Weekly Oil Report: World’s Nightmares Come True

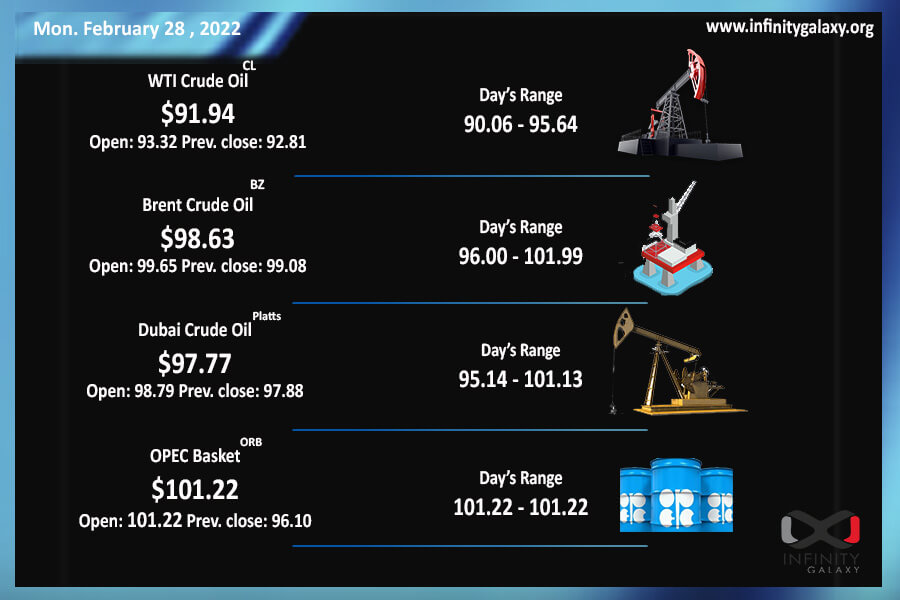

Oil price surpassed $100 during last week, and Brent exceeded $102.07 as the highest price of oil since 2014. Russia’s invasion of Ukraine prompted the prices aggressively; however, prices retreated to 90 gradually. Brent closed at $94.13 and WTI got to $91.92 on the last session of Friday. The turbulent situation has entangled the decisions of market participants.

Russia invaded Ukraine despite the rising hopes for a retreat last week. The country has not declared a definite number of casualties but the fierce resistance of Ukraine has surely slowed down the Russians.

Russian attack on Thursday shocked the world which pushed oil prices above $100 and gas prices to over $50. The western leaders’ reactions calmed the market proportionately. The most effective fact that brought back prices to 90 was the resistance to initiate sanctions on Russian energy sections. Western countries, specifically Europe, are highly dependent on the oil and energy of Russia; moreover, Europe is already under pressure.

Iran could reach a relative deal last week to pull some sanctions on the energy sections. However, the global tensions did not let the new affect the market. OPEC+ will probably stick with the former supply plan and keep it unchanged.

Petrochemicals were also under pressure during the last week. The fluctuations of the oil price confused traders to close new unurgent deals during last week. Most market participants are hesitant to make hasty decisions while waiting for a clearer vision of the war.