Weekly Oil Report: A Crack of Hope for Demand

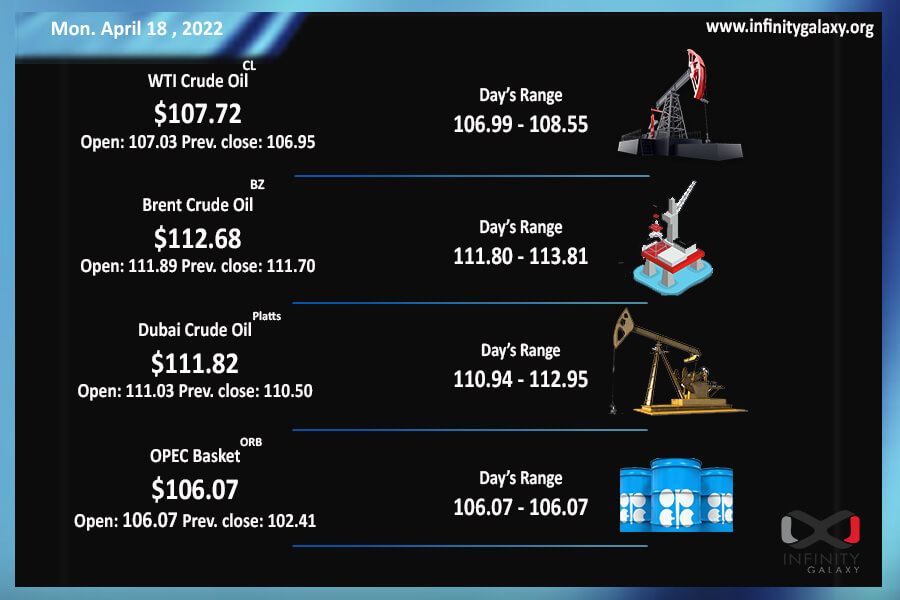

Reports on Covid cases and deaths in China show a moderately better situation. The crude prices, affected by the reports, rose higher during the last week in hopes of a better demand on China’s side. The Brent closed at $110.63 and WTI closed at $103.72 on Friday. Market fluctuations have increased. Effective factors on the price are changing every day and they make it nearly impossible to have long-term visions.

Although the Covid cases and deaths speed has decreased, the situation in China is not still promising and there might be more lockdowns in the country in the upcoming weeks. The demand outlook is dim while Covid continues spreading. Chinese refineries are expected to cut output by 900,000 bpd.

Sanction on Russia is limiting the export and import of natural gas and crude. The EU put the next round of sanctions on the agenda. OPEC believes that is impossible to replace Russian oil in the market and refuses to take the place of Russia in the market.

Commodities supply is currently lower than demand. “Inventories across energy, agricultural and metals are critically low everywhere,” Tracey Allen, commodities strategist at JPMorgan Chase & Co said. The shortage can result in a price crisis if it proceeds.

Natural gas, LNG, and coal have been increasing during the last week. Europe has pledged to increase capacity for the U.S gas. Other petrochemicals are also volatile to the fluctuations of crude oil. The market cannot anticipate the long-term trend since the crucial variables are growing. Traders should take advice on their spot purchases.