Weekly Oil Report: Geopolitical Tensions Driving Crude Higher

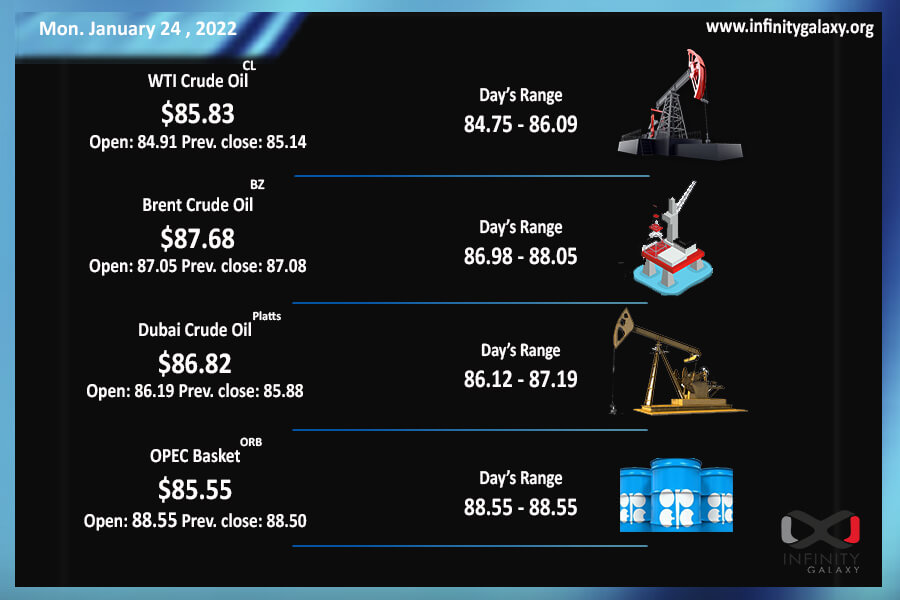

The market slowed down last week after the fearful starting days of the week. The increasing US oil inventory lit up the idea that the growth pace might have been fast. The two benchmarks, Brent and WTI, closed at $86.76 and $84.76 on Friday. But doubts did not last long. Tensions in Eastern Europe and the Middle East evoked fears of a tight supply in the market again.

Russia is moving ships and troops to Ukraine after the peace talks stalled. The fears of a war in the region have become stronger. The US ordered families of the Ukraine embassy to leave on war fears.

The risks of Houthi’s attack in the UAE are still diminishing supply outlook. After last week unprecedented attack of Houthi, the UAE intercepted two Houthi missiles targeting the Gulf country with no casualties on 24 January. The region is in fear of new attacks by Yemen rebels.

The financial institutions still believe that oil hits $100 in 2022. The geopolitical tensions and OPEC decisions are accelerating the prediction. OPEC is struggling to increase the supply and remained with the former release schedules. Yet, the new plans will be revealed in the committee meeting in February.

The energy crisis in Europe has been slightly eased. However, the demand remains strong as the cold weather hits regions. Petrochemicals are growing along with crude hikes. The market can see the highest prices in recent years when the $100 oil forecast become true.