Weekly Oil Report: OPEC Soothed the Tensions

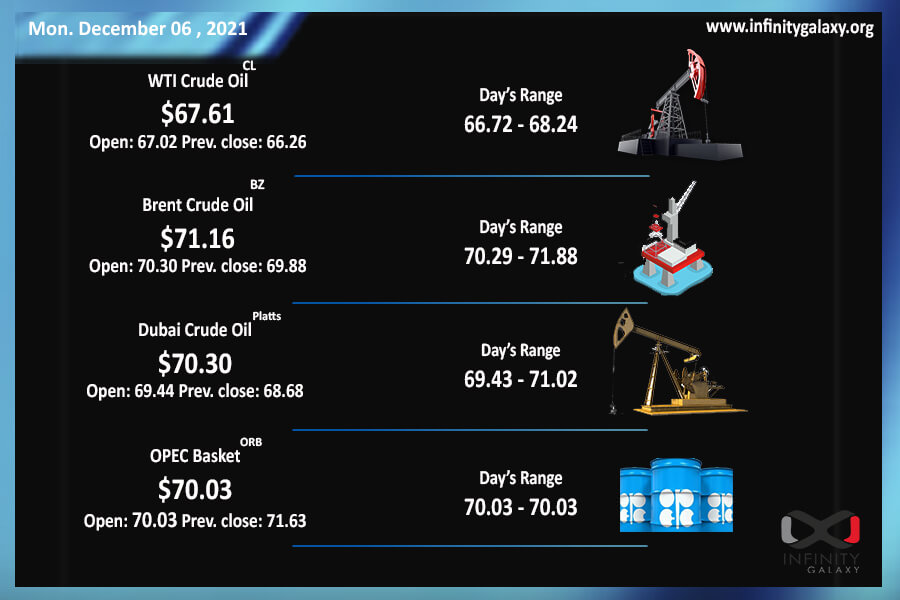

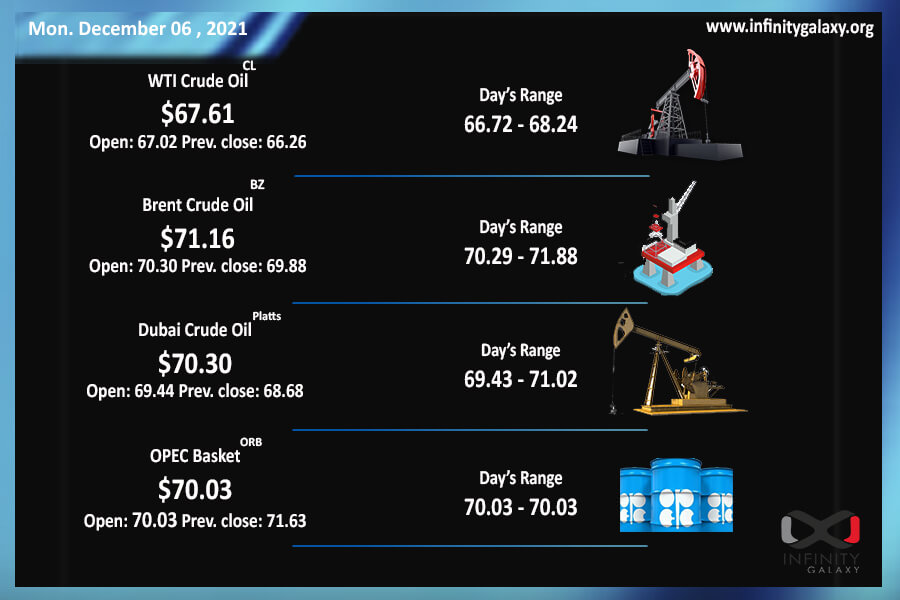

Crude was still under negative sentiments during the last week of November. Falling by about 10%, Brent closed at $69.56 and WTI touched $66.39 at the end of the trading session of Friday. OPEC confidently approved the increase of supply for January 2022. On the start session of Monday, the market opened above the closed price of last week but traders shall wait to see whether the gain is sustainable or not. Technically, prices are not over with the downtrend and we can see traders’ indecisiveness on the market.

Omicron, the recent variant of covid, is still unknown to the world. Governments have established more restrictions. Scientists believe that this variant is extremely different from the former types of the virus. Omicron has proved to be more contagious, and the fact is frightening all countries for another upcoming global lockdown. The deaths rate of the new virus has been reported to be low at the time of writing this article.

The dollar was strengthened by more valid news on the initiation of tapering policies. Commodities and Stock experienced bearish markets as the Federal Reserve statement stated a stronger position for new policies. The jobless claims report showed that the labor market is getting more robust.

Petrochemical markets and bitumen price have a more peaceful condition in the last week of November. At a glance, we can see traders separated into two sides. One group is waiting for more decrease in prices as they believe crude is still bearish. The other group is committed to spotting purchases since they cannot stall projects and risk their budgets.

| Find the latest bitumen price on our website |