Weekly Oil Report: The Shortest OPEC+ Meeting Pushed Prices Above $90

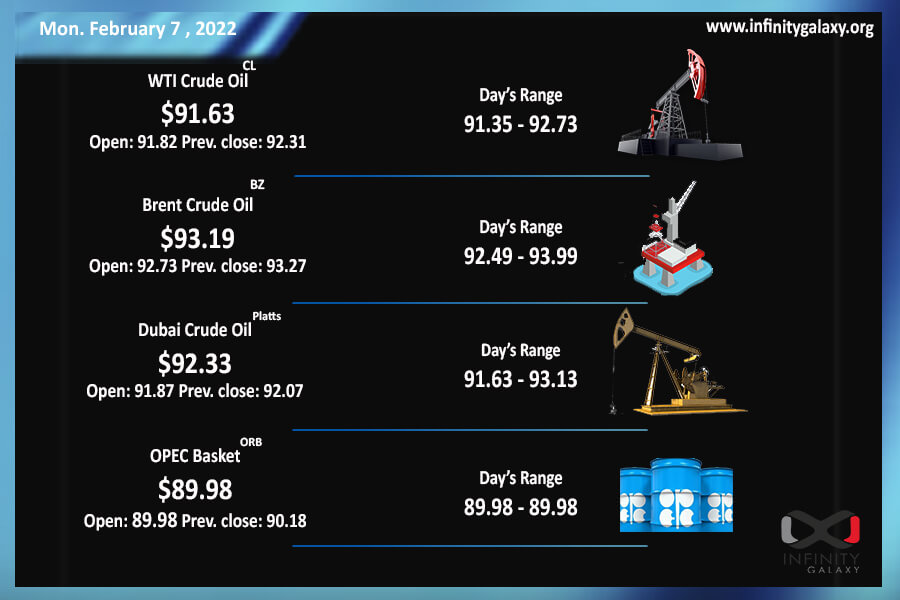

Crude oil rose above $90 during the first week of February. WTI and Brent gap narrowed as the market become tighter. Finally, Brent closed at $91.99 and WTI got to $91.95 on Friday, 4th February. Bullish factors of the market are almost getting stronger than before which is causing more growth. Geopolitical tensions, tight supply and ignoring net-zero commitments are several effective drivers.

The tensions between Russia and Ukraine have increased. Russia might start the attacks in mid-February. Risks of Yemen rebels’ attacks in the Middle East exist as well.

OPEC+ had the shortest meeting of its history on Wednesday! The cartel decided to keep the supply rate unchanged. Only in a 16 minutes meeting, OPEC ministers declared that they will stick with the 400,000 barrels per day output. The quick decision amplified the bullish effects of the constant supply. The market is expected to get a supply increase as Goldman Sachs anticipated.

Energy Information Administration (EIA) bullish inventory reports also stimulated the market. The crude inventory declined 1 million barrels for the week to January 28. The decrease has driven prices higher. Big oil is also quietly drilling for more crude oil despite recent net-zero pledges in the US. Shale oil might start oil extraction soon, according to reports.

Petrochemicals have rocketed in all the markets as the crude passed $90. Countries that have raised the rates of petrochemicals, including India who has declared a potential $50 – $60 increase until mid-February. The market is still potent for more growth.