Weekly Oil Report: Iran-US negotiations and weak demand hit sentiments

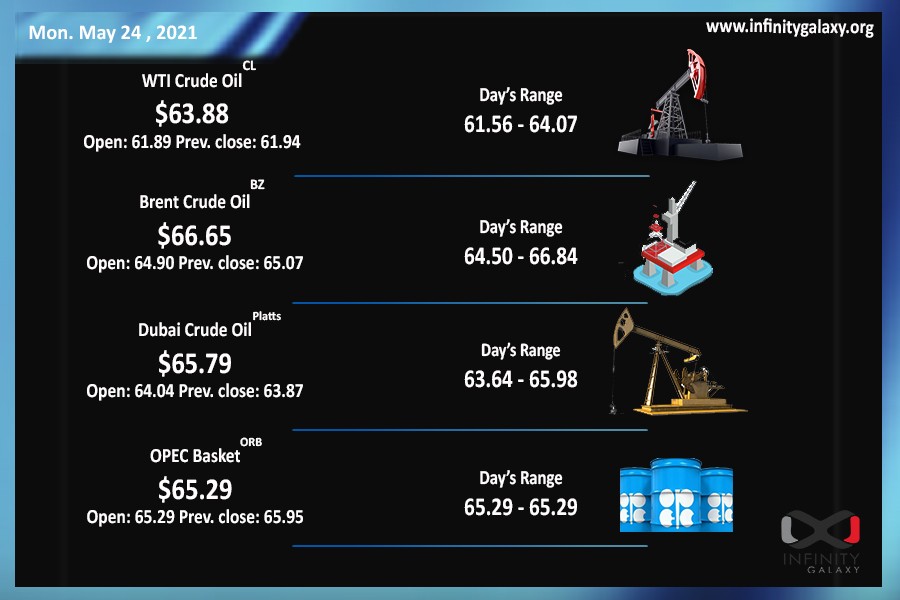

Brent failed at $70 again and decreased about 5% last week. Brent closed at $66.39 and WTI closed at $63.85 after struggling with the strong resistance. Technically, crude oil price charts do not show enough strength to break through higher prices. It is strongly possible for Brent and WTI to see lower prices and continue a sideways trend. Further fall is also probable for oil fundamentally. The tropical storms in the Gulf of Mexico caused WTI to rise about $0.35 on 24 May. However, it has not changed the expected trend yet.

Iran-US nuclear negotiations have progressed recently and it seems that the sanctions on Iran’s oil, petrochemicals, and the central bank will be gone. Without the sanctions, Iran will definably increase the production to above 2 million barrels per day. Although the talks have been controversial, they are not over yet. The negotiations will continue in the upcoming week.

Oil demand in Asia fell after the new phase of Covid spread and hit the market sentiment. However, fuel demand in America and Europe increased. Gasoline unavailability in the Southeast of America has been an issue lately. If the situation remains the same, it may support gasoline and crude prices.

New financial reports, including PMIs, have triggered fear in the market. The statistics indicate that the central banks’ policies may have led to fake inflation and the economy has not revived yet.

The G7 group of rich countries also announced their intention to stop financing the projects that consume coal or emit carbon by the end of 2021. They also set objectives to stop fossil fuel projects within a non-specified period. However, giants of crude oil have not declared any change of plan yet. The fact indicates that they still believe in the previous objectives and the events are not considered as a threat at the moment.

Israel and Palestine agreed on seizing fires on 21 March. The truce can bring a wave of relative peace to the region temporarily.

Oil product demand had also been steady for 2-3 weeks and experienced a mild decrease last week in Asia. However, it was not a surprise after the spread of the pandemic in several Asian countries and the cyclones in Indian ports. Following the crude oil possible fall and sideways trend, traders may observe similar movements in the oil products market. Although shipping freights fluctuations should not be ignored.