Weekly Oil Report: No Short-Term fix for Energy

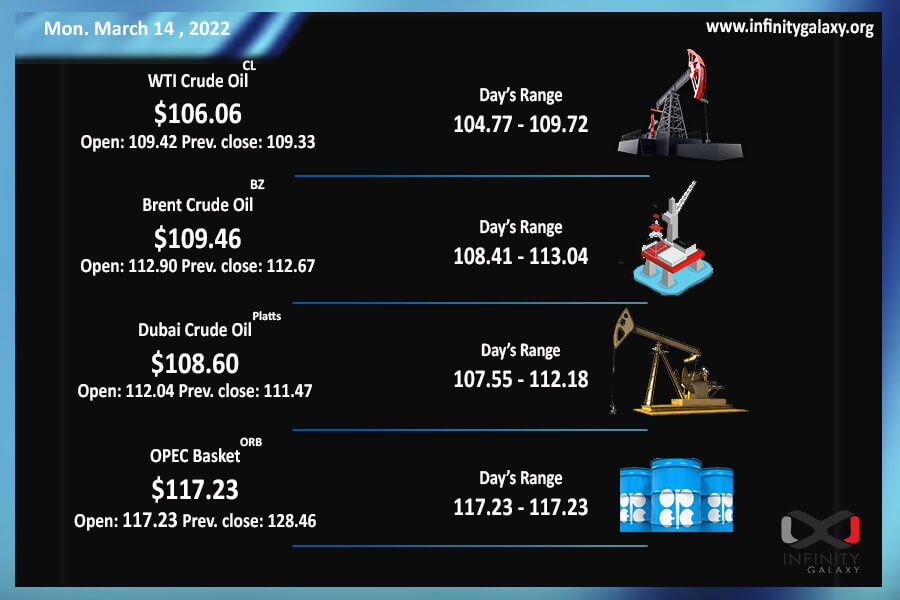

Crude oil had quite a surprising week in which it could see both a bursting surge and dump. It opened at almost $126 at the first of the week and touched over $130. After several positive sentiments for supply, it retreated about 12%, the biggest decline in months. Ultimately, Brent closed at $109.94 and WTI got to $109.14 on the Friday session.

The turbulent condition of commodities and energy has been troubling many governments and traders. The chaos does not seem to be over yet because the sensitive factors are almost unchanged. The demand is still rising and the place of Russia-Ukraine war is running in Europe. Hopefully, supply has been showing some promising signs but we cannot expect any market stability in the short-term vision.

Several OPEC+ members, including the UAE, volunteered to open taps. The committee increased the supply by 80,000 bpd in February, to 14.07 million bpd, compared to January. Considering the boost, the cartel might accept the request.

Shale oil company has been prompted to open taps with prices over $120. The US reserves also increased last week. The US rigs count has also jumped.

Canada intends to ramp up the oil and gas export to the US as Russia is now out of the market by the sanctions. The country already has a high record in exporting to the US according to 20212 reports. Iran might soon return to the international market in the oil sector.

The supply condition is improving but it takes a long time to replace Russia’s oil and gas. Traders should expect volatility in the prices of petrochemicals and energy.