Weekly Oil Report: Covid Helped Biden with Crude

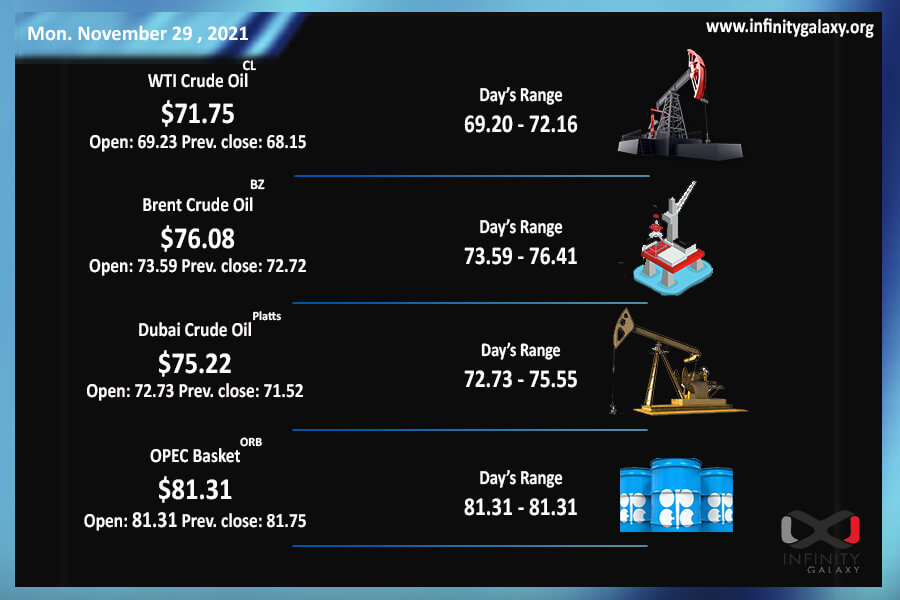

New fears have shocked markets of stocks and commodities. Crude oil that surprised traders by the rapid rally during recent weeks, stood as the leader of the plunge. Brent was closed at $71.65 and WTI Fell to $68.16 on Friday. The sharp falling movement and closing under the relative support might indicate more decrease during the week. The market is under huge pressure currently.

The new variant of Covid, called Omicron, has severely affected governments and markets. It has raised fears once again after a calm period in the world. The new variant was quickly spread through South Africa. Despite governments quick decisions to close borders and restrict travel, virus cases have been found in the UK, USA, and other countries.

The rapid transmission has frightened everyone about another possible global lockdown that current economies cannot afford. Markets, however, would revive if current vaccines prove to be effective in restraining the virus.

OPEC vowed to take action against any cooperation for decreasing prices by the US, India, Japan, and Taiwan. Biden and his office were in a difficult situation regarding economic activities and commodities. Surprisingly, covid took the effort to cut down crude prices for Biden. However, countries are now more alerted about their financial reports and economies.

OPEC+ and allies have not declared their new plans for the new condition. They will probably state their policies at the last meeting of 2021, on Thursday, 2 December.

Undoubtedly, two scenarios are probable for the current market:

- The new variant of covid proves to be deadly and governments initiate lockdowns. Consequently, prices will fall more due to decreasing economic activities.

- Current vaccines would be able to restrain the virus and new variant fatality to be low; Therefore, the world continues the current progress pace and prices keep rising again.

| Check out the latest Bitumen Price |