Weekly Oil Report: Biggest Decline of Crude After US SPR Release

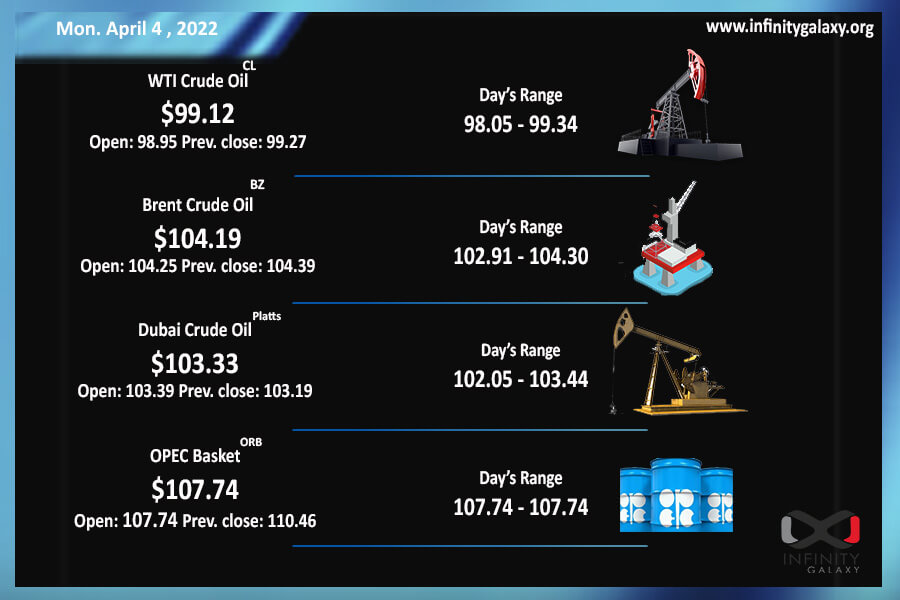

The market was turbulent during the last week of March since the crude recorded the biggest decline in nearly two last years. Brent jumped down by %10.44 and closed at $103.94 on Friday. WTI closed under $100 after a %11.79 decline. The US decision on Strategic Petroleum Reserve (SPR), OPEC agreement for a slight increase spiced up the fluctuating markets.

The US decided on having the largest SPR release in recent years to tame the prices of oil and gas in the world. Biden has pledged to release 180 million barrels over the next six months with the hope of bringing down gasoline prices.

OPEC+ countries agreed to slightly increase the supply in May. The cartel decided to add 430,000 bpd from May despite Russia’s obstacles. OPEC+ is still rejecting the US calls to loosen supply.

Oil and gas surging prices have become an obstacle to the growing economies. However, the attempts of the US might not be much effective in the long term compared to the lost reserves of Russian oil. The sanctions have troubled Russia but they have not brought the export to zero. The country had also threatened to trade its oil and gas only in Rouble but Putin rejected the idea yesterday.

China’s cities are currently under severe lockdowns due to the wild spread of Covid. Demand expectations have diminished as the country shuts down economic activities. Markets hope for better conditions in other countries.

Petrochemicals are still affected by the volatile crude market and do not follow any specific trend at the moment.