Weekly Oil Report: Slower Movements of crude

Note: Due to high requests from our audiences for crude price targets and more detailed observation, we decided to add a new part to our weekly oil reports containing the technical analysis of the chart.

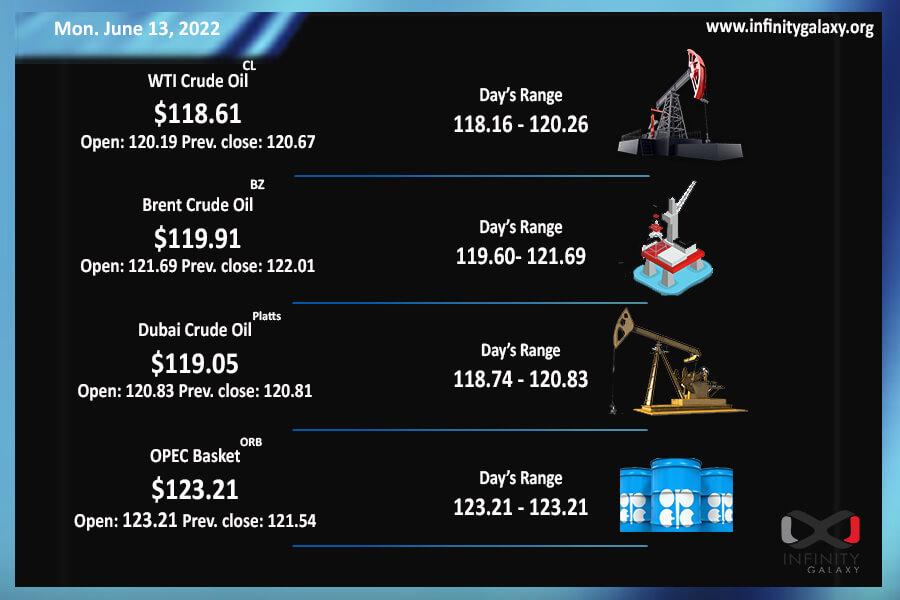

Fear and uncertainty are still flowing in the market and ended the week with an indecisive market. Brent closed at $121.83 and WTI settled at $120.23 on the Friday session.

Technically, the WTI price is approaching a strong resistant level at about $129. The momentum of the price is slowing down and there is a negative RD visible in the MACD and RSI Indicators* in the 4h chart. This type of divergence is usually a sign of getting close to a reversal; therefore, market participants should be cautious around the resistant price level.

Aside from the momentum, the market volume is also diminishing gradually which can approve the slow and tough movement of the price. The overall direction of the crude can be positive during the coming week.

Remember that the analysis above is a personal idea and only a possibility, always do your own research before any decision.

New reports on inflation represent a huge growth in prices. Soaring inflation will inevitably lead authorities to increase the interest rate faster than expected. The idea of higher interest rates is putting stocks under pressure and leaving the market indecisive.

The reimposition of lockdowns in Shanghai and Beijing bolded the probable lower demand of China during the week. Saudi Arabia has decreased its exported oil volume to China for July. The country has also increased the official selling prices for Asia and Europe.

OPEC reports indicate that the committee failed to fulfil its output targets for May again. The failure highlights doubts about OPEC’s new promise for a bigger increase in July and August.

Citi and Barclays, two multinational banks, raised their price forecasts due to the delay of Iran nuke talks and sanctions against Russia. Citi anticipates Brent at $113 per barrel for the second quarter of the year and Barclays sees $111 this year and next.

The petroleum products market is still volatile following inflation and crude. The shortage of raw materials is still a bottleneck for many products and drives prices higher. High fluctuations in currency exchange rates are also bothering traders. In Iran, the dollar/rial is surpassing its historical top prices; therefore, the price of the export products has plunged drastically and exporters refuse to trade new cargoes at the moment. Many importers are also reluctant to import goods because of their volatile currency value.

* Indicators are statistics used to forecast financial or economic trends, including RSI and MACD.