Weekly Oil Report: Tensions Rising in Crude Market

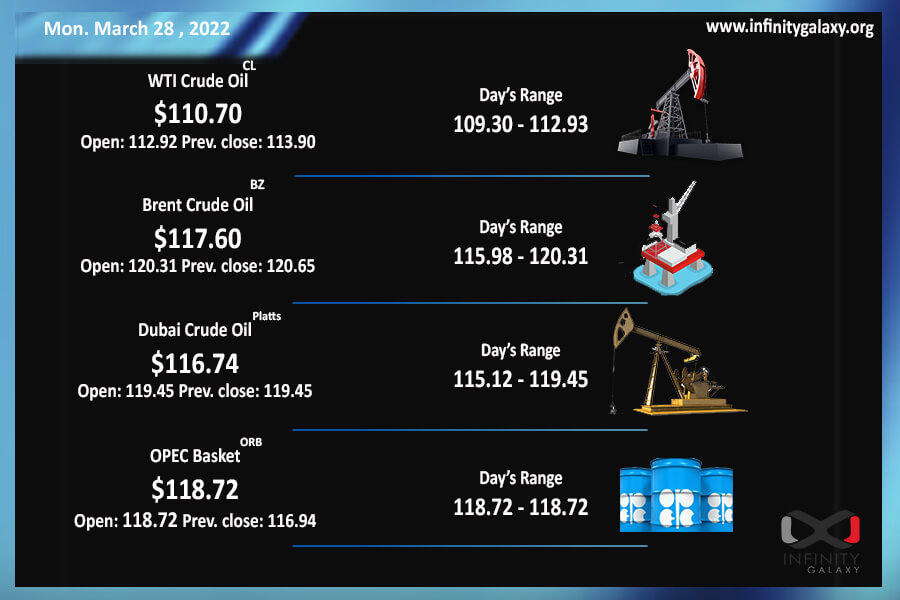

Crude oil had tough days during last week. Russia’s threat to cut gas import to Europe, a missile attack on Aramco oil terminal and covid resurge resulted in prices over $120 during the week. However, Brent closed at $116.05 and WTI closed at $112.64 on Friday’s last trading session. Fundamentals are mixed but they mostly tend to be bullish.

The Covid surge in China and several other regions have made traders cautious. Demand might be weaker in China than expected in 2022. Booster doses have been almost effective in restricting the virus but it has not defeated it yet. The danger can be real but the world is more worried about geopolitical tensions and supply disruptions.

Russia has threatened Europe to stop Gas exports. Meanwhile, Europe is trying to find a replacement to seize the oil import from Russia. Germany plans to expand its LNG import terminals and halve the oil import by Russia by this summer.

Russia is also considering selling oil and gas in crypto to avoid sanctions.

The oil prices spiked up after the missile attack on the Aramco oil terminals. The attack is presumed to be from Yemen’s Houthi. OPEC also declared that hiking oil prices are not its concern and it avoids boosting the supply.

Petrochemicals are still volatile and traders are uncertain about the future of the market. Most of the traders try to adapt to the current situation and have not stopped their activities.