Weekly Bitumen Report: Positive Oil Trend and Bitumen Support

During the last week, oil price touched its highest level. According to Reuters, the reason of such surge can be attributed to the concerns about intensification of tension and its effects on oil demand due to the unexpected increase of US SPR.

According to the authentic sources, after the drone attack of Ukraine to Russia’s energy infrastructure leading to fire in an oil site in a main port, the index of Brent crude oil and WTI raised due to the attacks.

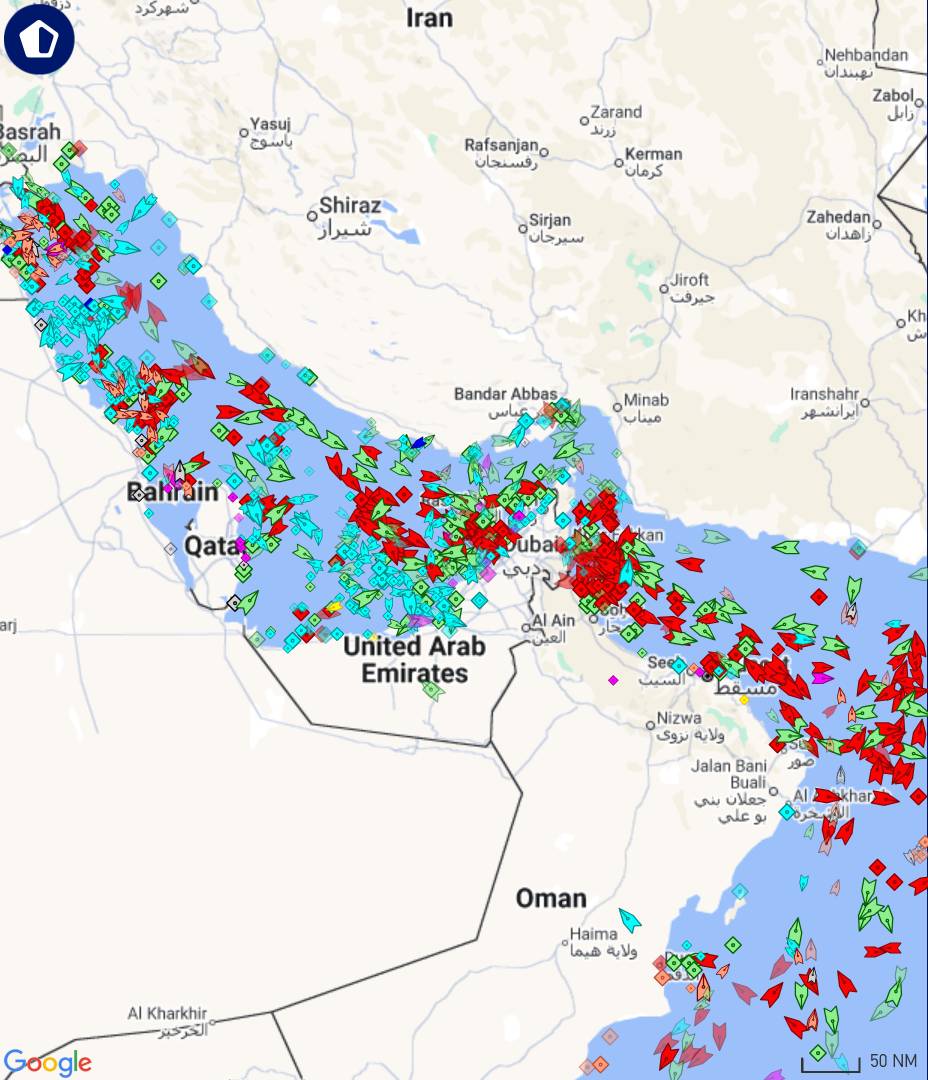

Additionally, the intensification of tension in the Middle East increased the risk of supply disorder of oil by the producers in the region.

In the meantime, according to the published data in China during the past week, its industrial production in May was lower than expected, but the retail which is a consumption criterion faced its fastest growth since February.

A market analyst in Singapore’s IG institute declared that worries about the outbreak of geopolitical tension in the Middle East led to the significant improvement of oil price in the last week.

Besides, the Energy Information Administration of America reported the surge in oil refining capacity of the United States in 2024, for the second consecutive year.

On the other hand, Russia Energy Ministry declared that its oil production in May exceeded the OPEC+ determined plan. However, since late 2022, OPEC+ ran the plan of considerable reduction in oil production to support oil price.

On June 19, Singapore’s CST180 touched 515 USD. Bitumen price in Singapore and South Korea closed at 450 and 415 USD, respectively.

In Bahrain, the bitumen price remained unchanged at 480 USD and a surge in bitumen price was observed in Europe in the range of 455-520 USD.

The price of bitumen in India also decreased by $2.5 in mid-June, and it does not seem that the trend of bitumen prices in India will change significantly.

The price of bitumen in Iran, with less than 10 days left until the presidential elections, has come under more pressure due to election conditions and rising costs, and it does not seem that a significant change in the current trend will occur until the elections. However, the price of bitumen in Iran is still the best price for buyers.

For further information of bitumen market, stay in touch with Infinity Galaxy team.

This article was prepared by Razieh Gilani, the export manager of Infinity Galaxy (www.infinitygalaxy.org).