Weekly Oil Report: Bearish Sentiments Pile Up

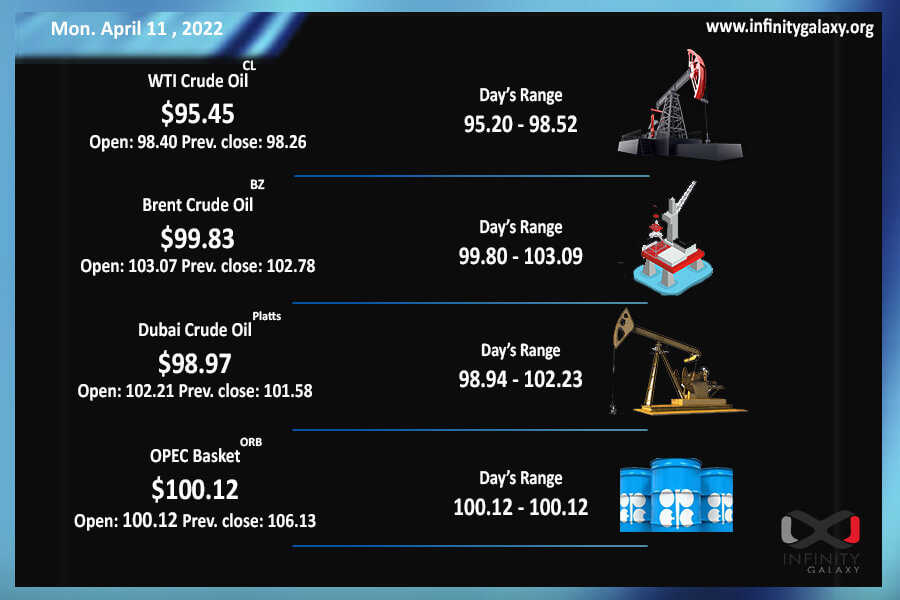

Oil prices slowed down during the last week and WTI dived down below $100. After turning sentiments on demand and supply, Brent closed at $101.91 and WTI got to $97.76 on Friday’s last session. The spread of covid in China and eased fears of Russia’s supply helped the bearish sentiment.

It seems that the market overestimated the effects of sanctions on Russia. The fear of Russian supply disruption has eased down as the country continues to export to China and India. Moreover, the US attempt to release its strategic petroleum reserves was successful at least in the short term to pull down the price.

The demand outlook has darkened in the US and China. After the gas price increase in the US, the demand seems to be decelerating. China’s demand is also jeopardized because of the outbreak of covid in recent weeks. Big cities of the country are currently under heavy lockdowns policies.

While crude has slowed down, Fuel is making new records one after another. The high prices of crude and shortage of raw materials have led to surging prices of diesel and jet fuels. Demand destruction is possible due to the high prices.

Other petrochemicals were still in limbo by the crude. In the past two weeks, the market was almost steady along with the crude plunges. Traders prefer to make spot purchases to avoid pausing their projects. We recommend consulting with experts before making any decisions.