Weekly Bitumen Report: Immediate Developments in the Middle East and Jump in Bitumen Price

After the assassination of Hezbollah leader and an Iranian General in the air strikes of Israel, in a retaliatory action, Iran fired more than 200 Ballistic missiles at Israel’s land on October 1.

These missiles were tracked by America, England, France, and the defense of Israel’s Iron Dome but most of them hit other targets in Israel. At the same time, Israel announced that it would respond to this attack. However, most analysts believe that Israel will not have any attacks in the short term.

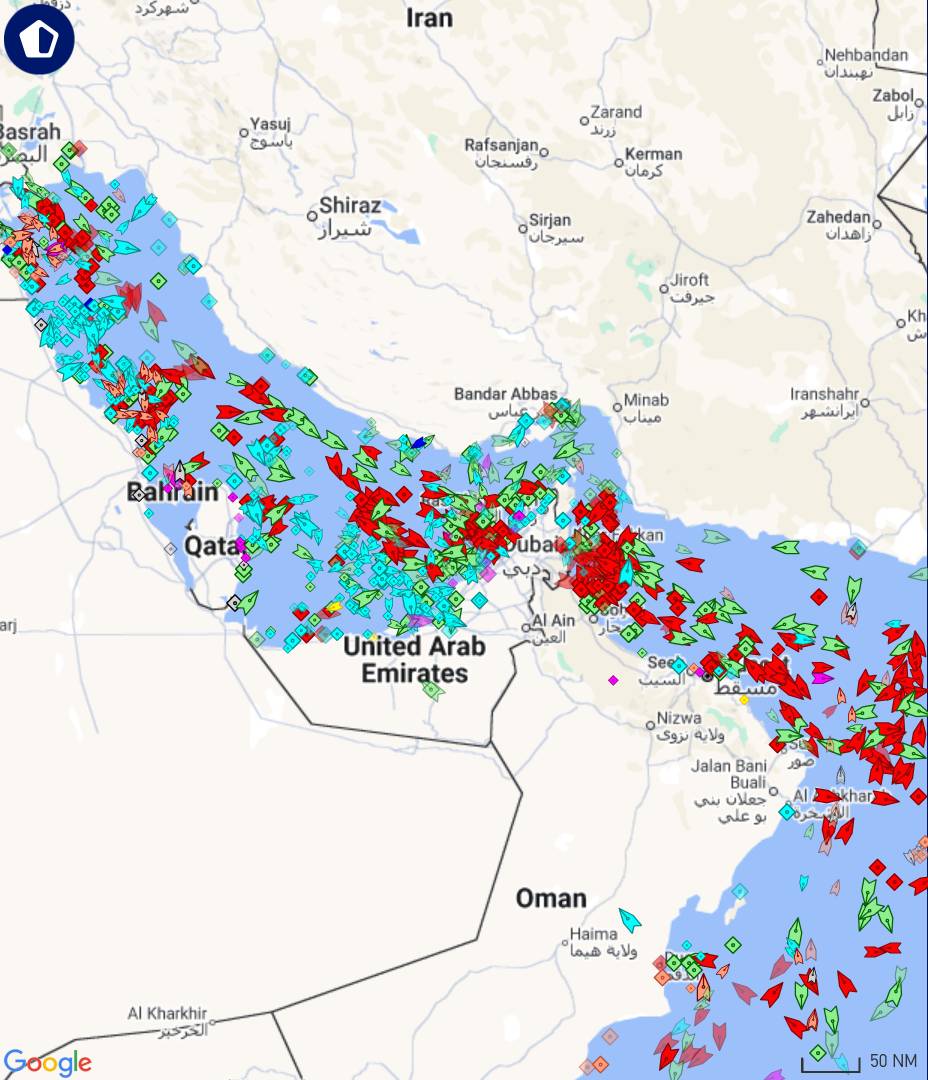

As a result of this attack, clearing the Middle East sky from the flights, and Houthi attacks of Yemen to two commercial ships with Panama flag led to more intensification of the Middle East crises.

On October 2, Israel announced its ground attack to Lebanon and invaded its land up to 400 meters and released news about severe drone attacks in different regions of Lebanon.

All this news caused most of the time in the presidential debate of the US election candidates to be spent supporting Israel and discussing regional events.

Simultaneously, the normalization of conditions for the return of two oil fields in Libya for oil exports, the ongoing Hurricane Helene in the U.S., and contradictory news about the impact of China’s largest support package in that country have resulted in the direction of oil prices being notably unclear over the past week, despite rising tensions in the region.

In the meantime, the Wall Street Journal cited the Saudi Arabia Minister of Energy that if some members of OPEC+ coalition continue the supply exceeding the determined quotas, the global crude oil prices might fall up to 50 USD. However, concerns about the Middle East tension have empowered the possibility that crude oil prices could exceed above 80USD.

On Thursday, crude oil reached up to 77 USD. Singapore’s 180CST faced a significant surge and closed at 448 USD.

Bitumen price in Singapore and South Korea were recorded at 529 and 445 USD, respectively.

Bitumen price in Bahrain is still unchanged at 395 USD and the range of bitumen price in Europe is 390-470 USD.

On October 1, the Indian refineries reduced their bitumen prices around 4 USD, contrary to the expectations. Considering the end of monsoon season and the start time of new purchases, this decrease seemed to be unexpected.

On the other hand, bitumen prices in Iran encountered a considerable jump due to the recent political changes and shortage of vacuum bottom supply. During the last week, the Iranian refineries competed for vacuum bottom around 20% on average which was an unprecedented record during the last one year.

Bitumen prices are expected to rise more in case the Middle Tension gets heavier and China experiences a positive economic situation.

To check the latest bitumen prices at different destinations, check Infinity Galaxy website: https://infinitygalaxy.org/bitumen-price-today/

This article was prepared by Razieh Gilani, the export manager of Infinity Galaxy.