Weekly Oil Report: Reasons of Crude Price Rebound

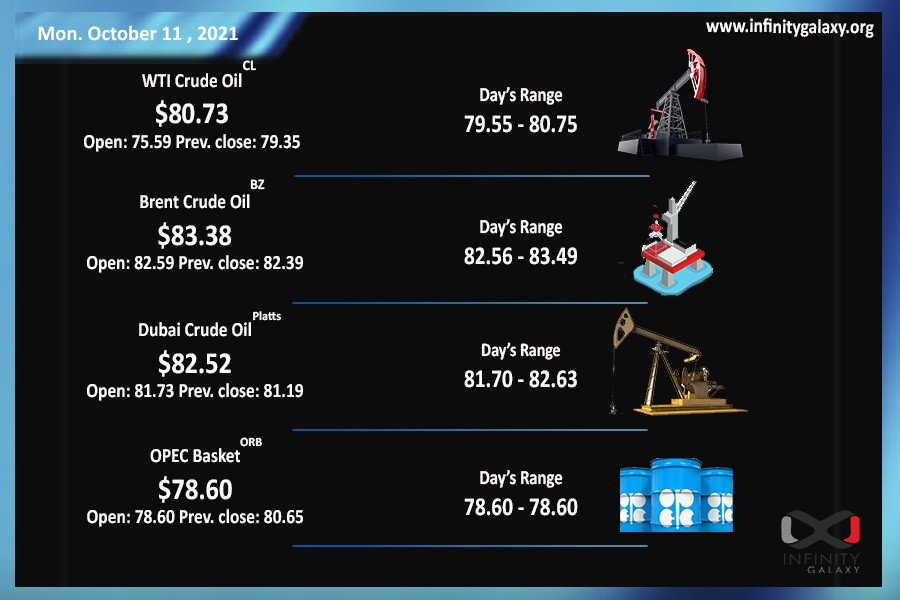

The market was extremely positive about oil conditions after knowing supply is still under control. While the US had asked OPEC to increase the supply to reduce the oil sharp growth, OPEC did not consent to boost production significantly. After the meeting, Brent took back the three-year high and closed at $82.05 On Friday. WTI closed the week at $79.50, the highest price since 2015. If the fundamentals remain steady, oil might see $100 soon.

Oil-oriented economies of OPEC+ countries are glad to see the rally of prices. But the world is worried about the sharply rising trend, including India and the US. They are trying to protect their fragile economies by releasing their strategic oil reserves.

Besides the economic profits of higher oil prices, OPEC avoids increasing the supply due to its demand fluctuation in the short term. The group knows that any hasty decision can lead to a sharp fall in the price; therefore, they take every step cautiously.

Dollar weak condition was another incentive for the energy and commodities. The non-Farm Payrolls were lower than market expectations. When job creation is not compelling as desired, the majority of economic activities can be affected.

FOMC meeting is due to be held on Wednesday, 13 October. If the Federal Reserve announced the beginning of quantitative easing, the dollar might get the stronger negative sentiment.

Petrochemicals and energy are making a crisis in several regions. Prices are boosting rapidly along crude and industries are getting into trouble for raw materials. The demand outlook of petrochemical is also improving.