Weekly Oil Report: Mixed Sentiments Linger in Markets

On Friday, Brent oil closed at $81.61 and WTI settled around $77.31. Watch crude technical analysis and comment your ideas:

Bears took over crude oil for the third consecutive week. The market has a mixed sentiment at the moment. Considering the broken resistance, it is possible to see a slight correction after the sharp fall.

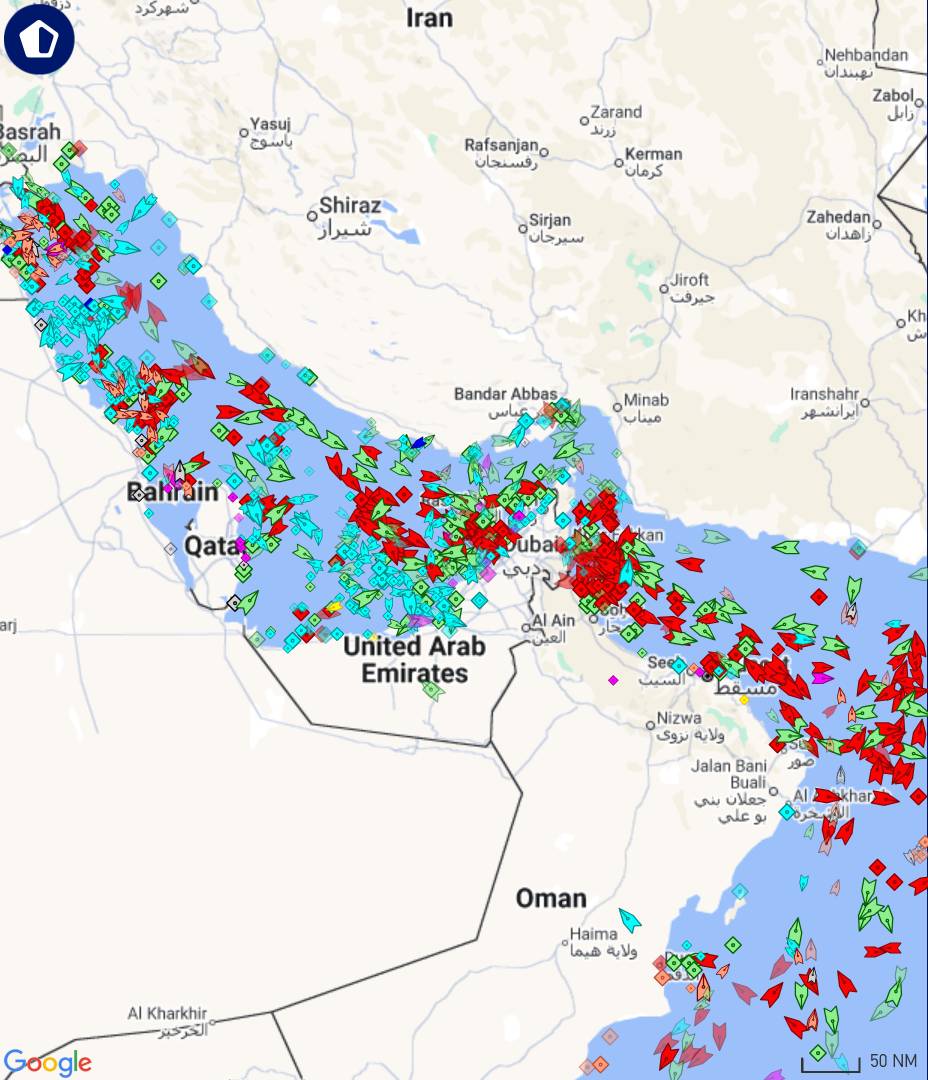

As mentioned in the last episode, there are many negative and positive elements affecting the market. Demand concerns, inventory build-ups and economic fears are suppressing the price on one side while the ongoing war and geopolitical tensions can heat it up at any time.

China is facing chaos in real states. This sector is a crucial driver for the second world economy and its long recession is a real burden. However, demand outlooks have not altered yet.

Saudi Energy Minister, Prince Abdulaziz bin Salman, told Bloomberg that oil demand is healthy and drops are only caused by the speculators. An OPEC meeting is coming up on November 26 and oil forecasters believe that the cartel will extend the cuts to 2024.

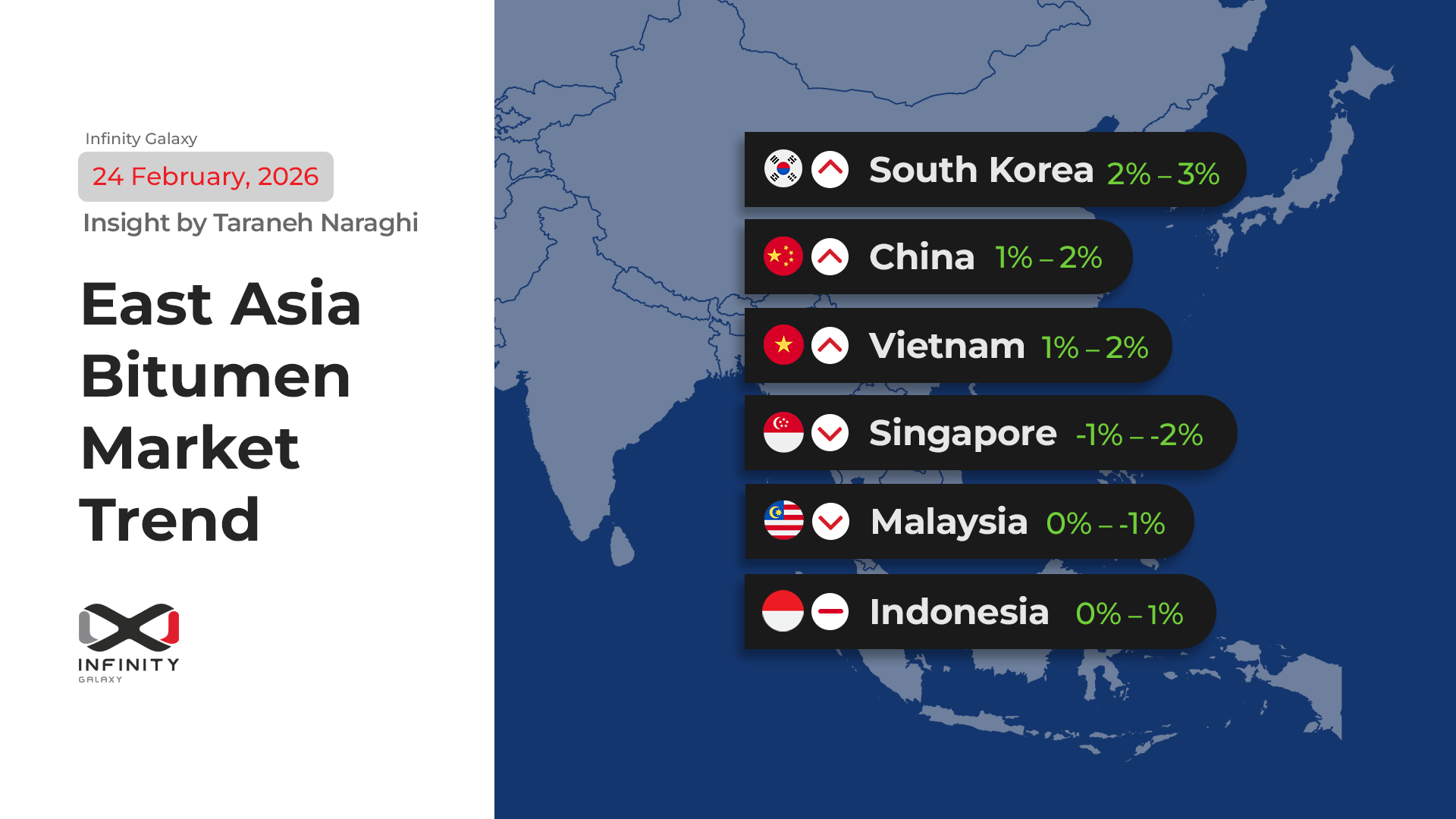

Bitumen and fuel experienced fluctuations after oil shock. Fuel also dropped last week and It is possible to see more fall in both markets. However, it is not certain due to unclear situation of crude oil.

If you need bitumen, contact me for the exact price.

| Location | Price (USD) |

| Iran (bulk) – BND FOB | 310 – 315 |

| Singapore Bulk | 480 – 490 |

| South Korea Bulk | 435 – 440 |

| Bahrain Bulk | 400 – 405 |