Weekly Oil Report: Crude Waiting For OPEC

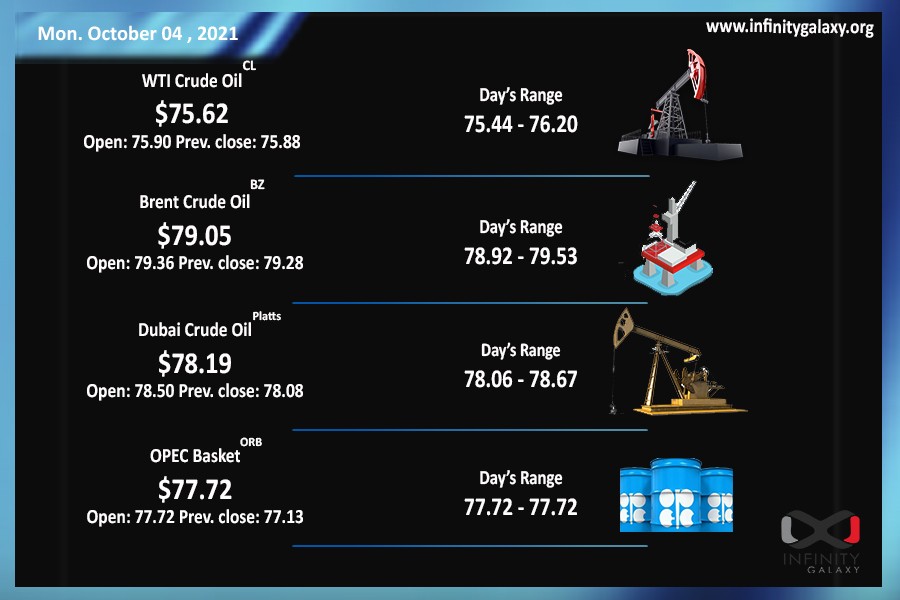

Oil took the rally to $80 in the last week of September and had the 4th week of gains. Brent closed the week at $78.80 and WTI took over $75.72 on Friday. The market situation has both strong bullish and bearish sentiments. Bulls of the market still believe that prices will hike as the dollar is weakening. Bears, however, are waiting for the supply increase of US and OPEC allies.

The reports indicate that the US has once again asked OPEC and its allies to intervene. The US government does not appreciate high oil prices as inflation is already increasing in the economy and industries need to run their production lines. OPEC agreed to the US request last time and made a fall in prices. Market participants shall look for the OPEC meeting on Monday, October 4.

The US crude oil inventories also increased by 4.6 million last week. The Federal Reserve is still eager to increase the interest rates when they detect healthy inflation. The economic reports are still confusing for a firm decision. For instance, the Jobless claims were not as promising as they expected. It increased by about 362 k this month. However, ISM manufacturing PMI has released 59.9 above forecasts. The manufacturing PMI is a leading indicator of economic health.

Oil products are making capital out of crude bullish sentiment. The demand is rising and the price is getting higher due to the rally of oil and increasing freights. The reports show that the situation of petrochemicals is constantly improving.