Weekly Oil Report: The Vicious Cycle of Covid and Economic Transformations

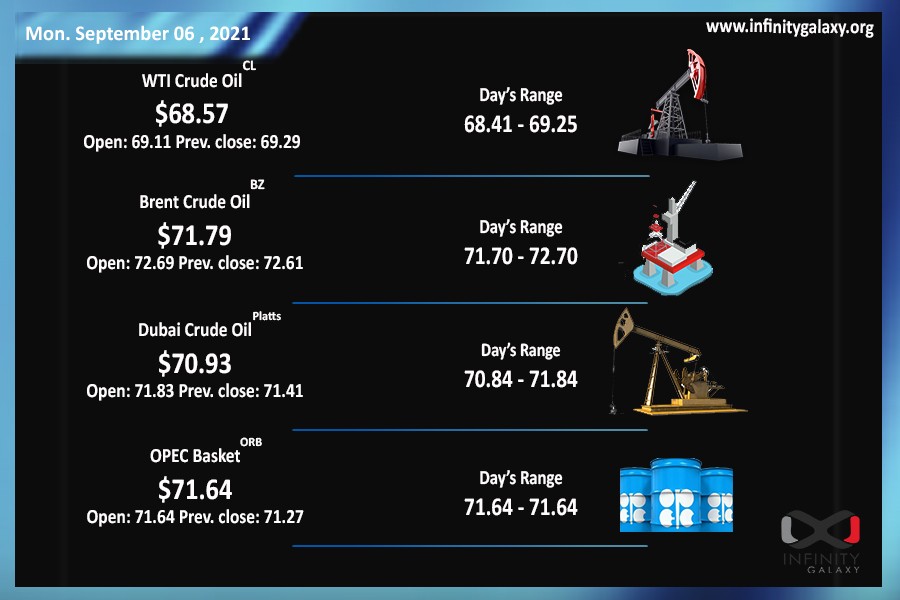

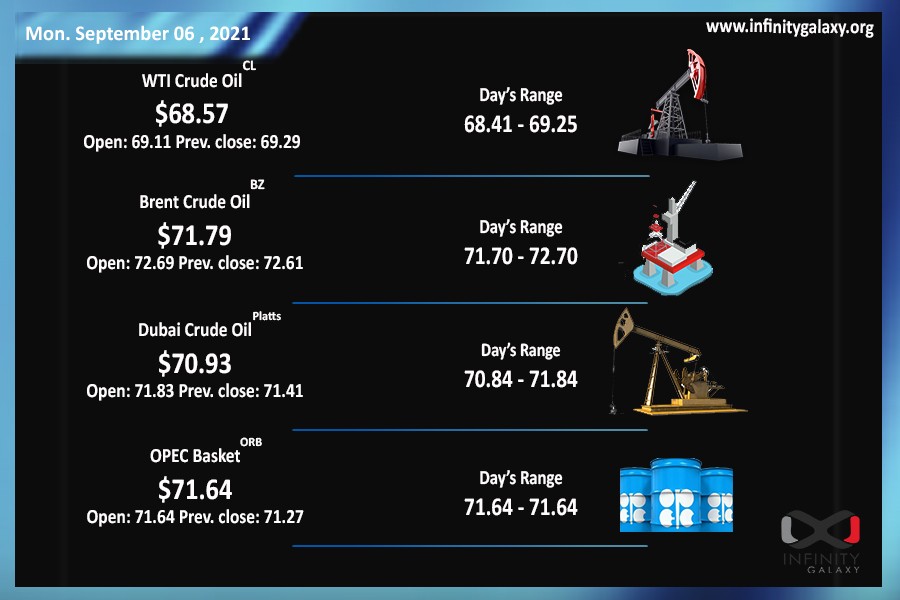

Crude succeeded to rise a bit higher in the first week of September. However, the rise was not significant due to several incidents, including the oil spill of the Ida hurricane in the Gulf of Mexico and a variant of interest of covid. The crude ended Friday with Brent at $72.05 and WTI at $69.20. The price charts of oil declare a possible fluctuation by about $ +2 / -2 through the coming week.

The world is almost stuck in a vicious cycle with the covid fear. While the loss and fear of Delta and Lambda variants have not thoroughly disappeared, The World Health Organization (WHO) added a new variant of interest to the monitor list. The new variant, called mu, seems to have genetic differences from the other known variants. The virus is detected in several countries and it can cause more severe infections than the former ones.

Financial reports were not as promising as the market expected. The Non-Farm Employment Changes were lower than expected while Average Hourly Earnings rose. The numbers are almost the signs of slowing improvement. Therefore, the stock got negative sentiments on the Friday market.

Crude market outlook demonstrates bullish targets due to:

- OPEC meeting result: The OPEC and allies instantly decided on keeping the production levels as the October on the Wednesday meeting. The decision indicates that the participants still look for better demand.

- Big oil record revenue: Giant oil companies such as shale forecasts are bright on revenues of 2021. Accordingly, we might say they foresee a huge demand for profit.

- China rising demand: Crude oil demand has risen up in China, one of the biggest economies of the world. Oil consumption is rising in the country after the reopening of the economy.

Petrochemicals usually follow up the crude trend. With the rising demand for oil in mind, we can expect rising prices for oil products in addition to the rising freights.