Weekly Oil Report: Absence of Israel Revenge Pushed Oil Down

Oil fell by about 8% last week as tensions dropped in the Middle East. Watch crude oil technical analysis:

On Friday, Brent closed at $73.14, and WTI closed at $68.78. WTI is back to its falling channel which started in July. The double top pattern shows we can have more falling. Brent was also rejected last week and it can go to the bottom of the Channel.

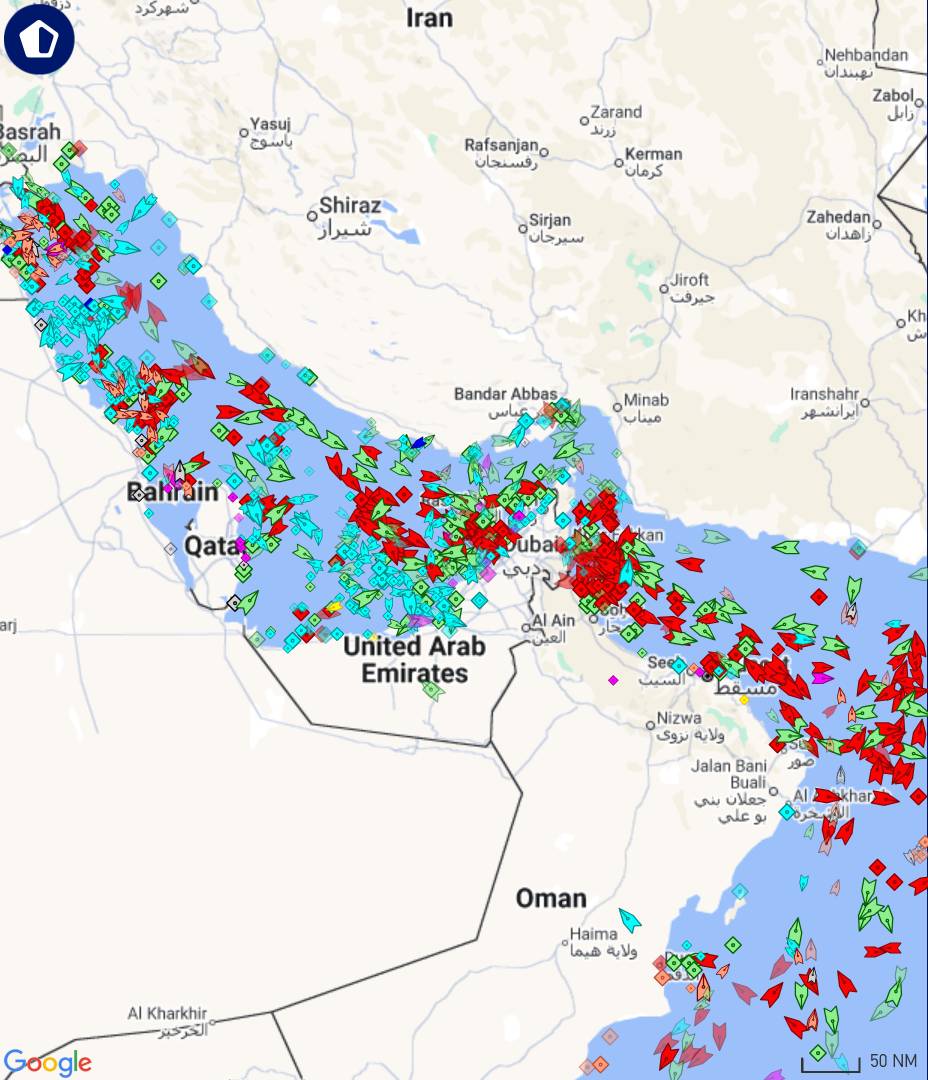

Israel, despite several ultimatums, didn’t take its revenge after Iran’s action. Killing Yahya Sinwar, Leader of Hamas, and attacking some parts of Beirut were some small attacks from Israel but they didn’t cause any major tensions in the region. The absence of retaliation decreased the risk of war in the Middle East and it shifted market sentiment bearish.

The US election will take place on November 5. The result will be important for the political tensions in the Middle East. At the time of writing this article, polls show Harris is ahead of Trump by 2%.

OPEC revised crude oil forecast for the third consecutive month. On October 14, the cartel cut its forecast for global oil demand in 2024 and 2025. The decision reflects the fact that markets should expect lower crude consumption from China.

Bitumen market had a confused trend rising in some parts and falling in others. While Singapore had a drop, India increased the price by $25. Iran price is also increasing due VB shortage and competition among factories.

Feel free to contact me for any bitumen inquiries. You can also check an estimate of price for your required destination port on Bitumen Price Today.

| Location | Price (USD) |

| Iran (bulk) – BND FOB | 295 – 300 |

| Singapore Bulk | 530 – 535 |

| South Korea Bulk | 445 – 450 |

| Bahrain Bulk | 395 – 400 |

By Mahnaz Golmohammadian, the international sales expert of Infinity Galaxy (www.infinitygalaxy.org).