Weekly Oil Market: Tight Supply Evoking the Price Again

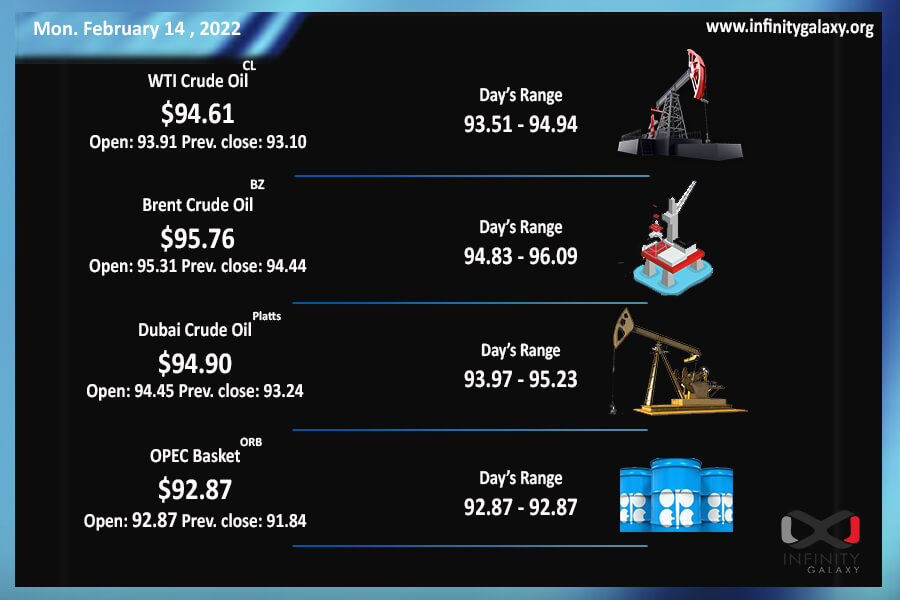

The 2nd week of February started a little dull for crude because of more possibility of the nuclear agreement of Iran and the US and more supply. But the market sentiment changed due to OPEC underproduction and war possibilities on Friday. Brent closed at $93.57 and WTI surpassed Brent to $93.88 on the last trading session.

Iran appeared closer to having a nuclear agreement with the US to lift the sanctions. The possibility brought up the excess supply issue that drove prices down about 2%.

On Friday, however, the OPEC+ reports about an underproduction convinced the market that the tight supply is not over yet. Therefore, the price surged to over $93 only one day.

European markets are on high alert as the crisis between Russia and Ukraine flares up. The potential disruption of Russia oil and gas export could end up in a disaster. Analysts believe that if the war between the two countries happens, oil prices will definitely exceed $100.

Despite every market analyst, the head of commodity analysis at Citigroup believes that the situation is temporary and oil will fall to $65 by the end of the year. He added that the tight supply is not lasting much and soon the market will face excess crude. We shall remember that the world is facing a huge shortage. Demand is 100 million barrels a day, while the spare capacity of oil is 2.5 million. Considering the supply disruptions mentioned above, lower prices of crude are not sensible for the upcoming months.

Petrochemicals are still rolling higher even though the crude price was not rising during the week. Prices can have a huge surge following Friday’s news on OPEC+ production problems. The fact that traders are making deals even with high prices shows that the market will not flip soon.