Weekly Oil Report: Energy Crisis Worsens Along Crude Rapid Rise

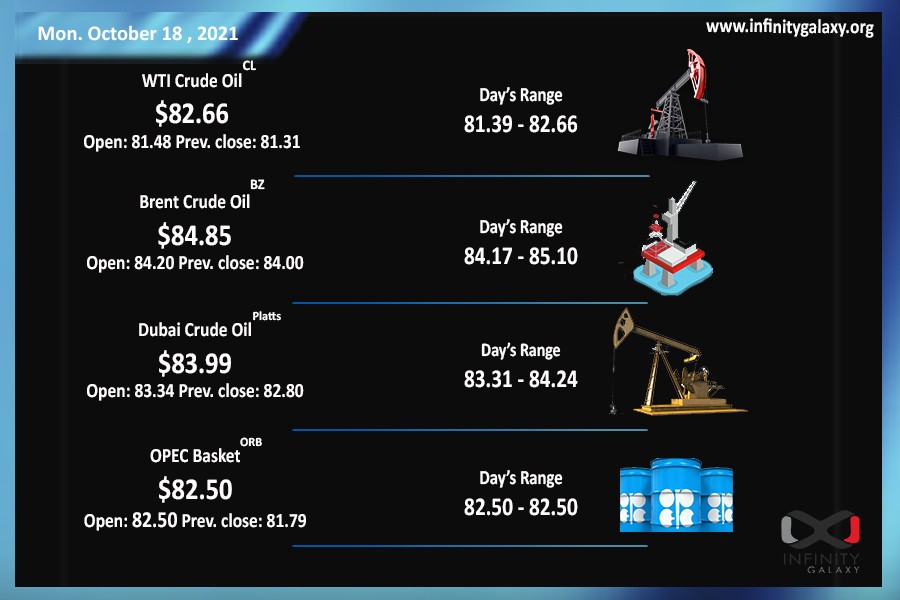

Oil had another gaining week and succeeded to reach near $85. The price has not been seen in the market for a long time. Brent closed the week at $84.24 and WTI could get to $82.47 on Friday. On Monday, the market continued the rising path. At the time of writing the report, Brent achieved $84.91.

The coal and gas crisis is making the oil-switch scenario stronger than before. The rising demand for fuel oil, crude, and several derivatives in various countries, such as China, Japan, and Germany, is the result of the gas and coal crisis. With the current tight supply from OPEC, the market does not hope much for lower prices of crude. The industries might face severe issues by the rising price.

FOMC stated a higher possibility of beginning the tapering process about mid-November. They believe that inflation might last longer than they expect. Retail sales reports of September show that economic activities were improved and the inflation actually real.

DXY had a red week after the tapering notion getting stronger. The dollar value is still lingering in the current zone. The calendar does not contain any market-moving report for the week and the Central Bank statements are the main driver for the dollar.

Petrochemicals were rocketing during the week as well. FOB and CFR prices changed significantly for many regions. The expected market outlook is making traders worried about higher prices; therefore, they prefer buying the current cargoes to avoid more expenses in future.