Weekly Oil Report: Crude Falls Back as War Possibility Recedes

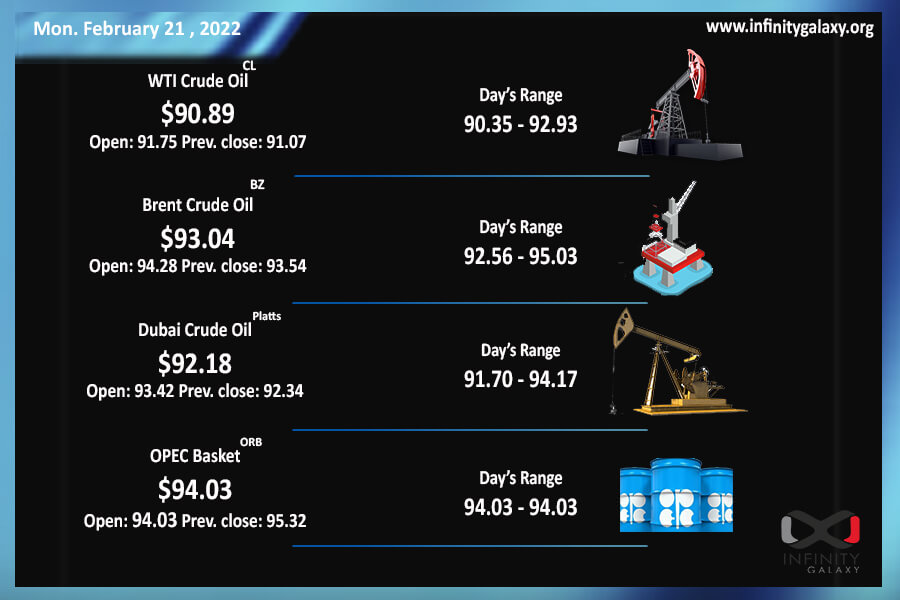

Oil prices declined after 9 weeks of consecutive growth after lower war possibilities and supply expectations. Brent oil closed at $91.66 and WTI fell to $92.00 on Friday trading session. Iran nuclear negotiations had a strong effect on the oil decline.

After months of negotiations, Iran seems close to having an agreement with the US. The possibility of an agreement means more supply in the market from the Iran side. The country is preparing to release its oil production as soon as it can.

OPEC+ wants to add Iran to join the supply deal of the committee since the market will be affected hugely after Iran entrance. Iran has not clearly stated its agreement to OPEC but the country might join the cartel’s deal to keep oil prices high.

Russia had stated to start the war in mid-February but the country partly retreated. The tensions are not solved in the region; however, the market feels fewer negative sentiments at the moment. The US is still concerned about the war possibility.

The number of oil and gas rigs is still increasing in the United States, despite the decline in oil. Gas prices are also increasing. The energy crisis still remains a danger.

Petrochemicals did not increase much during the last week but the markets did not also fall following the crude. Traders are still eager to have their deals at the best price possible because they do not expect crude oil to have any severe fall.