Weekly Oil Report: Oil Dents As Covid and Demand Outlook Slump

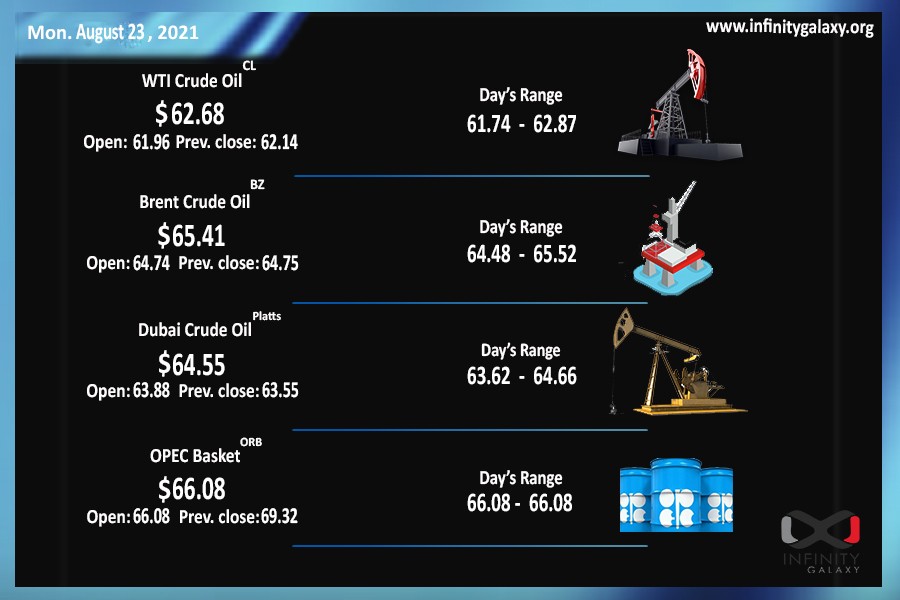

Market participants experienced disappointing days last week. Oil and fuel resumed the descending pattern all along. Negative sentiments empowered the situation for Brent to drop to $64.41 and WTI to get to $61.92 at the end of the market on Friday. The Brent resistance at $64 has been strong enough to hold the price at the time of writing the article. However, it was the seventh week that oil was declining.

The Federal Open Market Committee (FOMC) report shocked the market on Wednesday. The committee’s decision illustrated that the Federal Reserve intends to start tapering policies due to the rising inflation in the US. Crude reacted heavily and fell about 6% until Friday.

The Covid condition has worsened in many regions. Many countries are struggling with a shortage of ICU beds. More children are getting hospitalized during the Delta variant. Doctors fear it gets worse as the Delta is tearing through various regions faster than the vaccinations.

The US consumer reports stated a negative condition that caused emotional reactions in the market. Chinese refineries throughput also reported a decrease compared to March 2020. As China is one of the biggest consumers of oil and one of the prominent importers, the dumped report strengthened the unpromising outlook of demand.

The market is highly distressed with the pile of negative sentiments running through. The unclear condition of Covid and Demand has frightened the market participant. The resurge of Covid has also trembled Federal Reserve decisions on tapering. Jackson Hole Symposium, a gathering of central bankers, finance ministers, academics, and financial market participants from all over the world, takes place on Wednesday, August 28. Although several participants refused to join, Fed Chair Powell will speak on the economic outlook. Traders hope that he declares the Federal Reserve grounds in respect to covid rose fear.

The Petrochemical demand has not changed significantly, despite the falling oil price. The Freights are rising in various places; therefore, rates have been nearly steady.