Weekly Oil Report: Persistent Growth of Commodities

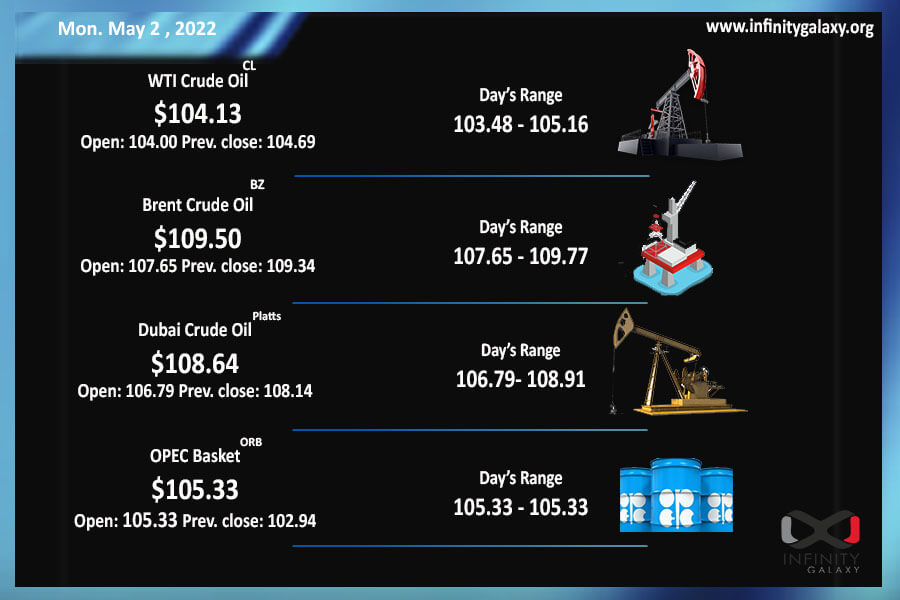

Crude oil recorded over 2% growth for the fifth consecutive month. Brent closed at $105.85 and WTI closed at $104.13 on the Last week of April. The situation with fundamental concerns stays similar to former weeks. Technically, the momentum of the price growth has slowed down and we might have a price correction in May if the market does not face a sudden change in supply and demand.

Russia claimed to have taken over several regions in Ukraine. These victories have risen the fear that Russia might not only restrict the war to Ukraine. A series of attacks in the breakaway of Moldova are causing civilians to flee from the country. Expansion of war can bring more volatility and distress to oil and gas markets.

The war in Ukraine has also triggered the food industry. Russia and Ukraine are both big producers of food commodities. Since the onset of the war, food commodities soared to their highest in 14 years. Energy and food increases are both crippling for the economic growth of the world.

China’s zero-covid policies are still jeopardizing the demand. Fortunately, there were no reports of a covid sharp outbreak in other countries. Moreover, despite the increasing prices, fuel consumption and demand are still high in various regions.

OPEC+ is meeting on Thursday, May 5. The committee regularly discuss the production plans at the meeting but there is almost no chance to see a change in the cartel’s supply arrangements. Although OPEC decided to increase production by 400,000 bpd every month, it only added 57,000 bpd in March. The tensions in Libya decreased the production levels according to the reports.

Petroleum products are experiencing a fluctuating situation as well. Several products have increased during the week while others were steady or decreasing. The market is highly sentimental. For instance, on 1 May, India decreased bitumen by $10 but increased fuel prices.