Weekly Oil Report: Quick Recovery Gave Hope

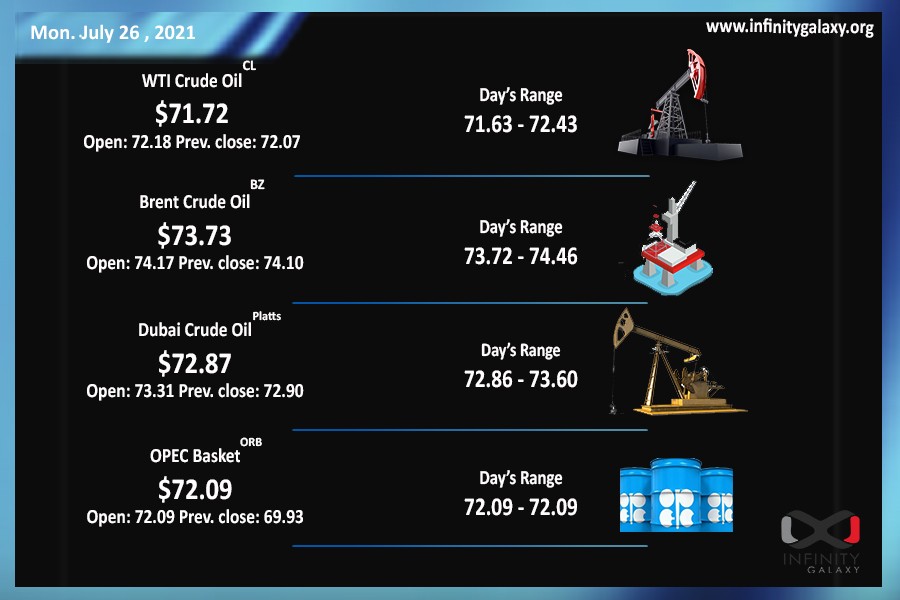

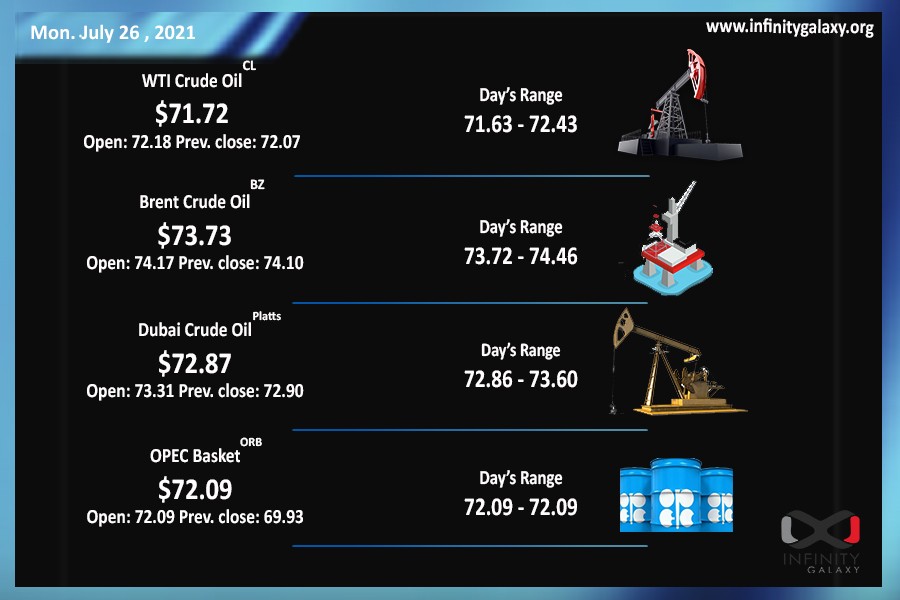

Oil crashed to $65 – $66 during last week after the OPEC decision. As we reported in last week review, the drop was predictable after the inconsistency and uncertainty among traders. Despite the sharp drop of crude, it could revive above $70 gradually. Brent could close the week at $73.36 and WTI ceased at $72.06 on Friday 26 July. The charts of crude say that we might see under $70 again but it is not permanent.

The covid outbreak is still spreading quickly all around the globe. New variants are popping up from various spots, and some are resistant to the vaccines. Several people who have got the virus recently are among the vaccinated population. Delta variant is circulating in countries, though it is not the only one. A new variant of the virus, called Lambada, has scared scientists as they believe current vaccines might be ineffective.

By the re-rise of the virus, central banks need to discuss their monetary policies. The U.S. Federal Reserve’s statement on Wednesday will tell the market whether they will implement the tapering policies or not.

The demand of the market has not changed significantly. Predictions are still hopeful about summer and the price. Financial institutions such as Goldman Sacks declared that $80 crude is coming by the end of summer.

Oil products are in a similar state with constant demand. Regardless of the disputes rising with the recent covid outbreak, constructions and productions are still running due to the plans. Some refineries have faced supply shortages, and their product prices have been rising.