Weekly Oil Report: OPEC Still Expects More Demand

On 11 May, OPEC clearly stated to keep the supply steady as planned. The alliances have decided to increase production by about 2 million barrels per day.

The demand from American and European countries rose after speeding the vaccination. Several cities succeeded to restrain the disease and made their cities mask free. Their fuel and oil demand have risen after getting back to normal. The US oil inventory and Shale oil also decreased the supply.

The second week of May seemed to be fortunate for the US dollar. The financial reports were promising and market sentiments were positive. It did not take long that the US retail sales report turned the page. The report showed that inflation is not rising and the economy is not reviving very well. Therefore, USD fell unexpectedly. In the upcoming week, FOMC will release its minutes and it can move the market accordingly.

As Infinity Galaxy reported last week, India is at a critical period and the spread of the new variant of the disease is affecting the demand. However, others market demand could cover the negative effect.

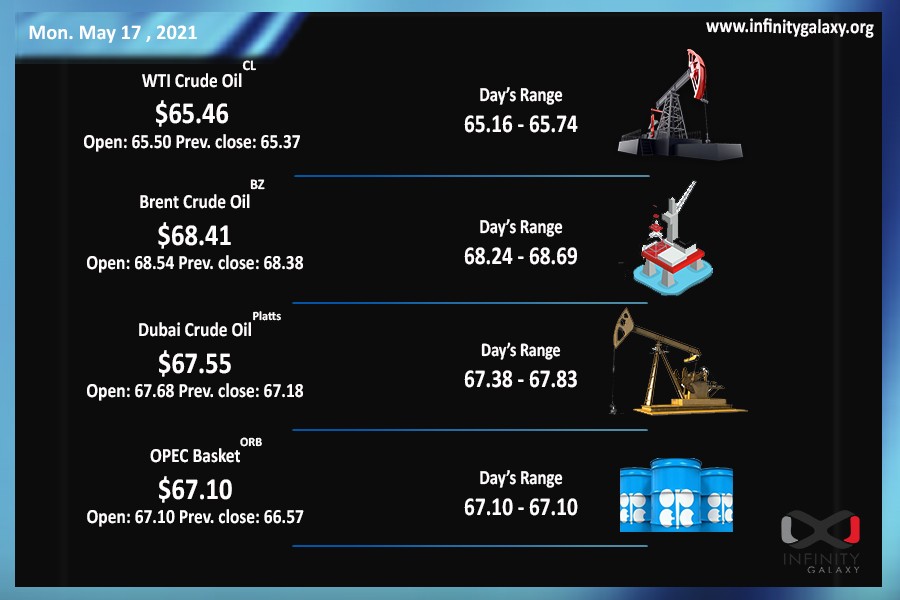

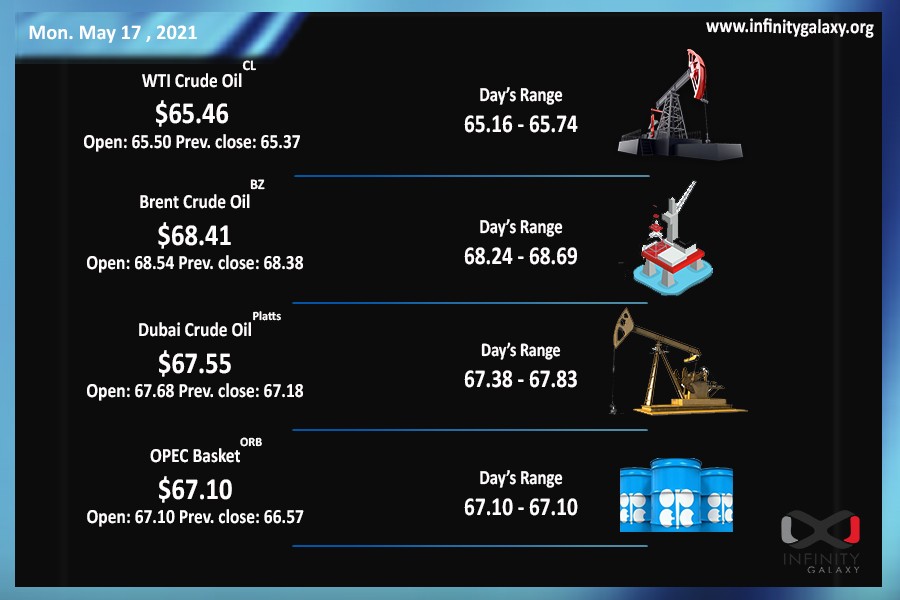

At the moment, WTI is about $65 and Brent is around $68. The current WTI price is at the strong area of $63-65. According to the economic calendar, we may not expect any unreasonable change. However, the war in the region can be a bit risky. If it expands, it might restrain the supply.