Weekly Oil Report: Iran Increasing Crude Oil Exports

Oil has been under pressure as the emission-free programs set to get stronger. On Thursday, U.S. President Joe Biden unveiled a new emissions-reduction target to cut greenhouse gas emissions by 50-52 percent from 2005 levels in 2030. China has also declared to get to carbon neutrality by 2060. According to studies, electric cars are getting more popular globally. All these announcements are paving the way for renewables and no emission strategies.

Financial institutions such as Goldman Sachs reported a dim long-term vision for oil and carbon-based fuels. However, they declared higher prices for oil in the short term.

Iran and the U.S. negotiations led to more promising fields. It is highly likely to get to an agreement soon. The possibility of a new agreement caused some volatilities including a decrease of dollar price in Iran and negative sentiments of the oil market. According to a Reuters report, Iran has exported around 500,000 bpd despite sanctions. In anticipations of the agreement, Iran is flaring up the production. Therefore, the market fears an oversupply in addition to the OPEC decision.

Both countries have not officially declared any announcement yet. However, they are likely to reach an agreement before 18 June, Iran’s presidential election.

In addition to the negotiations and the threat of renewables, uncertainties about oil demand and the Covid-19 cases are rising. India has been in a critically severe situation over the past week. The new variant of the virus is spreading much faster than before and it is paralyzing one of the most important consumers of oil and petrochemicals.

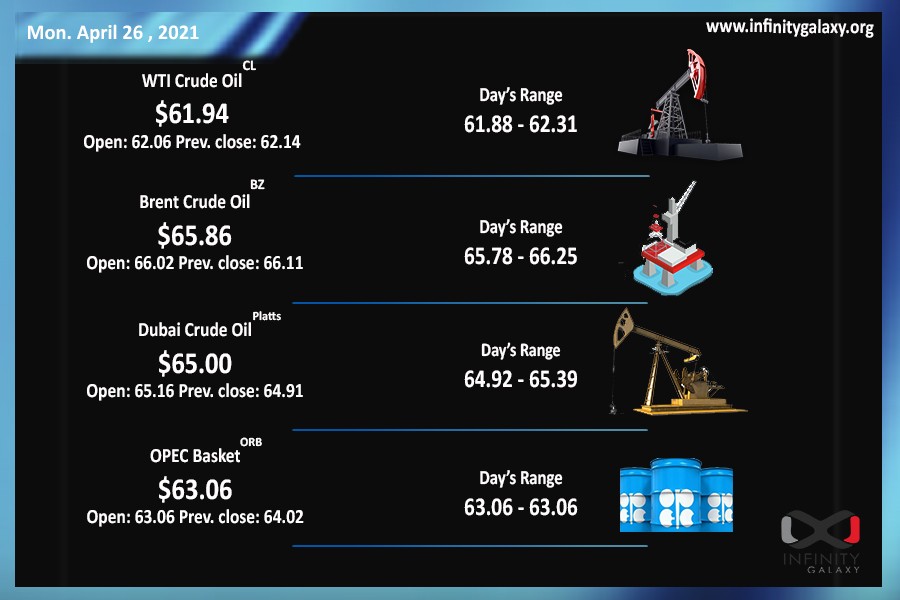

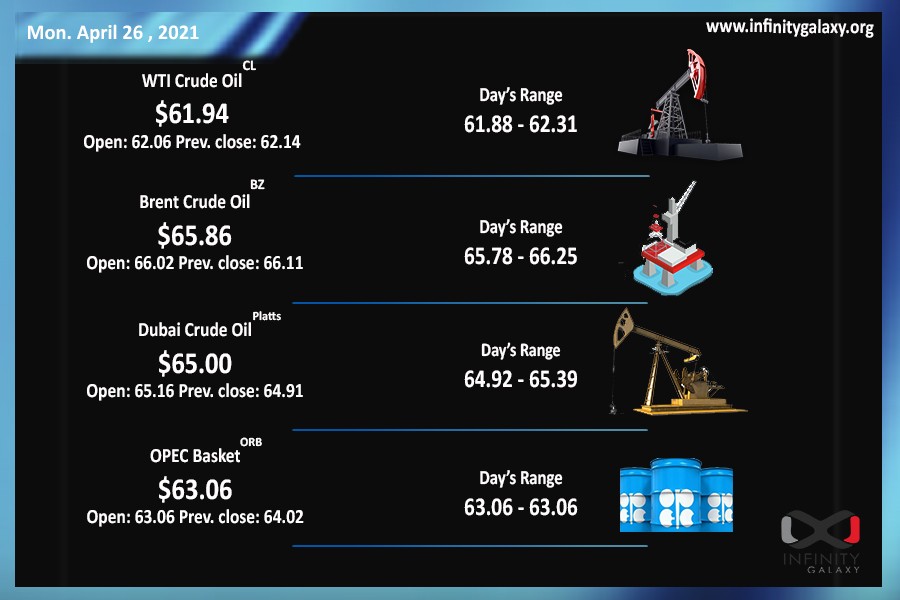

Last week , Brent oil price decreased about 3% and ended the week at $65.17. The selling power is still superior over the purchase. Brent started lower on the first trading day of the week. With more positive news over Iran and the U.S agreement and the lower demand in giant markets of India and China, we shall see lower prices in Brent and WTI.

This article is prepared by Mahnaz GolMohammadian (www.infinitygalaxy.org).