During the last week of May, the price of crude oil decreased due to concerns about the US debt ceiling. However, on June 1, it experienced a slight increase after news of an agreement between the two American parties on increasing the debt ceiling.

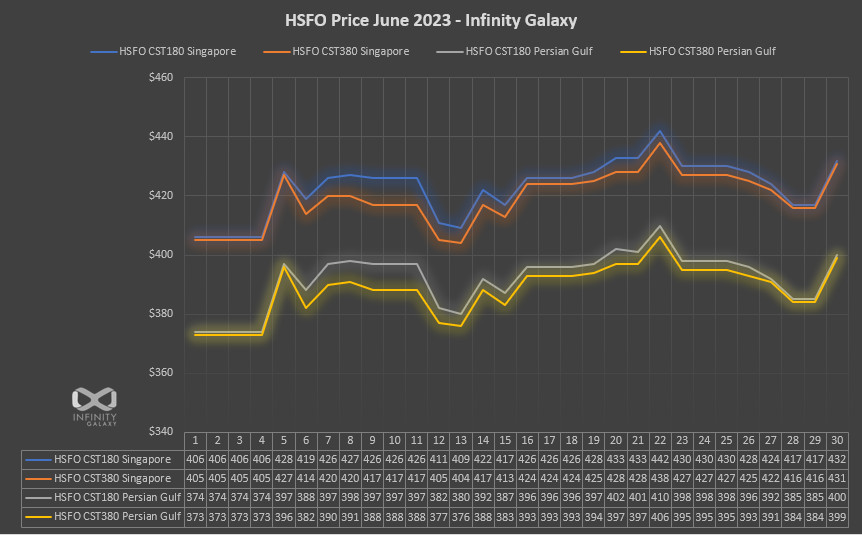

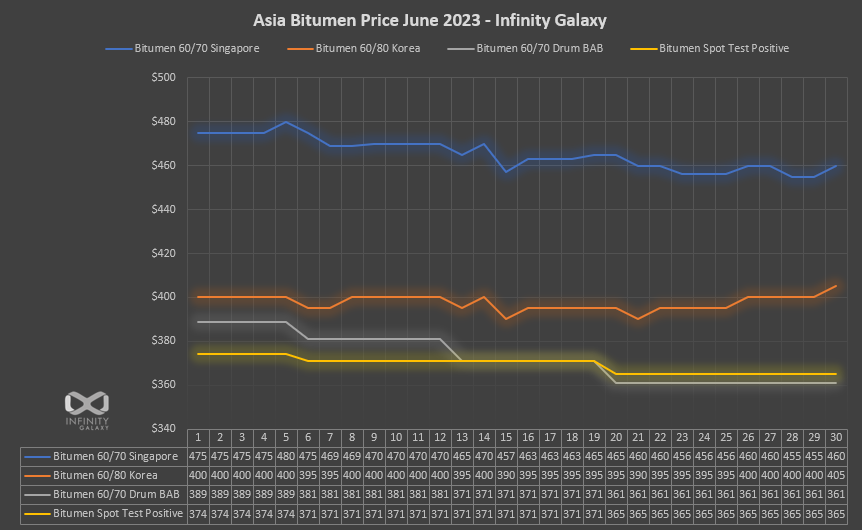

The bill has gained bipartisan support in the House of Representatives and now needs to be passed in the Senate to avoid a default on US debt. The fall in crude oil prices affected other markets as well, including a significant drop in Singapore’s HSFO CST180 and bulk bitumen prices in Singapore, South Korea, and Bahrain. However, bitumen prices in India experienced the highest fall in three months.

In the Persian Gulf, the US dollar devalued against the Iranian Rial due to factors such as visits by the Sultan of Oman and news of agreements and the release of frozen funds. While competition for vacuum bottom decreased in Iran, concerns about further USD devaluation caused a fragile bitumen price. The market could see positive changes with the US agreement and the release of Iran’s frozen funds, increasing the likelihood of price increases.

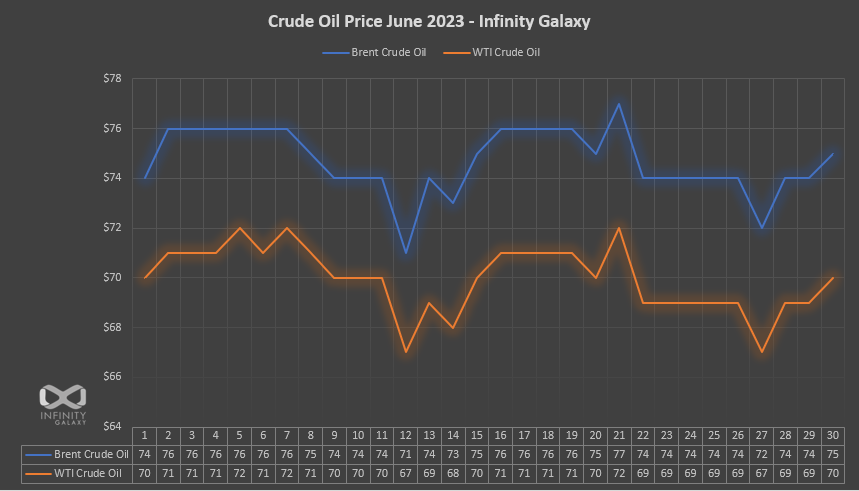

In the second week of June, despite Saudi Arabia’s announcement of reducing oil production in the latest OPEC+ meeting, oil prices remained stagnant, with Brent crude trading between $72 and $76.

While the focus in the US was on inflation, surprising job growth of 339,000 new jobs added in May did not contribute to an increase in oil prices. Weak economic statistics from China have raised concerns about a severe economic recession.

The visit of the President of Venezuela to Saudi Arabia, along with closer ties between Saudi Arabia-China and diplomatic relations with Iran, suggests a shift in the balance of power in the Middle East. This development concerns the United States and may lead to changes in political and trade dynamics in the region.

In terms of market prices, Singapore HSFO 180 CST increased by $21 in the first three days of the second week of June, while Singapore and South Korean bitumen prices experienced slight fluctuations. Bahrain bitumen remained stable at $370. However, in India, bulk bitumen prices dropped unexpectedly by $22 in two refineries, likely due to the onset of the monsoon season.

In Iran, the base price of vacuum bottoms slightly decreased, resulting in the lowest level of Iran bitumen prices since the beginning of 2023. With ongoing negotiations between Iran and the US, the value of the US dollar against the Iran rial has reached its lowest level in three months.

In the second week of June 2023, the Federal Reserve of the USA announced in its latest meeting that there would be no increase in interest rates, after raising them 10 times since March 2022 to control inflation. However, concerns about inflation remain, with the inflation rate in America reaching 4%.

In terms of market prices, oil prices fluctuated between $71 and $76. Singapore’s HSFO CST180 experienced a fall of $22 but recovered to $422. Singapore and South Korea’s bulk bitumen prices were at $470 and $400, respectively, while Bahrain’s bitumen price remained fixed at $370. India’s bitumen prices experienced a sharp decrease of $36 on June 15, which was a significant drop within May.

Logistic issues between Iran and India have affected the export process, leading to delays and complications. With no clear outcome in the negotiations between Iran and America, the US dollar strengthened against the Iran Rial. The level of competition among refineries in Iran decreased to 40%, resulting in lower bitumen prices. Iran’s bitumen price reached its lowest level compared to other Middle Eastern producers, which was remarkable considering historical records and oil prices.

In the third week of June, the European Central Bank maintained interest rates in the Euro area, while the US Federal Reserve halted its interest rate increase trend for the first time since March 2022. This resulted in the Euro area’s base interest rate reaching 3.5%, the highest in 22 years. Concerns about an economic recession in Europe have been discussed previously.

Despite US sanctions, Iran’s crude oil exports reached their highest monthly level in the past five years, surpassing 1.5 million barrels per day in May 2023, according to Kepler’s data. This is the highest monthly export rate since withdrawing from the JCPOA.

The price of Brent crude oil fluctuated within the range of $71 to $77, with no positive outlook for a significant increase.

In terms of market prices, Singapore’s HSFO CST180 saw a modest increase of $5 over the past three days. Singapore and South Korea’s bulk bitumen prices dropped by $5, settling at $460 and $390, respectively. Bahrain’s bitumen price remains fixed at $370.

India experienced a significant fall in bitumen prices, dropping by $36 on June 15, with expectations of further decline by the first of July. This consecutive drop in demand and prices in India attributed to the heavy monsoon in the western ports of the country, which is affecting refineries.

The competition for vacuum bottom purchases recorded an average rate of 44% during this week of June. The devaluation of the US dollar against the Iranian Rial poses challenges for Iranian exporters and manufacturers compared to previous months.

Third week of June witnessed several significant events with potential long-term impacts. Indian Prime Minister Narendra Modi’s visit to Washington was a notable occurrence. Developments in the relations between Iran, the UAE, and possibly Bahrain in the region also garnered attention.

Another important news item was the attack by the private group Wagner in Russia and its subsequent retreat, affecting the global economy.

Regarding oil prices, Brent crude oil remained within the range of $71 to $77 as in this week of June.

Singapore’s HSFO CST180 experienced a drop of around $15 in the first three days of the week, with the bitumen price in Singapore reaching $465 after a $5 decline. South Korea’s bitumen price remained unchanged at $400. As previously mentioned in Infinity Galaxy’s report, Bahrain increased its bitumen price by $20 and stabilized at $390. In India, following a $35 fall in mid-June, another decline expected on July 1.

On June 24, Iran witnessed a 30% increase in bitumen prices due to a change in the USD rate used in the pricing formula. The modification initially reflected the previous market situation, but the competition rate of up to 47% for vacuum bottom purchases and the devaluation of the USD against the Iranian Rial due to the Eid al-Adha holiday led to further increases in Iran’s bitumen price.

Overall, Europe experienced an increase in bitumen prices due to seasonal demand, while the Asian market remained fragile. Additionally, logistical operations were affected by the hot weather in the main ports of the Persian Gulf.

Crude Oil Price Chart, June 2023

HSFO Price Chart, June 2023

Click on the link below to watch the Infinity Galaxy crude oil reports:

Crude Oil and HSFO Report:

Bitumen Price Chart, June 2023

Click on the link below to read the Weekly Bitumen Report of Infinity Galaxy:

Weekly Bitumen Report:

Every Monday and Friday, you can check the Infinity Galaxy blog and YouTube channel to become aware of the bitumen market condition and news. If you have any questions or you would like to keep in touch with our experts, drop a line in the comment section.