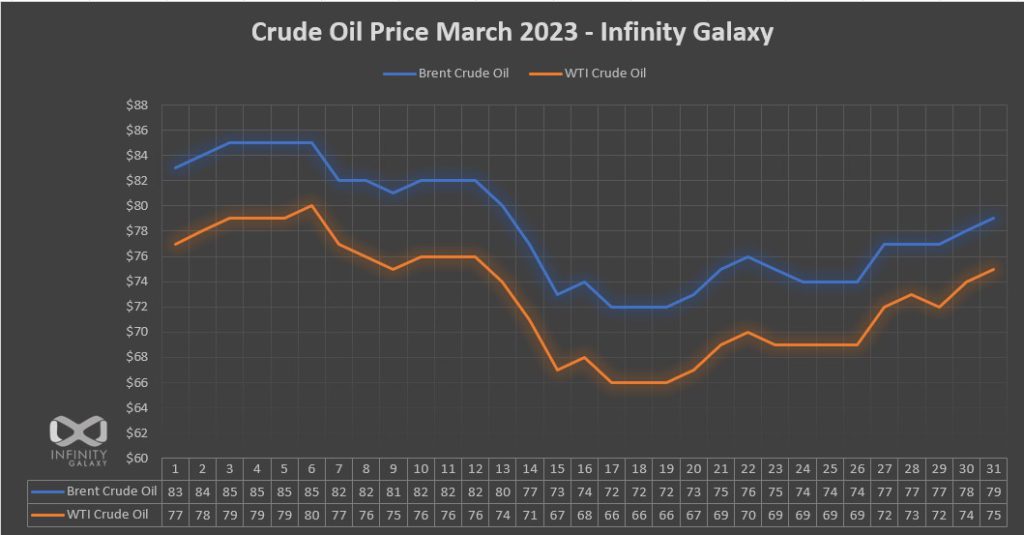

In March, Brent crude oil had a weak movement with slight comebacks to expected price levels due to incentives from the Federal Reserve. The oil price closed at around $74.49, with WTI settling above $69.19 on March 24. The price was influenced by an increase in interest rates during the week, and the complex economic condition affected all markets, including gas, fuel, bitumen, and petroleum products. The Bitumen market was also fragile, with traders cautious about their next move. Iran saw a spike in rates by about 21% due to the change in the dollar value against Rial.

During the second week of March, Brent crude oil dropped over 12% due to the fear of recession and chaotic economic conditions, with a potential correction in the coming week. The fall was influenced by several fundamental factors, including the Swiss central bank’s pledge to fund Credit Suisse and the willingness of Russia and Saudi Arabia to step in if the economic collapse continued. The bitumen and petroleum product markets were also affected by the volatilities of crude oil.

Crude oil did not break the resistance of $80 USD nor fall below it last week. Emirates denied rumors of leaving OPEC, leading to an upward trend in oil markets. However, minor resistances hindered growth, and there are rumors that the Federal Reserve System may not increase interest rates as previously agreed, which could positively affect oil prices. Singapore’s fuel increased $5 USD to reach $468 USD on March 3, and this trend may continue. Bitumen markets saw growth, especially in Iran, due to the improved crude oil prices.

The crude oil price jumped to $85 in the first week but fell back to the previous price channel, indicating a fake jump. The Brent daily chart showed the price was in a triangle, and the third price rise failed to reach the yellow line. Economic organizations predict crude oil above $100 in H1 2023, but the market sentiment is uncertain. The US Federal Reserve was showing reluctance to sharply increase interest rates. The bitumen market in Iran saw a recovery of about $40 due to Rial jumping 20% against the dollar, while Bahrain’s price may also grow in the coming weeks.

Overall, the crude oil market was volatile in March, with several factors influencing its movement, including economic conditions, interest rates, and geopolitical developments. While some markets experienced growth, such as the bitumen market in Iran, the sentiment remains uncertain, with predictions varying widely.

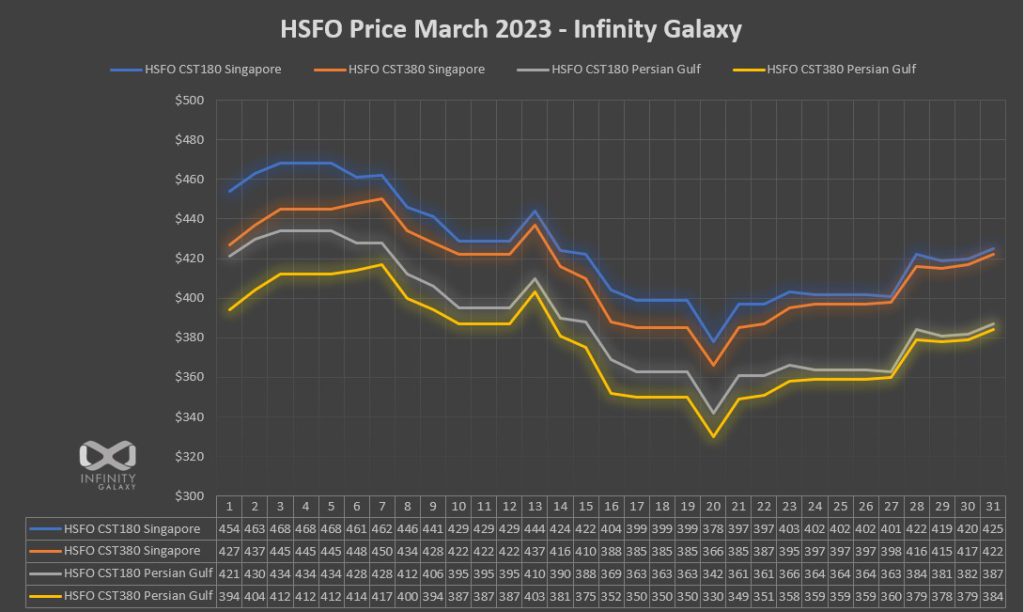

You can watch the Weekly Infinity Crude Oil Forecast prepared by Mahnaz Golmohamadian on Infinity Galaxy YouTube Channel if you are interested in knowing more about the crude oil and HSFO market analysis during March 2023.

Below the last chart, you can click to read the weekly bitumen market reports in March 2023.

In these reports, Razieh Gilani, the export manager of Infinity Galaxy has analyzed the bitumen market weekly and has examined the factors affecting the bitumen price fluctuations during this month.

Take a look at charts and let us know your comments.

Crude Oil Price Chart, March 2023

HSFO Price Chart, March 2023

Click on the link below to watch the Infinity Galaxy crude oil Vodcasts:

Crude Oil and HSFO Report:

Bitumen Price Chart, March 2023

Click on the link below to read the Weekly Bitumen Report of Infinity Galaxy:

Weekly Bitumen Report:

Every Monday and Friday, you can check the Infinity Galaxy blog and YouTube channel to become aware of the bitumen market condition and news. If you have any questions or you would like to keep in touch with our experts, drop a line in the comment section.