Weekly Bitumen Report: Will OPEC+ Oversupply Neutralize the Geopolitical Risks?

The Political and Economic Developments of the Week

From Ukraine’s Drones to OPEC+ Oversupply, Oil at the Crossroads of Risk and Supply

In the past week, a set of simultaneous developments in Russia, OPEC+, and America formed the oil market atmosphere. The drone attacks of Ukraine on Russia’s oil facilities raised concerns about supply disruptions, however, Moscow attempted to neutralise the impact of these attacks by increasing oil export from its western ports up to 11%.

At the same time, OPEC+ decided to increase production from October. It should be noted that the increase was more limited than the previous times and the production level of some members is still higher than the agreed proportion. The latest report of EIA estimated that with the acceleration of supply, the market is on the verge of surplus. On the other hand, America put more pressure on the main buyers of Russia’s oil such as India and China and once again, the European Union proposed the plan of complete stop of import from Russia up to 2026.

In a global scale, the world is anticipating to know the Federal Reserve decision if it will decrease the interest rate in the upcoming meeting or not, a decision which directly affects financial supply decision and energy demand. From one hand, the combination of these factors created a higher geopolitical risk in the market, surviving the possibility of short-term surge of crude oil prices and on the other hand, despite the upward supply of OPEC+ and Russia, the shadow of oversupply and downtrend pressure on the market are still felt. So, the trend of crude oil prices can quickly change by any news of war or monetary policy.

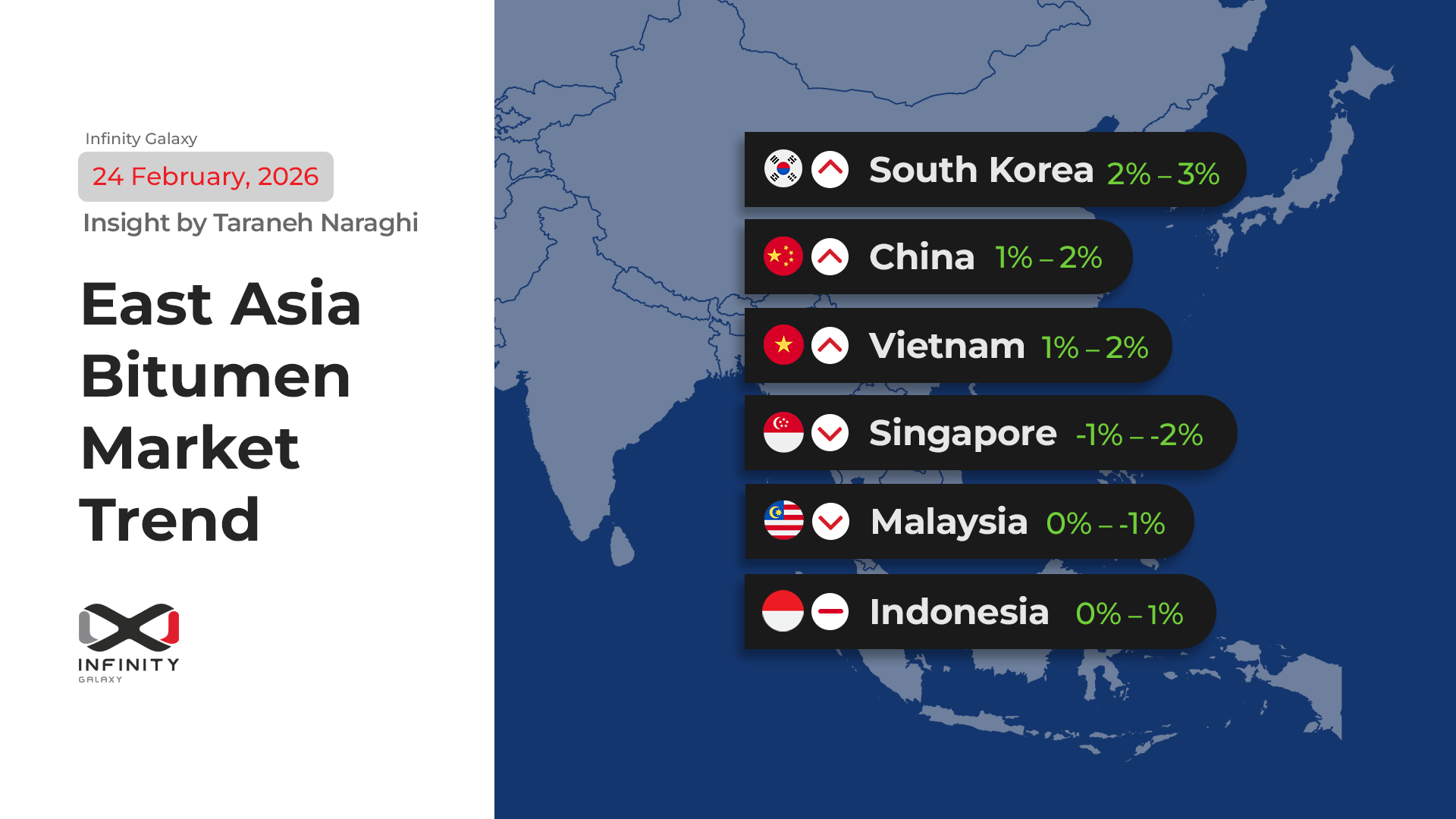

Crude and Fuel Oil Markets in East Asia

A Gradual Decline in the Shadow of Weak Demand

On Thursday, 18 September, crude oil reached $67.54 and it is expected that crude oil prices remain in a range of neutral to slightly upward trend in short-term.

Besides, Singapore’s 180CST closed at $406. The bitumen prices in Singapore and South Korea were reported at $412 and $407, respectively.

Unlike the previous weeks that prices dropped more tangibly, bitumen prices in Singapore and South Korea observed a slighter decline within this week. The regional demand is still weak but price fall was less than last week.

Bitumen Market in Bahrain and Europe

Supply Pressure and Recession in Projects

For another weeks and after a long time, bitumen prices in Bahrain remained stable at the same level of $400. In Europe, the prices decreased slightly to the range of $370-410. The weak demand of post-summer holiday has not recovered Europe’s market yet.

| Latest Market Prices (18 September 2025) | |

|---|---|

| Crude Oil | $67.54 |

| Singapore’s 180 CST | $406 |

| Singapore’s Bitumen | $412 |

| South Korea’s Bitumen | $407 |

| Bahrain’s Bitumen | $400 |

| Europe’s Bitumen | $370-$410 |

India Bitumen Market

The Monsoon Remains the main Obstacle

Following monsoon season and serious rainfall, the market is still suffering from recession and construction activities are too slow in India.

China Market

A Dual Hit of Storm and Purchase Decline

Bitumen prices dropped about $10 in East China. The recent heavy rains and storms in North and East of China were the main obstacle for the construction activities. Unlike last week when there was hope for a gradual recovery, this week the decline in demand became more serious.

Market Analysis of Iran

Instability and Weak Demand in the Market

By approaching the 30-day deadline of Trigger Mechanism activation or cancellation, there are more pressures on export process. The exchange rate instability and market recession in the last 3 months created a fragile and stagnant situation in the market.

Insight by Razieh Gilani from Infinity Galaxy

The global markets of bitumen and crude oil got stuck between 2 contradictory powers: On one hand, Ukraine’s attacks on Russian facilities and the pressure from the U.S. and Europe on Russian oil importers have strengthened geopolitical risks and the likelihood of a short-term price surge. On the other hand, OPEC+’s decision to increase production and the International Energy Agency’s forecast of an oversupply have imposed a heavy ceiling on price growth. This confrontation has left the oil market in a fragile position, where any political or economic news could change its direction.

In such circumstances, Infinity Galaxy establishes its role as a reliable partner for clients by simultaneously monitoring political developments and supply trends; a partner that can keep the export pathway clear and stable even in an ambiguous environment.

Talk to Our Bitumen Experts

At Infinity Galaxy, we’re here to answer any questions about buying bitumen. You can also check the latest bitumen prices by destination. Let us know your inquiry using the form below.

"*" indicates required fields