Weekly Oil Report: Bullish and Bearish News Colliding

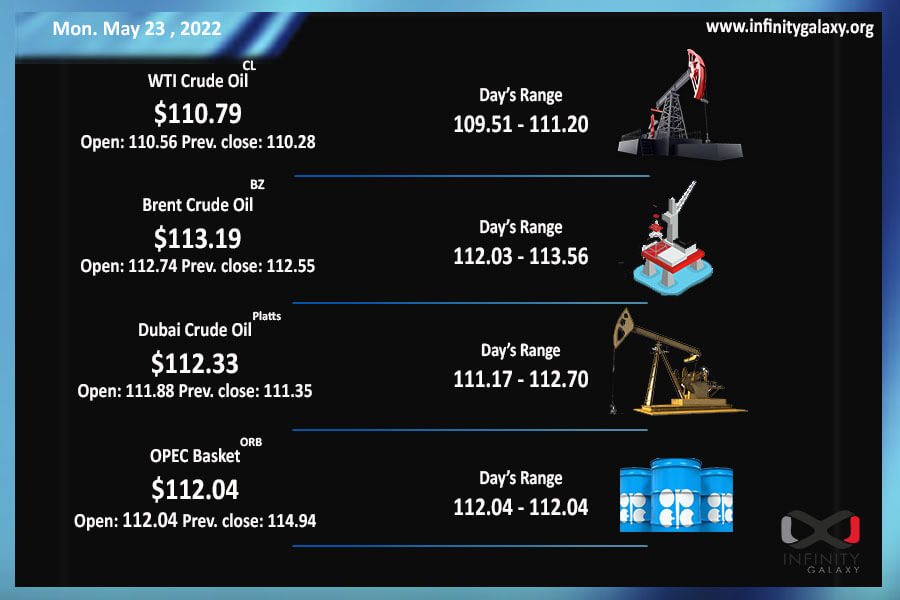

Crude oil experienced a week full of volatility and indecisiveness under more pressure from demand and supply. Fears of recession, famine, new virus outbreaks, and tighter supply left market participants uncertain about bullish and bearish sentiments. Consequently, WTI fluctuated in the range of $104 – $116 and closed at $110.52 on Friday. Brent also withstood volatility and closed at $112.54 in the last session.

Russia-Ukraine war consequences are emerging in various segments of energy and food. The war has disrupted food trades, including grains, in the main ports of Ukraine. Russia is accused of using food as a weapon against Ukraine and the world. If the situation does not change, a global famine might happen.

The EU is trying to persuade Hungry to join the sanctions and ban Russian oil. If the EU succeeds, a tighter supply can be a bullish sentiment for oil. Meanwhile, the US Federal Reserve stated that they are ready to take any action required to tame the inflation. The statement shocked stocks and equities; in addition to a bearish sentiment for oil.

Unfortunately, China seems to have another outbreak in other cities while it is reopening Shanghai. The demand is again in danger but the authorities have not changed their outlooks yet. The country is also considering Russian oil which can put downward pressure on crude.

Bullish and Bearish news collisions have left the market uncertain about its next move. Market participants are just reacting to the news headlines vigorously. The situation is the same in oil products. For instance, Iran kept the prices steady while it was expected to increase. India increased rates by about $3 last week and now it is talking about a $20 decrease. Fluctuations are vivid in the Singapore market as well. In general, strategies are not stable in any market. Traders make instant decisions to avoid making huge losses.