Weekly Oil Report: Crude Rally Speeds Up

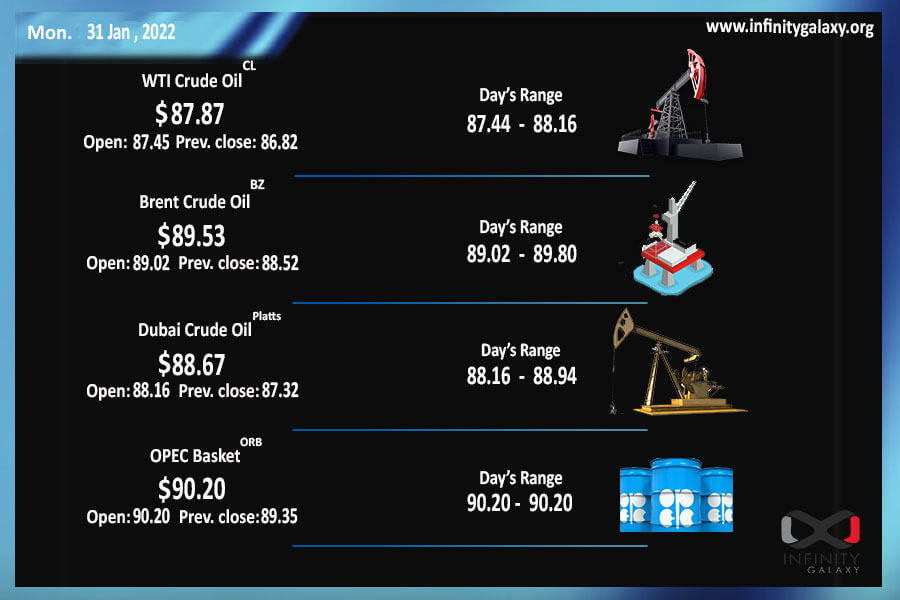

Brent rocketed through $90 in the last week of January, the price that it could not regain since 2014. Although the break was short and unstable, it reinforced the $100 forecast along with supply disruptions. Brent closed at $88.66 and WTI closed at $87.24 on the final trading session of Friday.

Geopolitical risks are still amplifying the supply disruptions. The prolonged Russia and Ukraine standoff has worried Europe more than before. Russian troops are moving toward Ukraine. Britain, the United States and other NATO allies are more concerned about the war possibility. Several defence experts believe that Russia will finally initiate attacks. Attacks of Houthis still continue in the Middle East. The UAE shoot down the 3rd missile of Yemen rebels during the Israel president visit.

The draining inventories and spare production capacity is also pulling the price. Oil companies prefer to return cash to shareholders instead of increasing production. OPEC cartel seems unfaithful to its commitment to increase production by 400,000 bpd. In December, OPEC+ added only 253,000 barrels daily and stayed behind its target. OPEC will surely discuss the supply targets on Wednesday, 2 February.

The petrochemicals stayed bullish along with crude. The market is getting more potent and the outlook is growing with better demand. While some traders are waiting for lower prices, it might be better to make their decisions faster to avoid falling behind the market as it is would probably be unleashed in February.