Weekly Oil Report: Jackson Hole 2024 Pulled Oil 2% Higher

Crude oil increased as Jackson Hole 2024 took place on August 22. Watch crude oil technical analysis:

On Friday, Brent closed at $79.05 and WTI closed at $74.91. WTI had about 2% growth only in two days while it was constantly falling in days before. On Brent’s chart, a diversion is visible at the current level.

Fluctuations are wild because of volatile demand and supply. The slowdown in global oil demand, especially signs of a recession in China, pushes prices low from time to time. New reports show that China is still struggling with the property sector.

Fed’s annual economic conference in Jackson Hole brought more hope for an interest cut in September. “The time has come for policy to adjust,” Powell said in his keynote speech.

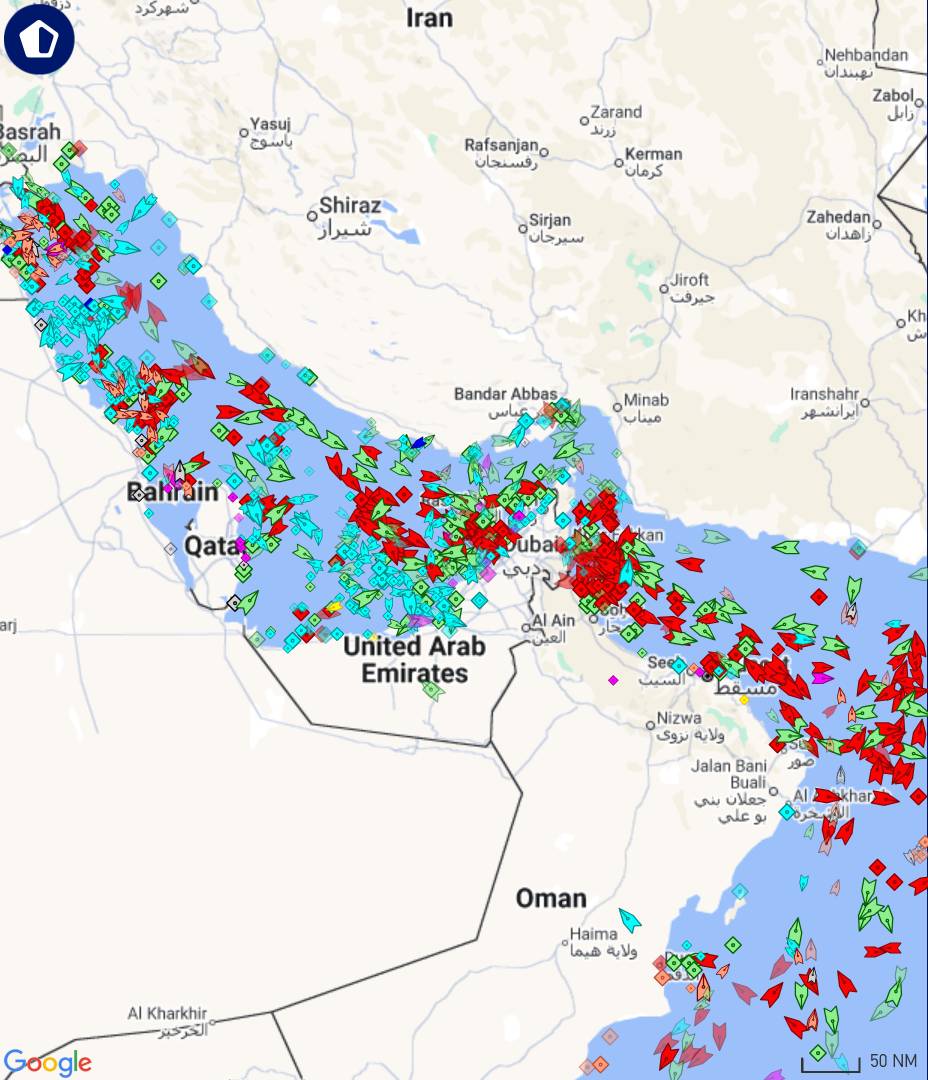

Geopolitical tensions in the Middle East set the scene for oil increase too. Major Israel-Hezbollah missile exchange is escalating the risk of war in the region.

Bitumen markets are now facing seasonal GRI by shipping lines. This GRI will increase export costs accordingly. Iran VB rates had a 7% decrease but it probably won’t affect the final prices since expenses are rising. India’s market is also indecisive with price changes. Europe and East Asia, on the other hand, experienced a slight growth.

Feel free to contact me for any bitumen inquiries. You can also check an estimate of price for your required destination port here.

| Location | Price (USD) |

| Iran (bulk) – BND FOB | 289 – 294 |

| Singapore Bulk | 494 – 499 |

| South Korea Bulk | 405 – 410 |

| Bahrain Bulk | 420 – 430 |

This article was prepared by Mahnaz Golmohammadian, the export manager of Infinity Galaxy (www.infinitygalaxy.org).