Weekly Oil Report: US Demand Season Pushing Prices

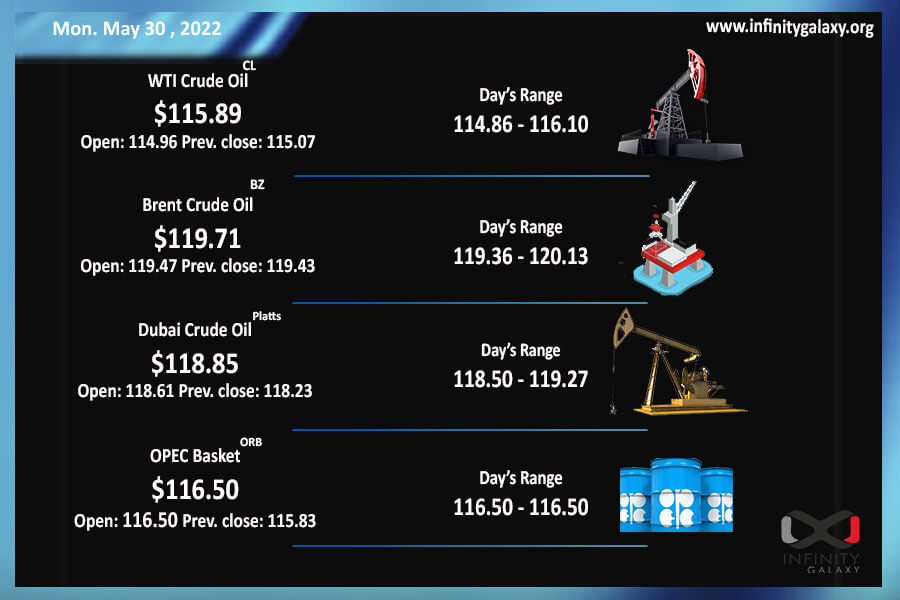

Crude oil closed the last week of May with gains for the six consecutive months. With about 6% growth on Friday, Brent closed at $119.20 and with 4% growth, WTI settled at $115.08 in the last trading session. Improving demand is highlighting the supply disruptions more than before.

The high demand season in the US starts on May 30. Moreover, the EU probably starts new embargoes for Russia on the same day. Both events will have tightening effects on the supply and increase the prices eventually. We might see the prices rising above $120 in June.

In the long term outlook, the market can confront several risks including the low refining capacity and a worldwide recession. The refining capacity was decreasing even before the pandemic but the outbreak and lockdowns accelerated the process. Several refineries were shut down during the lockdowns and they will not come back to the production cycle. Other refineries are recovering slowly. Therefore, we can say that the U.S Shale had the right decision to reward shareholders instead of investing in production.

On the other hand, China’s economy is bringing up questions about the future of the world. In recent years, China was the pulling incentive of other economies but the country seems to be slowing down at the moment. The world can confront a big recession if China fails to improve its economy.

Most petroleum products were almost volatile in a range of – $10 / + $10 in the Middle East during the week. The decrease in several products was caused by the fuel prices leveling off in Singapore and Asia. Traders, however, try to purchase their required cargoes instead of waiting for lower rates due to the knowledge that the market is still unstable.