Weekly Oil Report: Is Crude Heading for a Disaster?

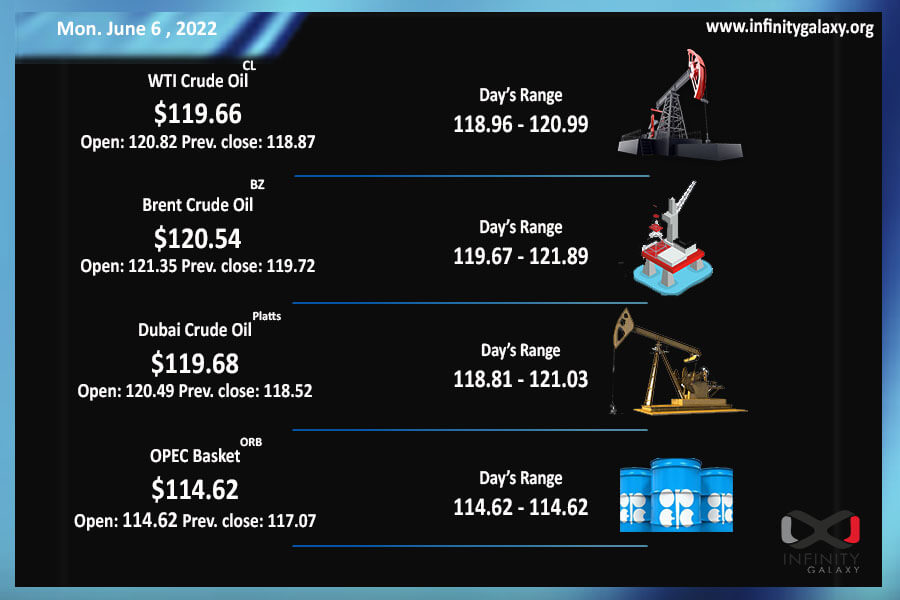

Last week, plenty of turmoil happened to the oil market, including a new set of EU sanctions on Russian oil, an OPEC agreement to increase production, and price spikes despite dollar improvement. Oil prices often act inversely to the US dollars but crude grew over the last week despite the strong dollar. Eventually, Brent closed at $121.24 and WTI settled at $120.34 on Friday’s session.

China is finally over the lockdowns after several months. By the heavier demand from China’s side, price growth happened during the first week of June. Moreover, the supply is now endangered by the new set of EU Embargoes to punish Russia in the market. The decreasing US inventories also prompted the prices.

The rumours were in the market about OPEC suspending Russia from the cartel. However, the OPEC did not discuss any matters regarding Russia during the meeting on Thursday, 2 June. The committee has agreed to increase the production to overcome the price rally but the records show that OPEC did not adhere to its supply plans.

Commodities prices seem to be on an unstoppable rally. The increasing prices of crude can paralyze every economy in a short period. As you can see in the chart below, the market is getting to a price set similar to the situation before the 2008 crisis. The growing inflation and weak stocks are other concerning factors.

The situation is also uncertain regarding petroleum products. Prices are volatile in various regions and traders are indecisive. The fuel price changes have been manipulating markets and it is still a determining factor in price formation.