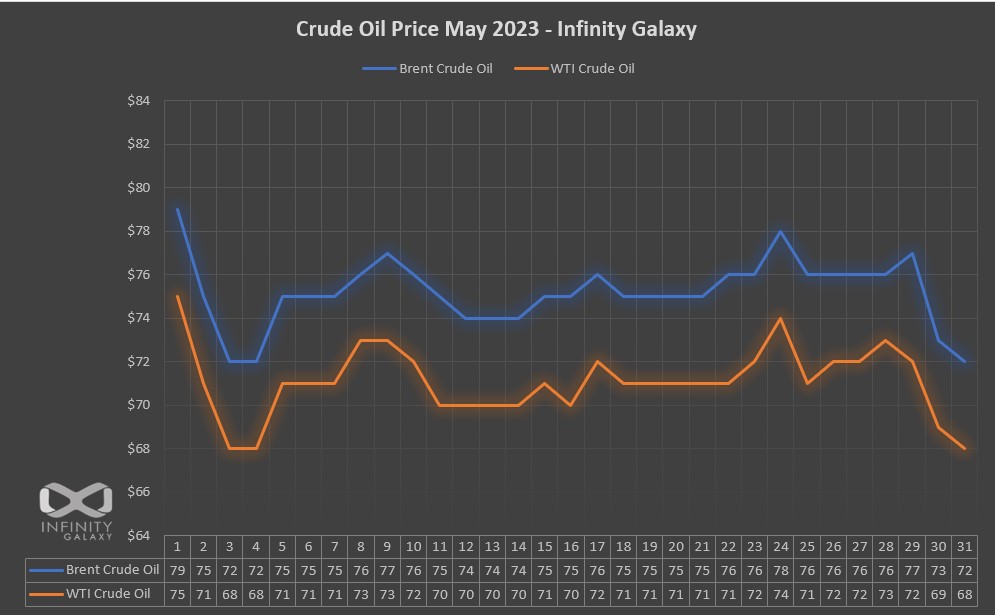

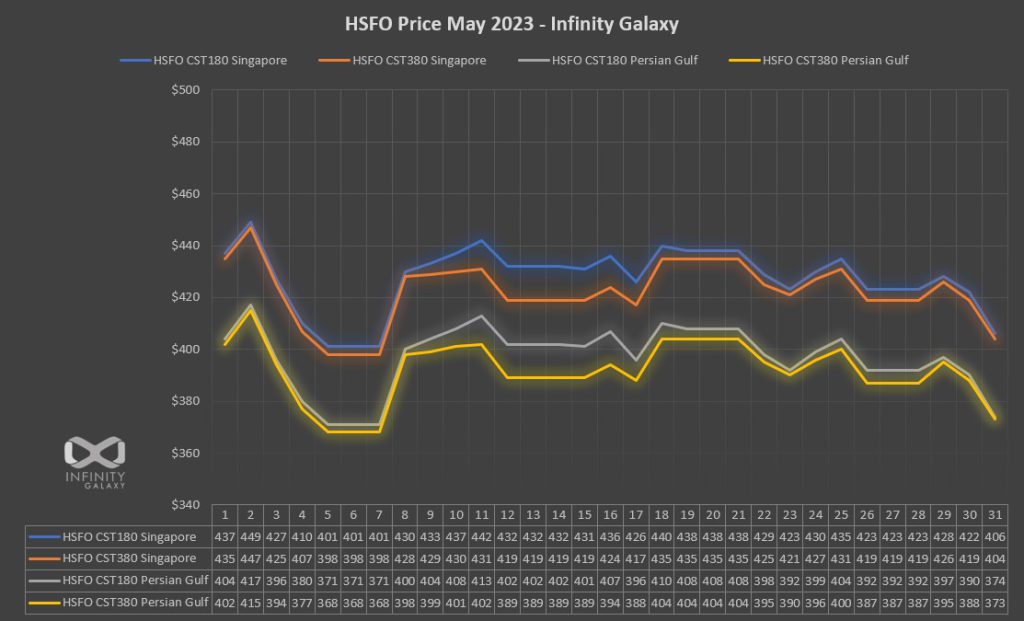

The fall of Brent and WTI oil prices was the most important news of the week, which started on May 1. The reasons for the fall were proposed by analysts, who cited weak demand in China due to a decrease in production in April and the first contraction in PMI Index since December 2022. Additionally, Russia loaded the highest level of its oil from its western ports since 2019 in April, despite sanctions imposed by the USA and West, causing supply to exceed demand. The cut of 1.6 million barrels in April 2023 delayed concerns about a fall in oil prices. As for fuel prices, they dropped accordingly.

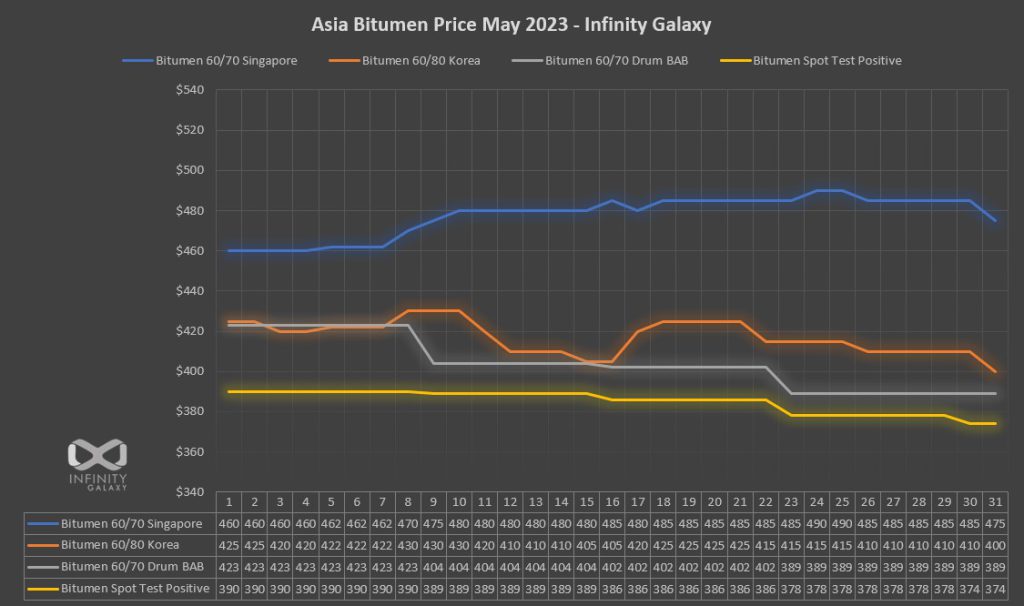

In the second week of May 2023, Syria’s return to the Arab Union after 12 years could lead to more political and economic peace and stability in the Middle East, but this remains to be seen. China’s domestic tourism reached its highest level before the outbreak of COVID-19 during the 5-day holidays at the beginning of May, which along with partial improvement in economic growth, is a sign of improving economic conditions for the second economic power of the world. Bitumen prices declined in all markets from Europe to East Asia.

In the third week of May, the inflation in the United States decreased, and the Federal Reserve might have stopped increasing the interest rate in the next month. However, there were concerns about the US debt ceiling negotiations, bank health, and global economic vision that may have affected the value of the US dollar as a safe valve. The USD index increased by around 2% since mid-April, but there was still a 10% gap from its highest record observed last September. The oil price decreased by 1% due to concerns over American debt and the possibility of significant default. Global oil demand was expected to reach 102 million barrels per day, with China leading the way after its oil demand hit 16 million bpd two months ago. Bitumen prices faced pressures and instabilities. Iran’s bitumen price dropped, while it was expected to increase due to demands from East Asia and Africa.

In the last week of May 2023, the release of news about declining oil and fuel reserves in America and a warning from Saudi Arabia’s energy minister caused slight fluctuations in crude oil prices, but Brent oil remained below $80. At the Qatar Economic Forum, Qatari Energy Minister Saad Al-Kaabi warned that worse WAS yet to come for the economy. Bank of America PREDICTED oil WOULD reach $90 in the second half of 2023. There MAY HAVE BEEN further supply cuts in upcoming OPEC meetings. Bitumen prices HAVE SEEN some instability, with South Korea SEEING only a small increase due to falling prices in China. Iran saw a 2% drop in vacuum bottom prices due to decreased demand from India, leading exporters to seek other markets.

Take a look at charts and let us know your comments.

Crude Oil Price Chart, May 2023

HSFO Price Chart, May 2023

Click on the link below to watch the Infinity Galaxy crude oil reports:

Crude Oil and HSFO Report:

Bitumen Price Chart, May 2023

Click on the link below to read the Weekly Bitumen Report of Infinity Galaxy:

Weekly Bitumen Report:

Every Monday and Friday, you can check the Infinity Galaxy blog and YouTube channel to become aware of the bitumen market condition and news. If you have any questions or you would like to keep in touch with our experts, drop a line in the comment section.