Weekly Bitumen Report: Will the Fragile Ceasefire of the Middle East Reduce the Risks of Oil and Bitumen Markets?

The Political and Economic Developments of the Week

The Middle East Frail Ceasefire, Hopes in the Middle of Political Chaos

On October 9, Israel and Hamas reached an agreement to start the first phase of a ceasefire after a long period of unrest. This agreement includes a hostage swap and the retreat of Israeli forces from some regions of Gaza. The ceasefire was based on the 20-point peace plan of Donald Trump, emphasizing Gaza reconstruction, prisoner freedom, and the establishment of international forces. Although the global community welcomes this plan, doubts about the enforcement guarantee remain.

In the meantime, the American federal government has been shut down since October 1. The crisis was formed because of Congress’s disability to approve the budget and stop many of the governmental services. During this political deadlock, Trump intensified the country’s political atmosphere with harsh statements against Democratic leaders and threats to deploy the National Guard to Chicago.

Overall, it was a tense week for global politics: the ceasefire was the only hope in the Middle East; however, Europe is struggling with a political crisis in France and division in the East, and America faced a government shutdown.

Crude and Fuel Oil Markets in East Asia

Crude Oil Market after Ceasefire, Temporary Calm under the Shadow of OPEC+ Caution

During the week, the crude oil market was fluctuating under the shadow of risk reduction in the Middle East and the OPEC+ cautious decision. The ceasefire between Israel and Hamas removed a part of geopolitical insurance from the prices and prevented further uptrend. At the same time, OPEC+ showed a sign of caution by limited production rise, but concerns about excess supply remain. Overall, the prediction of growth in global inventory and weak demand from EIA led to a slight bearish signal for further weeks.

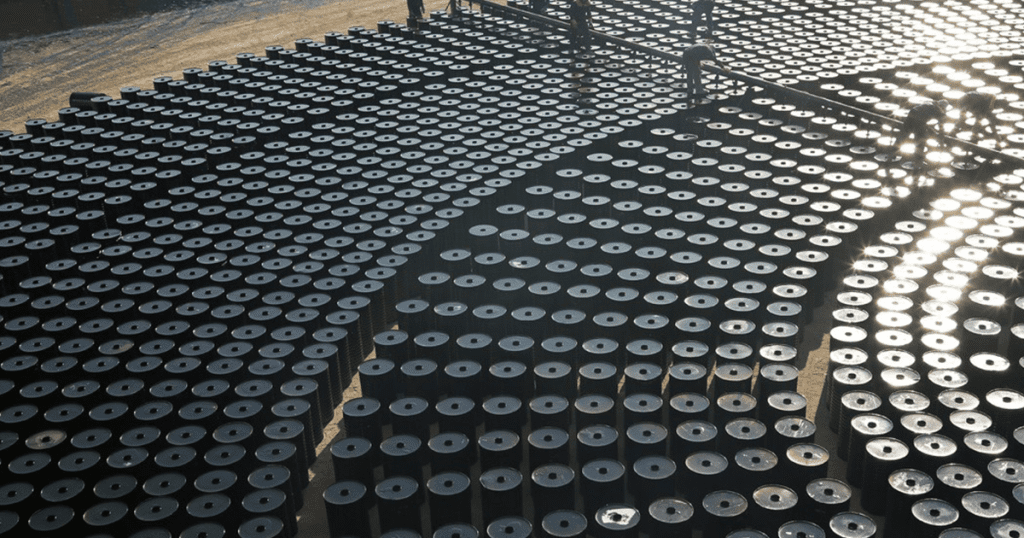

On Thursday, Singapore 180CST closed at $399. Bitumen prices in Singapore and South Korea were recorded at $405 & $403, respectively. Following last week’s trend, Singapore faced another fall to $4 and recorded the range of $398-408. The market is still facing inventory oversupply and weak demand.

Bitumen Market in Bahrain and Europe

Fragile Stability in Bahrain and Decline in Europe

Bitumen price in Bahrain is strongly fixed at $400. However, bitumen prices in Europe reduced following a reduction in crude oil and HSFO prices and remained in the range of $380-415.

| Latest Market Prices (09 October 2025) | |

|---|---|

| Crude Oil | $66.38 |

| Singapore’s 180 CST | $399 |

| Singapore’s Bitumen | $405 |

| South Korea’s Bitumen | $403 |

| Bahrain’s Bitumen | $400 |

| Europe’s Bitumen | $380-$415 |

India Bitumen Market

India Awaiting a Boom after the Monsoon

There were no tangible changes in India bitumen market compared to last week, and the prices remained in the same range of last week.

China Market

Weak Signals of Demand Recovery

Unlike last week, there were no changes in the bitumen market of East China, and it remained stable in its last week’s range. The construction projects are gradually starting after a long recession. However, bulk purchases have not yet begun. Hope for improvement in October and increased demand from southern China has somewhat reduced the market’s mental pressure.

Market Analysis of Iran

Demand Pressure and Exchange Rate Halting Price Growth

Bitumen prices in Iran are still under demand pressure to reduce more. The exchange rate fluctuations remained fixed same as last week. However, the increase in VB prices and production constraints in some units may prevent a continued sharp decline in prices.

Insight by Razieh Gilani from Infinity Galaxy

While a major part of geopolitical risks has been eliminated from the market, dealers follow fundamental data rather than emotional reactions. The balance between high supply and weak demand is the primary signal from the market this week.

According to Razieh Ghilani from Infinity Galaxy, the current calm in the market is fragile; although the ceasefire has temporarily reduced the price pressures, its continuation depends on real political stability. In the short term, the market is in a neutral balance state, but any disruption in the supply chain or a return of tensions could halt the current downward trend.

Talk to Our Bitumen Experts

At Infinity Galaxy, we’re here to answer any questions about buying bitumen. You can also check the latest bitumen prices by destination. Let us know your inquiry using the form below.

"*" indicates required fields