Weekly Oil Report: Situation Turns Against Crude Rally

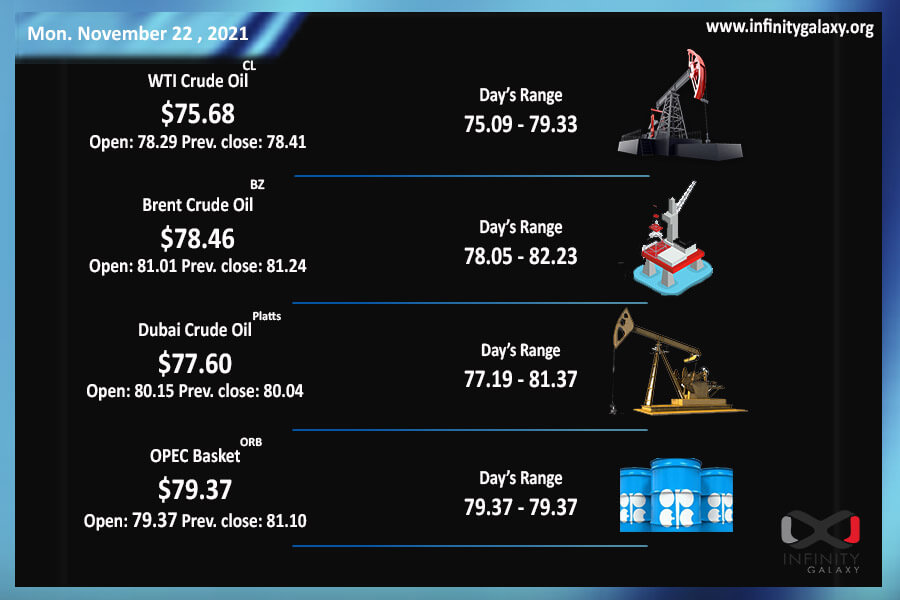

Bearish news could take over the few bullish factors of the market during last week. Brent oil closed the week at $77.69 and WTI fell to $75.64 at the end of the market on Friday. The gap between Brent and WTI has slightly increased again. Technically, the price has not passed over the critical $76 stage but fundamentally things are not in favor of crude at the moment.

OPEC and Russia statements regarding the supply surplus in a close future brought uncertainty to the market. OPEC+ countries and allies seem to be failing at fulfilling October’s quotas. Some even had a lower supply compared to September. The EIA decreased 2.1 million barrels of the US inventory but it could not stop the price fall.

Covid rising cases in Europe and several other countries raised concerns about demand threat and slowing economic recovery. The situation is not urgent yet; therefore, the fear of excessive demand and energy crisis is still an issue for the region.

Biden is still worried about the crude situation and his government was not ready to face such a complex situation with inflation and energy. Gas prices are rising devastatingly. Therefore, the US has put pressure on refineries to increase the supply. Japan has declared releasing its strategic stockpiles to tame the price of energy.

| View the latest Bitumen Price |