Weekly Oil Report: Macroeconomy Dominating Commodities

After 4 falling weeks, oil recorded growth of about 3%. Brent closed at $79.70 and WTI closed at $77.00. The indicator’s divergence shows a possibility of price correction in short term.

Macroeconomic fears stressed many in stocks and commodities last week. Japan’s Nikkei index recorded the biggest loss since 1987 after the central bank’s decision to increase interest rates some days before.

The rising US unemployment added to the pressure on USD/JPY. Experts are suspected of a so-called Sahm Rule which states that the initial phase of a recession has started when the three-month moving average of the U.S. unemployment rate is at least half a percentage point higher than the 12-month low. It can bring more fear to the market.

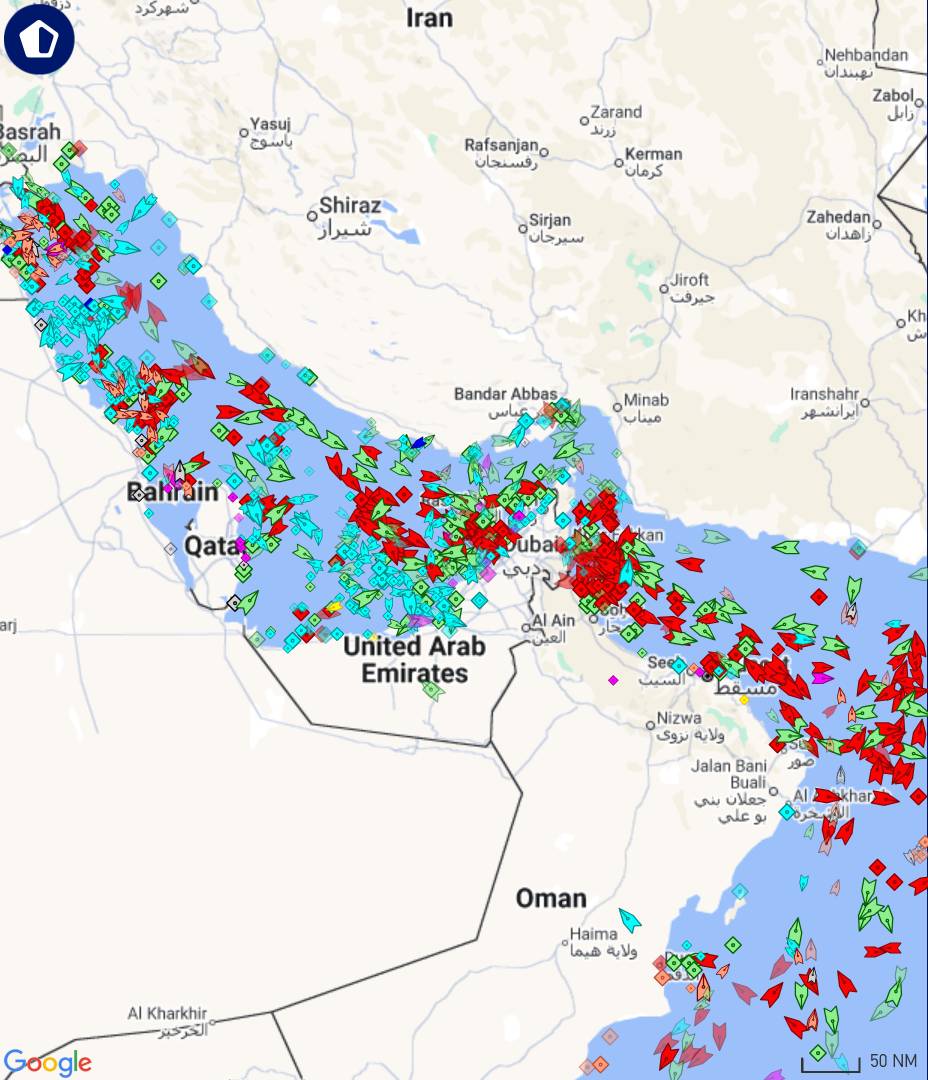

Unlike Macroeconomic concerns, the Middle East tensions didn’t expand deeper since Iran has not initiated any attack in response to Israel assassinating Hamas leader in Tehran. The representative office of the Islamic Republic of Iran at the United Nations in New York announced that they have the right to legitimate defence as Iran’s security was violated. He also mentioned that this has nothing to do with the Gaza ceasefire.

While crude oil increased, bitumen stayed stable in East Asia and a little down in Europe. Bahrain had the largest decline by 30$. In Iran, despite the decrease in VB by about 7%, the competition kept prices in the previous range. At the moment, bitumen is not following the rangebound movement of oil.

Feel free to contact me for any bitumen inquiries. You can also check an estimate of price for your required destination port here.

| Location | Price (USD) |

| Iran (bulk) – BND FOB | 299 – 305 |

| Singapore Bulk | 490 – 495 |

| South Korea Bulk | 410 – 415 |

| Bahrain Bulk | 420 – 430 |