Weekly Oil Report: World Focused on Middle East and World War III

Oil was pumped up after hectic tensions in the Middle East. Watch crude oil technical analysis:

On Friday, Brent closed at $78.05 and WTI closed at $74.39. Brent’s coming resistances are shown on the chart. It’s not bad to take a look at WTI chart too. WTI price broke a long-term resistance last week and might have a pullback. But we shouldn’t neglect the importance of Middle East risks.

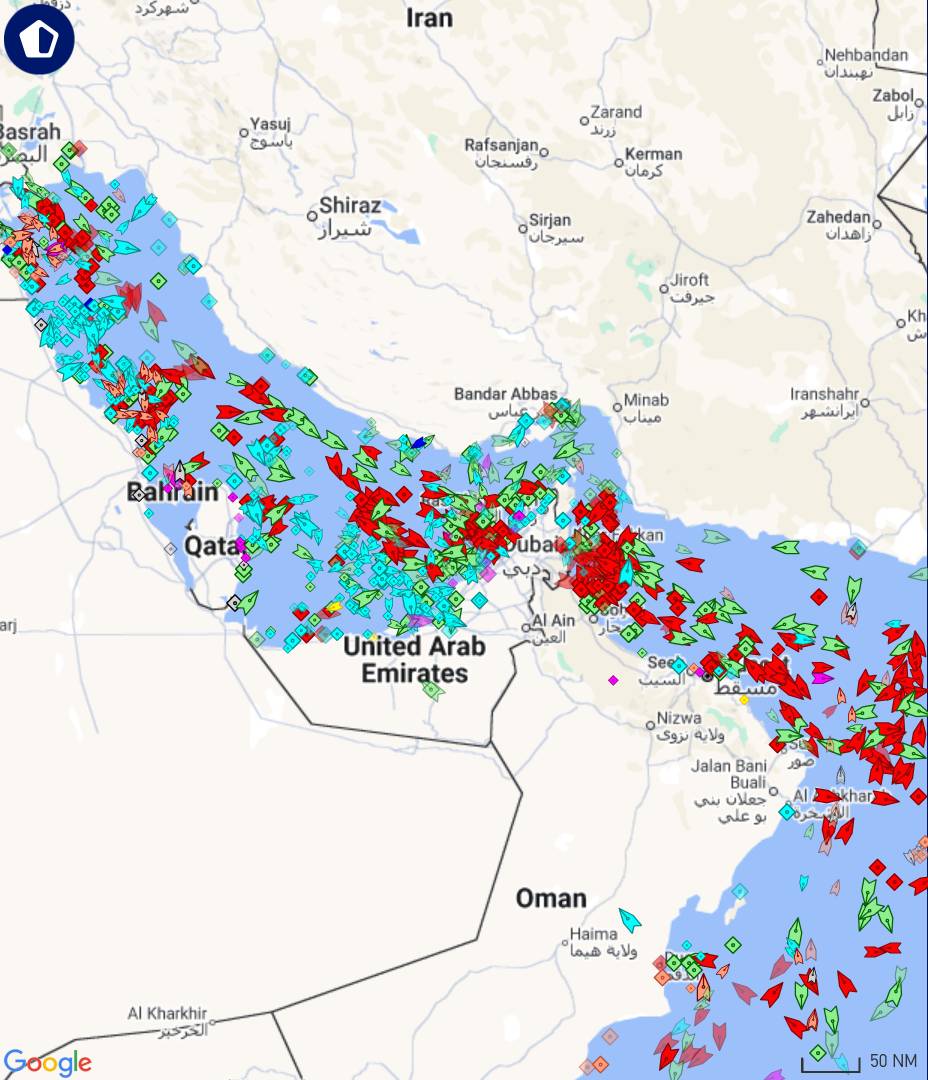

Israel has promised to make the retaliation attack this week. U.S. President Joe Biden said he would not support any Israeli strike on Iran’s nuclear sites in response to its ballistic missile attack. Meanwhile, Donald Trump criticized Biden and advised Israel to go for nuclear sites first. Israel has not announced any target yet. Iran is applying airspace precautions to avoid possible casualties.

OPEC+ is now more careful about the supply. The group were due to decrease production cuts by the onset of October. However, they decided to delay production increase because of price concerns.

Libya is restarting oil and gas refineries and exports after shutting down sites due to some governmental issues.

In the US, the deadly Hurricane Helene disrupted about 24% of oil production in the Gulf of Mexico. Nine oil and gas platforms had been evacuated as of Friday.

The Energy Information Administration (EIA) reported that U.S. oil demand increased to its highest seasonally since 2019. The total consumption rose by 1.2% from June to July which is the highest in the last 5 years.

Considering the regional risks, supply and demand, the market expects bullish movements in oil if fundamentals stay as they are.

Bitumen price has been moving along with oil jumps in different markets. Prices in Korea, Singapore and Africa increased last week. In the Middle East, Bahrain stayed stable but Iran had some increases.

Feel free to contact me for any bitumen inquiries. You can also check an estimate of price for your required destination port on Bitumen Price Today.

| Location | Price (USD) |

| Iran (bulk) – BND FOB | 288 – 292 |

| Singapore Bulk | 500 – 505 |

| South Korea Bulk | 410 – 420 |

| Bahrain Bulk | 395 – 400 |

By Mahnaz Golmohammadian, the international sales expert of Infinity Galaxy (www.infinitygalaxy.org).