Weekly Oil Report: Supply Disruptions Intensify

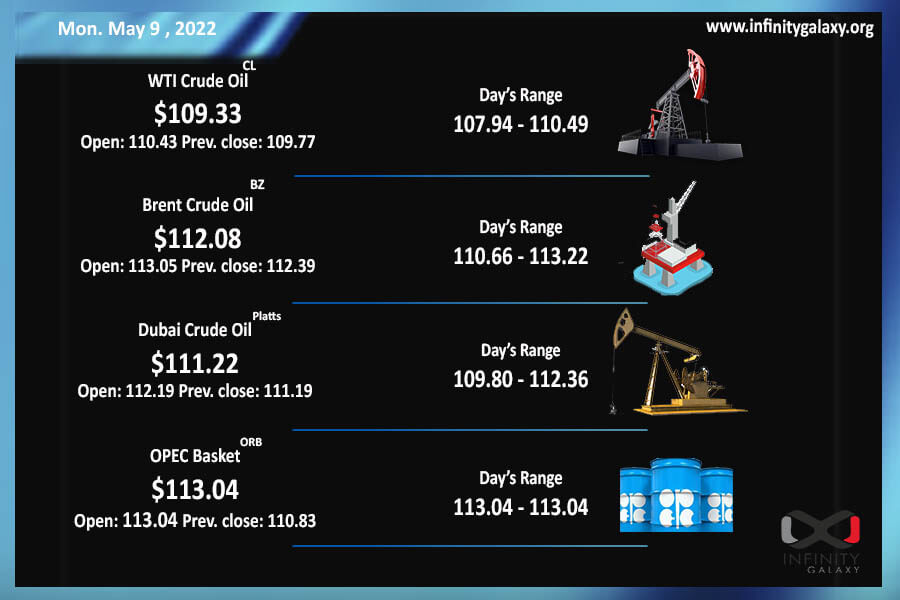

The first week of May brought another consecutive week of growth for crude. Brent oil closed at $112.34 and WTI touched $110.49 at the end of Friday’s session. Russia’s new war deadline fears, the EU’s disappointment to find new suppliers, and the new US attempts to stop the oil monopolies intensified the supply disruptions.

May 9, the Victory Day in Russia, can be a dangerous deadline for the war in Ukraine. Putin’s measurements on Monday, May 9, can change the path of war which is still called a “special military operation” in Russia.

OPEC stayed silent about Russia during the short Thursday meeting. The cartel only applied a slight increase in production while avoiding discussing any matter about Russia’s sections. The nearly intact supply plan was a total disappointment for the EU which is trying to find a replacement for the Russian oil. The crude oil embargos will come into effect in six months; therefore, the EU members have a sixth-months period to find an alternative to Russia’s oil and its products.

The rising price of oil and energy prompted the US to take further actions to curb the price crisis. NOPEC (No Oil Producing and Exporting Cartels) legislation was passed by the U.S. Senate on Thursday after almost two decades. The bill allows the US to sue OPEC under U.S. antitrust law to promote competition and prevent monopolies. It can have severe consequences for OPEC members, especially Saudi Arabia, and disrupt the supply chain further.

Oil products, despite several traders’ expectations, are unlikely to decrease. Considering the inflation condition, it is irrational to expect a decrease in prices. Moreover, according to PetroChina, China’s demand will increase in 2022 despite the zero-covid policies. Stronger demand and disrupted supply can result in higher prices of crude and oil products.