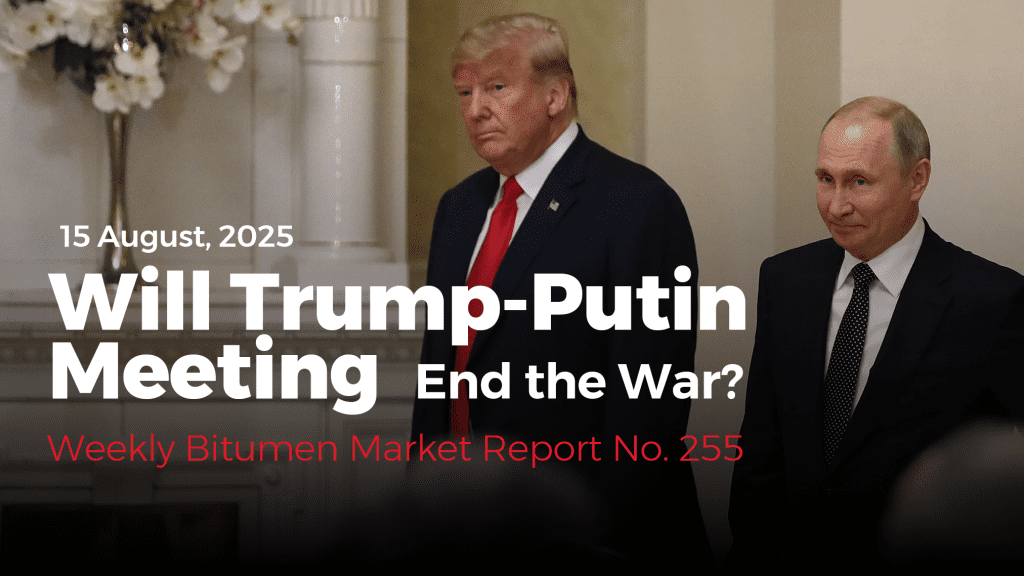

Weekly Bitumen Report: Will Trump-Putin Meeting End the War?

The Political and Economic Developments of the Week

From Gaza Bombardment to Trump-Putin Meeting, Turmoil in the World

In the last week, Israel severely bombarded Gaza. The eastern positions of Gaza were under heavy aerial and ground fire attacks. According to the reports, 123 people were killed in one day, which was the worst statistic in the last few months.

China’s economy is still under pressure. The amount of loan allocation to the production sector was negative in July, marking the first time in the last 20 years, which is a sign of a slowdown in credit.

On August 15, Trump and Putin will meet in Alaska for the first time since 2019. The meeting is described as an opportunity to end the war.

At the same time, the average tariffs of imported goods from more than 60 countries, including the European Union, Japan, South Korea, and Taiwan, reached the highest level since 1993. These actions put significant pressure on global trade, and the markets are going through tense times.

Crude and Fuel Oil Markets in East Asia

Oversupply on the Way, Crude Oil is about to Fall

According to the report of the International Energy Agency (IEA), it is predicted that crude oil supply will increase up to 2.5 million barrels per day in 2025, while demand growth is slow. The oil market is in a state of oversupply, while the EIA has also stated in its report that Brent crude prices will average less than $60 in the fourth quarter of 2025. Since 2020, it is the first time to observe such a status because of an increase in oil inventories and oversupply.

On August 14, Brent crude oil reached $65.90. At the same time, Singapore’s 180CST closed at $400. Bitumen prices in Singapore and South Korea observed some drops accordingly and were traded at $429 and $410, respectively.

Bitumen prices in East Asia fell slightly in the last week.

Bitumen Market in Bahrain and Europe

Artificial Stability in Bahrain, Europe Remained at the Same Level Compared to Last Week

The price of bitumen in Bahrain remained stable at $400, while the price of bitumen in Europe stayed within the range of $408 to $460. This week, the price of bitumen in Europe contrasted with the previous week, which had seen an increase.

| Latest Market Prices (14 August 2025) | |

|---|---|

| Crude Oil | $65.90 |

| Singapore’s 180 CST | $400 |

| Singapore’s Bitumen | $429 |

| South Korea’s Bitumen | $410 |

| Bahrain’s Bitumen | $400 |

| Europe’s Bitumen | $408-$460 |

India Bitumen Market

India is Involved with Monsoon, Low Demand, and Slight Fluctuation

During the monsoon season, low seasonal demand led to bitumen price stability in their market. Besides, limited inventory in the market reduced the level of local trade, and there were limited price changes. During the week, the market continued its trend without any notable fluctuation.

China Market

Continued Fall in China’s Prices, Refineries’ Stock Still Full

The imported bitumen prices in eastern China dropped by about $2-3 more, following a slower downtrend compared to last week’s five-dollar fall. The surplus inventory of refineries and the absence of large consumption projects continue to exert downward pressure.

Market Analysis of Iran

Internal and External Pressure, Iran’s Bitumen Market Remains Frozen

During the last week, bitumen prices in Iran were still under pressure, like the last month. Electricity and water imbalances in Iran and the lack of price growth in different markets kept Iran’s bitumen prices in the same range, and even some slight drops were found.

Insight by Razieh Gilani from Infinity Galaxy

In a week that global markets were filled with issues like oversupply of crude oil, endless war in Gaza, and more severe tariff tension than the recession period, the bitumen industry is facing wide instability and a reduction in trade volume.

In Iran, the imbalance in energy resources and weak export demand have put additional pressure on prices; meanwhile, markets in Asia and Europe are mostly in a state of anticipation.

In such circumstances, Infinity Galaxy strives to provide its clients with accurate insights, appropriate timing, and reliable pathways for bitumen exports by continuously monitoring data, analyzing political and economic conditions, and maintaining global communications.

We believe that in situations where prices are driven by politics and fear, making the right decision requires deep analysis and ongoing collaboration.

Talk to Our Bitumen Experts

At Infinity Galaxy, we’re here to answer any questions about buying bitumen. You can also check the latest bitumen prices by destination. Let us know your inquiry using the form below.

"*" indicates required fields