Weekly Oil Report: On the Brink of an Energy Crisis

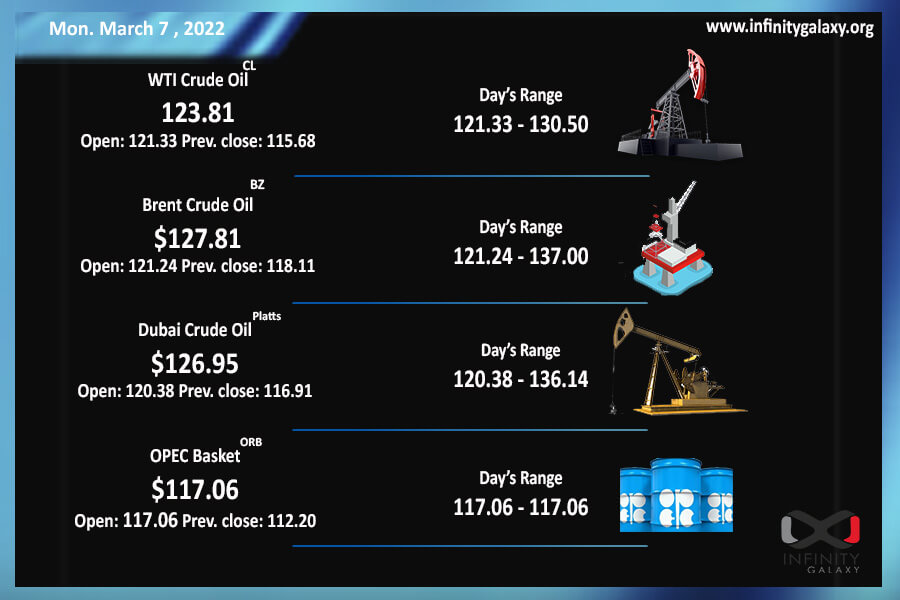

Crude strongly surpassed $100 during the first week of March after no sign of weaker demand or increasing supply. Brent closed at $118.04 and WTI reached $115.00 on the Friday session. The high prices are an alarm to countries and governments but OPEC+ members seem to be enjoying as decided to stick with the former supply plan on their last meeting.

The multi-year high price can lead the world to an energy crisis considering the current situation:

- War of Russia and Ukraine

- Oil and energy sanctions on Russia

- Restricted supply

- Demand surge

- Weak economies of post-covid

Russia and Ukraine war has intensified during last week. Russians have tried to take over cities and strategic port towns, including Mariupol. Ukrainian resistance has been beyond Russia’s expectations and the US is trying to impose sanctions on the Russian energy sector. The sanctions can worsen the prices immediately due to the drastic shortage.

Demand is increasing by the covid improvements. Moreover, economies are fragile due to three years of the outbreak. The unstable rising prices are a real burden on economies and governments.

We expect oil to be volatile in the range of $100 – $120 for the next couple of days. The prices are really high at the moment and the market is not certain about its reaction. If the above-mentioned stimulators exacerbate, we might see higher prices. Otherwise, the market might take a short rest after the sharp rise.