushed prices even lower.

Logistics were normal, which helped sellers offer more competitive prices to attract buyers. Still, buyer sentiment remained negative. The outlook for the next seven days is slightly down, driven by soft demand and constant supply pressure.

Singapore, Big supply, Slow buyers

Singapore experienced the sharpest fall, down 2.7% week-over-week. Several origins entered the market simultaneously, creating a supply surplus. This made Singapore one of the main sources pushing prices down across East Asia.

Demand from Indonesia and Vietnam became weaker because many buyers were waiting for further discounts. Some delayed cargoes were reported, but logistics did not show structural problems.

The expected trend for next week is downward, as high inventories will take time to clear.

Indonesia, Slight up

Unlike the rest of the region, Indonesia showed a 0.4% increase. Government-funded projects supported moderate demand, and domestic production remained stable. Although buyer sentiment was slightly positive, the market remained sensitive to Singapore’s falling prices. Because the overall regional trend is weak, Indonesia’s slight increase may not continue. The next-week outlook stands at stable.

Vietnam, Down with Singapore

Demand was weak, and most companies postponed purchases because they expected lower prices soon. Supply from South Korea and Singapore was high, adding more pressure. Buyer sentiment stayed negative, and no significant changes were seen in logistics. The short-term forecast remains downward.

Conclusion

Overall, the East Asian bitumen market was driven mainly by oversupply. Even countries with slightly better demand, such as Indonesia, were unable to escape the regional downward pressure.

Infinity Galaxy will continue to monitor the market closely and share weekly analytical insights.